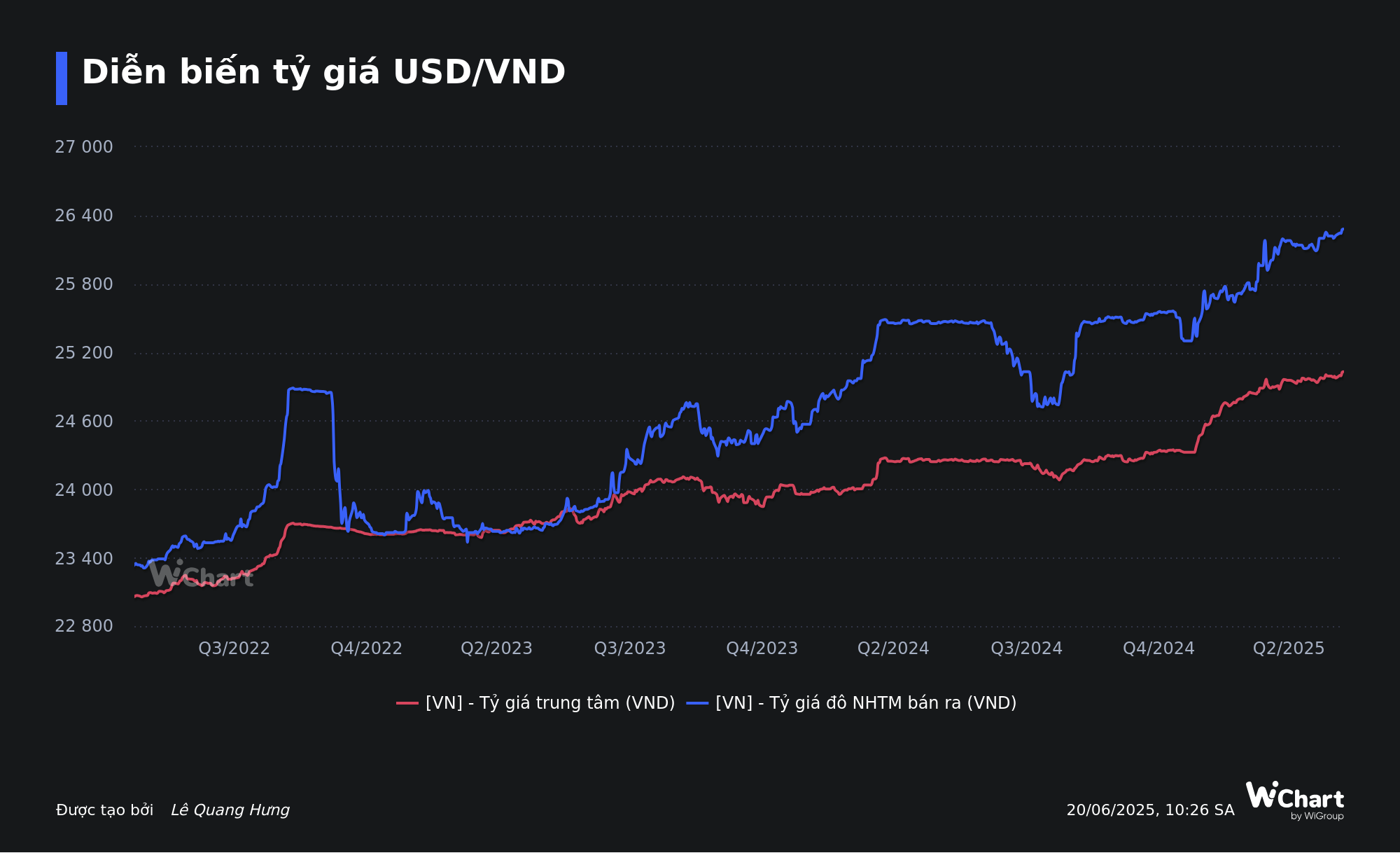

In today’s trading session (June 20), the State Bank of Vietnam has set the central exchange rate for the US dollar at 25,031 VND/USD, marking a nearly 2.9% increase since the beginning of the year and the highest level since the introduction of this mechanism in early 2016.

In the interbank market, most banks are offering rates at the ceiling of 26,282 VND per dollar for selling and around 25,800-25,900 VND for buying, also reflecting a nearly 2.9% rise since the start of 2025.

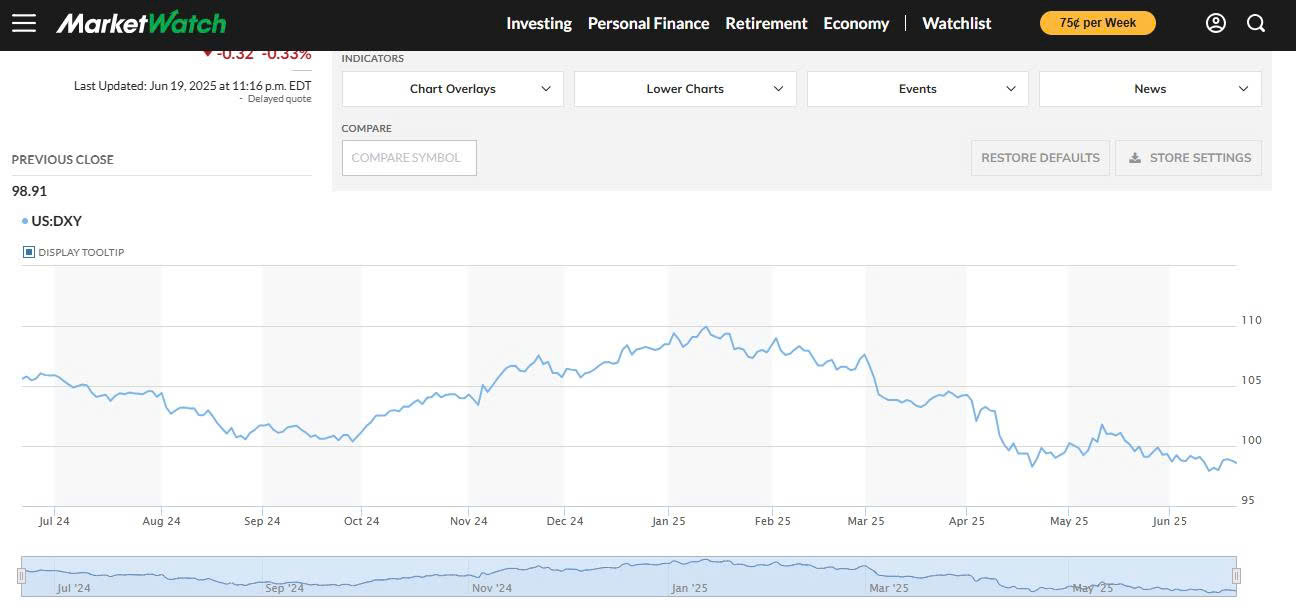

This trend goes against the weakening of the US dollar in the international market, as indicated by the US Dollar Index (DXY), which has dropped by 9% since the beginning of 2025 and hit a three-year low.

In a recently published analysis report, Vietcombank Securities (VCBS) states that the domestic exchange rate is witnessing a slight increase, despite the downward trend of the DXY. This indicates that the pressure on the exchange rate does not originate from external factors but is primarily driven by domestic market conditions.

According to VCBS’s assessment, speculative sentiment for the US dollar remains high among both individual and institutional investors. This reflects the market’s cautious approach amid the absence of official information regarding trade negotiation outcomes between Vietnam and the United States. Additionally, Trump’s postponement of the implementation of the countervailing tax rate, which is set to expire in early July, is prompting investors to shift towards defensive assets such as the US dollar.

“This continues to reinforce the sentiment of holding foreign currencies and increases domestic demand pressure on the greenback. However, we believe that this speculative sentiment is short-term in nature during the information trough about trade negotiation outcomes,” VCBS stated.

VCBS is confident that the exchange rate will show clearer signs of cooling down in the future as Vietnam continues to demonstrate its stable foundation. The country remains an ideal destination for investment and production-business activities. Therefore, VCBS maintains a positive outlook for the foreign exchange market, expecting it to move in a more favorable direction as trade tensions have temporarily eased compared to the previous period.

Similarly, ACB’s Market Research Department attributes the weak correlation between the global weakening of the US dollar and domestic exchange rate trends to the persistent high foreign currency demand from businesses. Additionally, the sharp decline in VND interest rates in the interbank market for short-term maturities has been a significant factor putting pressure on the exchange rate.

Previously, Fiin Ratings also attributed the high USD/VND exchange rate to the surge in domestic USD demand from businesses and the State Treasury, resulting in limited supply. Meanwhile, the State Bank of Vietnam has been flexible in adjusting the central exchange rate to allow the market more room for self-regulation.

In the domestic market, USD demand has increased significantly as businesses ramp up imports of raw materials to rush order completion before the 90-day deadline and stock up for the peak season. In the first five months of the year, Vietnam recorded a goods import turnover of $175.6 billion, up 17.5% compared to the same period last year, with production inputs accounting for 93.8%. Imports from the US rose to $7.2 million, a 25% increase year-over-year, in an effort to ease potential tariff barriers and avoid further pressure on the exchange rate.

Additionally, the State Treasury has continued its USD purchasing activities to fulfill foreign debt obligations, further tightening the USD supply in the market. Fiin Ratings anticipates that the State Bank of Vietnam will continue to adjust the central exchange rate flexibly. With the US dollar expected to weaken further, this will ease pressure on the exchange rate, allowing the central bank to widen the exchange rate band for market self-regulation rather than direct intervention using foreign reserves.

The Greenback’s Slippery Slope

The U.S. dollar remained on a downward trajectory in the week of June 9–13, 2025, despite a brief recovery following Israel’s strike on Iran.