Mr. Doan Nguyen Duc reports on the trading results of Hoang Anh Gia Lai Joint Stock Company’s insider shares (code: HAG-HOSE)

Accordingly, Mr. Doan Nguyen Duc, Chairman of the Board of Directors of HAG, announced that he had successfully purchased 10 million HAG shares as previously registered through a matching method in the session on June 19, 2025.

After the transaction, Mr. Duc’s ownership in HAG increased from 319,950,533 shares, holding 30.26%, to nearly 330 million shares, holding 31.2%.

According to data on the HOSE on June 19, 2025, 100 million HAG shares were traded by agreement with a value of VND 1,352.5 billion (equivalent to VND 13,525/share). Thus, it is estimated that the Chairman spent more than VND 135 billion on this transaction.

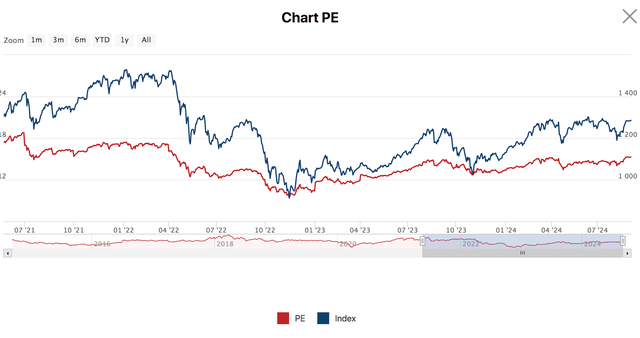

At the end of the June 19 session, HAG share price decreased by 1.52% to VND 12,950/share.

In the opposite direction, during the period from June 09 to June 16, 2025, Mr. Duc’s daughter, Ms. Doan Hoang Anh, sold 1 million HAG shares by matching orders, thereby reducing her ownership from 1.32% to 1.23%. It is estimated that Ms. Hoang Anh earned nearly VND 13 billion from this transaction.

In the same buying direction, Ms. Vo Thi My Hanh and Ms. Ho Thi Kim Chi, members of the Board of Directors, registered to buy 1 million shares each to increase their ownership. The planned execution time is from June 23 to July 22, 2025, through matching or agreement on the exchange.

If successful, Ms. Ho Thi Kim Chi will increase her ownership to 1,595,159 shares, holding 0.15%, and Ms. Hanh will increase her ownership to 1,300,001 shares, holding 0.12% of HAG’s capital.

Previously, the Board of Directors of HAG approved the plan to issue shares to convert part of the debt of “Bonds issued by Hoang Anh Gia Lai Joint Stock Company on December 30, 2016 – Group B”

The principal amount of these bonds is VND 2,000 billion, and the interest accrued as of December 31, 2024, is VND 1,937 billion.

Specifically: Based on the debt restructuring proposal of the owners of 100% of Group B Bonds, the Board of Directors approved the plan to handle the bond debt obligations, specifically, the Board of Directors of the Company will submit to the General Meeting of Shareholders for approval of the plan to issue shares to convert part of the debt of “Bonds issued by Hoang Anh Gia Lai Joint Stock Company on December 30, 2016, Group B Bonds”

Therefore, HAGL plans to issue 210 million shares to convert VND 2,520 billion of debt, and on average, each HAG share is priced at VND 12,000 for creditors.

The list of HAGL creditors includes 1 company and 7 individuals, namely: Consulting and Investment Development Company (VND 720.7 billion), Le Minh Tam (VND 395.6 billion), Nguyen Thi Dao (VND 83.2 billion), Phan Cong Danh (60.5 billion dong), Nguyen Anh Thao (VND 60.5 billion), Ho Phuc Truong (VND 599.8 billion), and Nguyen Duc Trung (VND 599.8 billion).

After the issuance, this group of creditors will hold 18.83% of HAGL’s capital.

“Chairman of APG Sells 6 Million Shares”

“From May 20 to June 17, a series of transactions were made that resulted in Mr. Nguyen Ho Hung reducing his ownership in APG. The transactions, which were agreed upon beforehand, saw Mr. Hung’s holdings decrease from nearly 6.8 million shares, representing 3.03% of the company, to 783,803 shares, now accounting for 0.35% of the company’s capital. This significant shift in ownership has undoubtedly sparked interest and curiosity among investors and market observers alike.”

Viconship Registers to Sell Over 6.3 Million VGR Shares, Expecting Over VND 386 Billion in Proceeds

As the largest shareholder in CTCP Cang Xanh Vip (UPCoM: VGR), Viconship has registered to sell over 6.3 million VGR shares from June 19 to July 18. The transaction could fetch over VND 386 billion at the current market price, as VGR faces the risk of losing its public company status.