Illustrative image

The Vietnam Gold Business Association recently provided feedback on the draft amendment and supplement to Decree 24 on gold market management (Decree 24).

The association suggested that credit institutions, especially commercial banks, should not be allowed to engage in gold bar production and trading.

Explaining this suggestion, the association stated that according to the Law on Credit Institutions dated January 18, 2024, commercial banks do not have the function and mission of gold production. Their primary role is monetary operations, particularly credit activities and payment services.

“If commercial banks are allowed to engage in gold bar production and trading, they will be forced to allocate significant capital for investments in factories, machinery, skilled labor training, and ventures outside their core competency of providing credit and capital support to businesses for economic growth,” emphasized the Vietnam Gold Business Association.

Additionally, commercial banks are not specialized in gold production and trading, and history has proven that their involvement in gold bar production and trading before 2012 was inefficient. Some banks left prolonged undesirable consequences that were only stabilized thanks to the determined and effective direction of the State Bank.

Another concern raised by the association is the proposed regulation regarding the conditions for granting gold bar production licenses to enterprises with a charter capital of VND 1,000 billion or more. They believe this requirement is too stringent and may only be feasible for one to three gold businesses. With this regulation in place, the number of enterprises participating in gold bar production remains insignificant, allowing the state to maintain a monopoly on gold bar production and supply, thus limiting the gold bar supply.

The association proposed a more appropriate charter capital requirement of VND 500 billion or higher. They also suggested focusing on the enterprise’s production capacity, business efficiency, reputation, brand recognition, bar quality, and compliance with state regulations related to gold trading.

Regarding the proposed annual limit and one-time export and import license for gold bars and raw gold for gold bar manufacturers, the association recommended reconsidering its removal. They argued that this regulation increases red tape and hinders gold bar export activities, which could generate foreign currency for the country. It also deprives enterprises of opportunities due to the constant fluctuations and multiple factors influencing the global gold market.

Waiting for one-time permit procedures may cause enterprises to miss out on exporting or importing at optimal prices, affecting production efficiency and export operations.

The association suggested that the State Bank should determine the annual limit for gold bar exports and imports and raw gold imports and allocate them to enterprises from the first quarter of the year based on transparency and without generating additional licenses. Enterprises can then proactively choose the timing and volume (within the limit) for imports or exports to maximize efficiency. Periodic reports on the implementation of import and export limits should be submitted to the State Bank.

Any adjustments to the limits would be considered and decided by the State Bank. Additionally, the association requested the drafting body to consider a mechanism to encourage the import of raw gold for gold bar and jewelry production to meet domestic market demands and facilitate exports and foreign currency generation. They advised against creating a mechanism for commercial activities involving gold bar imports and exports.

“Financial Roundup: 7 Banks Gear Up for Gold Production; Receipts Required for Purchases Over $800”

“As of July 1st, 2025, a new tax regulation will come into effect, requiring purchases of goods and services exceeding 20 million VND to be accompanied by non-cash payment receipts for tax deduction eligibility. This is part of a broader initiative to encourage digital transactions and enhance financial transparency. Only seven banks currently meet the stringent requirements to produce gold bullion, with a mandated chartered capital of 50 trillion VND. In other news, Vietnam Asia Commercial Joint Stock Bank (VAB) has received a favorable secondary bond rating, indicating strong financial health and stability. Stay tuned for more updates on Vietnam’s dynamic banking industry and its ongoing efforts to modernize and streamline financial practices.”

The Golden Opportunity: Unveiling the Authorized Banks and Enterprises for Gold Bar Production Post-Monopoly

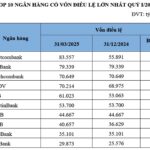

The proposed amendments to Decree 24 set a high bar for businesses seeking to enter the gold bar production industry. To be eligible for a license, companies must now possess a minimum chartered capital of VND 1,000 billion, while banks are required to have a staggering VND 50,000 billion in chartered capital.

‘State Bank to Explore the Establishment of a National Gold Exchange or Introduce Gold Trading on Commodity Exchange’

“Recent insights shared by Mr. Dao Xuan Tuan, the head of the Foreign Exchange Management Department at the State Bank of Vietnam, shed light on the crucial amendments to Decree No. 24/2012/ND-CP, which governs the gold market management. In his interview with the press, Mr. Tuan unveiled significant developments and updates to the regulatory framework surrounding Vietnam’s gold market.”

The End of Easy Profits: Riding the Golden Wave

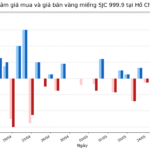

The Vietnamese gold market witnessed a tumultuous surge in April 2025, with gold prices fluctuating by up to VND 7.5 million per tael per day. This volatility presented a lucrative opportunity for savvy traders and investors to profit from the rapid price movements. However, those days of frenzied gold trading seem to be over, as the current market offers little room for such lucrative waves.