Oil Rises Nearly 3% as Middle East Conflict Intensifies

Oil prices surged by almost 3% as the week-long air assault between Israel and Iran escalated, and uncertainty over potential US involvement kept investors on edge.

Brent crude oil settled at $78.85 a barrel on June 19, up $2.15 or 2.8%, its highest close since January 22. WTI crude oil rose $2.06 or 2.7%, to $77.20 a barrel. Trading volumes were low due to the Juneteenth holiday in the US.

Israel bombed Iranian nuclear targets on June 19, and Iran responded by firing missiles and drones at Israel after attacking an Israeli hospital on the night of June 18.

The White House stated that President Donald Trump will decide whether the US will engage in the Israel-Iran conflict within the next two weeks. This potential involvement could lead to higher crude oil prices.

Iran is the third-largest producer in OPEC, currently pumping around 3.3 million barrels of oil per day.

Approximately 18 to 21 million barrels of oil and oil products pass through the Strait of Hormuz along the southern coast of Iran, and there are concerns that the war could disrupt this commercial flow.

JP Morgan stated that an extreme scenario, involving an expanded conflict and the closure of the Strait of Hormuz, could push oil prices to $120 to $130 per barrel.

Goldman Sachs suggested that a $10 per barrel risk premium is reasonable, considering reduced Iranian supply and the risk of broader disruptions, which could push Brent crude oil prices above $90 per barrel.

Phil Flynn, senior market analyst at Price Futures Group, commented that even if Middle East tensions ease in the coming days, oil prices are unlikely to return to the lows of $60 per barrel seen a month ago.

Russia’s top oil official stated that OPEC+ oil producers should proceed with their plans to boost output, noting the rising summer demand. Deputy Prime Minister Alexander Novak, speaking at an economic forum in St. Petersburg, said that OPEC+ should calmly implement its plans and not scare the market with forecasts.

Gold Steady Amid Geopolitical Tensions and Fed Rate Hike Expectations

Gold prices held steady as escalating geopolitical tensions were offset by expectations of aggressive rate hikes by the Federal Reserve.

Spot gold was down 0.1% at $3,365.79 per ounce. US gold futures for August delivery settled down 0.7% at $3,382.80 per ounce.

The strengthening US dollar made gold more expensive for buyers holding other currencies.

Copper Hits Near One-Week Low as Middle East Conflict Weighs on Sentiment

Copper prices touched their lowest level in nearly a week, along with other base metals, as the US dollar strengthened and concerns grew about global growth amid the Israel-Iran war.

Three-month copper on the LME fell 0.4% to $9,618.50 per ton after touching its lowest since June 13 at $9,585. LME copper has rebounded by 19% since hitting a near 19-month low of $8,105 per ton in April.

The retreat also reflected reduced trading activity as US investors observed the Juneteenth holiday on June 19.

The US dollar surged, bolstered by escalating tensions in the Middle East and Fed Chair Jerome Powell’s cautious tone on inflation as oil prices soared.

Dalian Iron Ore Rises After Five Days of Losses

Iron ore prices ended a five-day losing streak amid rising steel output in China, although gains were capped by the ongoing crisis in the country’s real estate market, which continues to weigh on demand prospects.

The September iron ore contract on the Dalian Commodity Exchange closed up 0.43% at 698 yuan ($97.07) per ton.

In Singapore, the July iron ore contract rose 0.6% to $92.95 per ton.

According to consulting firm Mysteel, daily iron ore consumption increased by 2.4% from the previous week to 609,300 tons/day, the highest average daily level in seven months.

However, China is entering the low season for demand, and inventories continue to rise.

Total iron ore inventories at China’s ports rose by about 1.06% as of June 13 compared to the previous week, reaching 133.4 million tons.

Weak real estate sales and a cautious market sentiment persist.

Goldman Sachs predicted that demand for new homes in China is likely to remain significantly below the market peak of 2017 for the next few years, indicating a prolonged real estate downturn in the world’s second-largest economy.

In Shanghai, hot-rolled coil and rebar both rose 0.13%, stainless steel climbed 0.68%, and wire rod gained 0.12%.

Rubber Falls as Slowdown in Chinese Demand Overshadows Supply Concerns

Japanese rubber futures ended a four-day winning streak as demand slowed in top consumer China, despite supply concerns due to wet weather.

The November rubber contract on the Osaka Exchange closed down 6.7 yen, or 2.2%, at 298.3 yen ($2.05) per kg.

September rubber on the Shanghai Futures Exchange rose 30 yuan, or 0.21%, to 14,030 yuan ($1,951.21) per ton.

In terms of demand, the operating rates of tire companies are low due to high inventory levels, and it is currently the off-season, according to Natural Rubber Network.

Auto sales data may impact automobile production intensity, including the use of rubber tires.

Coffee Falls as Robust Harvests in Brazil and Vietnam Weigh on Prices

Robusta coffee fell 0.4% to $3,876 per ton, its lowest since May 2023. The previous session closed 6.4% lower.

The larger-than-expected robusta harvest in Brazil is underway, despite recent rains causing delays, and a bumper crop is also forecast in Vietnam, the top robusta producer, ensuring ample supply.

Arabica coffee fell 3.1% to $3.223 per lb.

Vietnamese coffee prices dropped to their lowest since May 2023 due to pressure from falling global prices, increased robusta supply from other producers, and a complex global outlook.

Farmers in the Central Highlands sold coffee at 103,000–103,500 dong ($3.94–$3.96) per kg, a significant drop from last week’s range of 111,500–112,000 dong. These prices are the lowest since May of last year.

A trader in the coffee belt mentioned that trading activities are currently very sluggish as many anticipate further price declines. Due to escalating global tensions, everyone is trading cautiously. Another trader in the region noted that the weather is currently favorable for the crop, with sufficient rainfall.

Traders offered robusta coffee with 5% black and broken beans at $109–$129 premiums per ton to the September contract in London.

In Indonesia, Sumatra coffee was offered at $235 premiums this week to the September contract. Last week, the premiums were at $145 to the July contract.

Sugar Prices Rise as White Sugar Futures Rebound

Sugar prices rose, with white sugar futures rebounding by 2.8% to $482.30 per ton after falling to near four-year lows of $458.70 per ton the previous day.

Raw sugar futures, on the other hand, fell 1.2% to 15.88 cents per lb, the lowest since April 2021.

This year’s crop in Brazil has recovered from last year’s drought. The return of monsoon rains in India this week reinforced the idea that the country will have a bumper crop in 2025/26, and expectations are high for Thailand’s crop as well.

Indian Rice Prices Rise on Improved Demand

Indian rice export prices rose from a two-year low this week due to improved demand, while subdued trading activity and increased supply pressured Thai and Vietnamese rice prices.

In India, the 5% broken parboiled variety was offered at $380–$386 per ton, up from $378–$384 the previous week. White rice 5% broken was indicated at $373–$377 per ton this week.

The CEO of Satyam Balajee, a leading rice exporter, stated that the weak rupee is providing some support to exporters, and demand is expected to return.

As of June 1, India’s state-owned rice stocks, including unmilled rice, reached a record 59.5 million tons, well above the government’s target of 13.5 million tons by July 1.

According to the Vietnam Food Association, Vietnamese 5% broken rice was offered at $387 per ton, slightly down from $388 the previous week.

A trader in Ho Chi Minh City mentioned that trading activity was subdued, but the government is trying to boost exports to China.

In Thailand, the 5% broken rice variety fell to $397 per ton from $398 the previous week due to a stronger baht and weak demand.

A Bangkok-based trader expressed concern for farmers, noting that supply is abundant, and the upcoming harvest is expected to yield a high volume due to favorable water levels.

Meanwhile, rice prices in Bangladesh remain high despite government efforts to cool down the market.

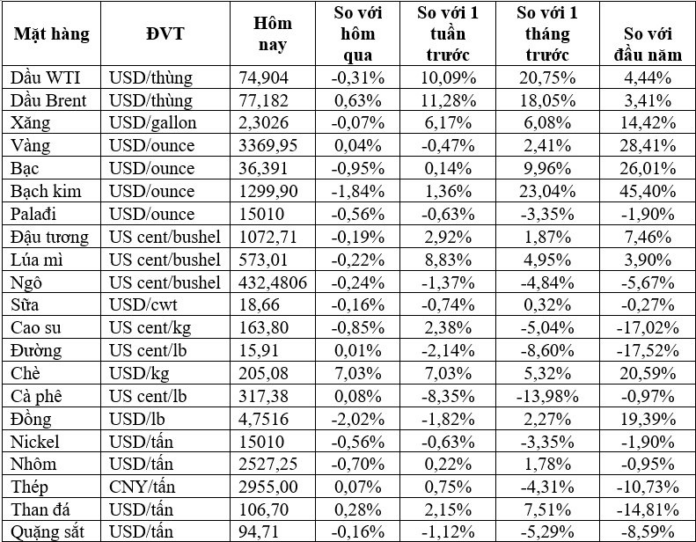

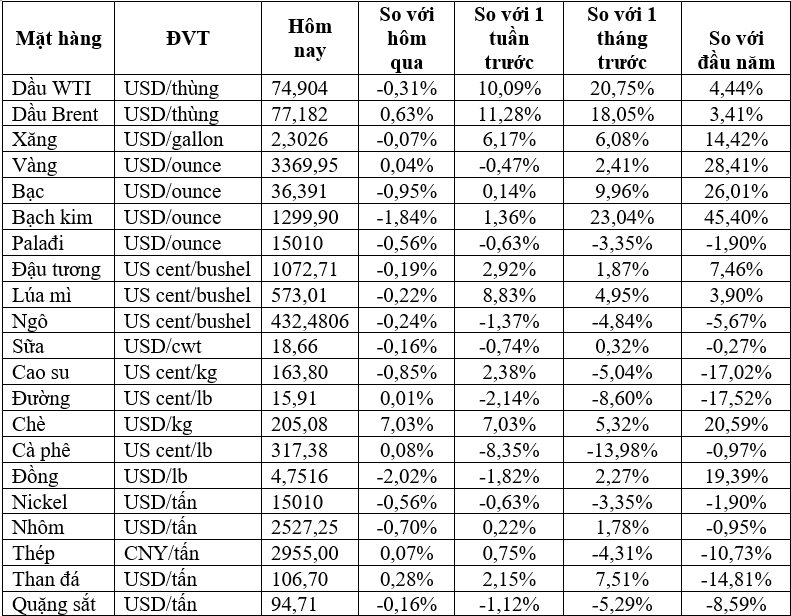

Prices of Key Commodities on June 20 Morning

The Golden Opportunity: How Retail Jewelry Businesses Can Shine in a Shifting Market

The Vietnamese jewelry manufacturing and retail industry could benefit from a more stable gold market.