In the latest update, Finnish foreign fund PYN Elite Fund has reported purchasing over 1.5 million shares of YEG of Yeah1 Joint Stock Company. The number of shares held by PYN Elite Fund in Yeah1 increased from 10.7 million to over 12.2 million, corresponding to a 6.39% ownership stake.

The transaction was made during the session on June 12, 2025. YEG shares surged to the daily limit of 6.67% to close at VND 12,800/cp. It is estimated that the foreign fund spent approximately VND 19 billion to complete this transaction.

YEG first appeared in PYN Elite Fund’s investment portfolio at the end of December 2024. By April 2025, the foreign fund officially became a major shareholder in Yeah1. In the latest report for May 2025, YEG recorded a 1.27% increase for the month but remained among the worst-performing stocks in the portfolio.

Regarding Yeah1’s business performance: In 2025, Yeah1 targets consolidated revenue of VND 1,300 billion and profit after tax of VND 140 billion, up 27% and 14%, respectively, compared to 2024. The growth momentum continues to come from the concert series “Anh trai vượt ngàn chông gai” (Days 3, 4, and 5). Yeah1 also plans to invest in producing two new programs: “Tân binh toàn năng” and “Gia đình Haha.”

After the first quarter, the producer of “Anh trai vượt ngàn chông gai” recorded revenue of nearly VND 218 billion, up 197% over the same period last year. Gross profit increased by 187% to VND 43 billion after deducting cost of goods sold.

As a result, the company reported a net profit of VND 23 billion, nearly doubling that of the previous year and completing over 16% of the full-year profit target.

Stock Market Update for Week of June 16-20, 2025: Navigating Volatility Around the 1,350-point Threshold

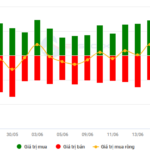

The VN-Index witnessed a slight decline, failing to sustain the 1,350-point mark in the week’s final session. The index’s candlestick chart displayed a series of long shadows, indicating investor hesitation around previous peak levels. With foreign investors’ net selling trend likely to persist, the short-term upward trajectory may encounter challenges, as evident from the below-average trading volume maintained over the past 20 days.

Unlocking the Strategy: Why the $700 Million Bet on MBB Shares?

In May, the Pyn Elite Fund allocated approximately 3% of its portfolio (VND 700 billion) to MBB stock, increasing its holding to 12.4%.

The Expert’s Take: Only 154 Stocks Out of the 10% Losers Trailing VN-Index, Opportunities in Mid-Cap Space

The HoSE boasts an impressive performance with 42 stocks surging over 30%, and a further 215 stocks experiencing gains of between 10% and 30%. The remaining 154 stocks still managed a rise of under 10%. With over two-thirds of the market gaining under 30% and half of the HoSE’s stocks outperforming the VN-Index, it showcases a robust and diverse market.

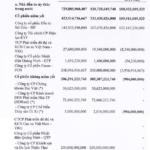

“HDCapital Offloads 1.5 Million FCN Shares”

On May 15th, HD Capital Management Joint Stock Company (HDCapital) sold 1.5 million shares of FECON Joint Stock Company (HOSE: FCN), reducing its holdings from over 17.6 million shares (a stake of 11.18%) to over 16.1 million shares (a stake of 10.23%).