**The Sky’s the Limit for Southeast Asia’s Budget Airlines**

Southeast Asia’s largest low-cost carriers are engaging in a competitive expansion race, despite rising cost pressures eating into profits. Qantas Airways is leading the charge.

Over the past two decades, budget airlines have thrived in Asia, thanks to rising incomes across the region.

Forecasts show that demand for air travel in Asia will outpace other regions over the coming decades. Carriers such as VietJet (Vietnam) and AirAsia (Malaysia) are expected to continue their aircraft acquisitions, expanding their already substantial fleets to capture more market share.

However, profit margins in this region remain lower than elsewhere. The International Air Transport Association (IATA) predicts that in 2025, Asia-Pacific airlines will achieve a net profit margin of around 1.9%, lower than the global average of 3.7%.

Airlines across Asia have largely restored their operational capacity since the pandemic, leading to intensified competition, especially in the price-sensitive customer segment. This has resulted in a decrease in airfares from their recent highs.

According to data from ForwardKeys, international airfares in Asia in 2024 were 12% lower than in 2023. AirAsia, the region’s largest low-cost carrier, recorded a 9% decrease in average fares in the first quarter as it increased capacity and passed on fuel savings to customers.

Vietjet signs a deal for 100 new A321neo aircraft. Image: Vietjet

However, airlines are facing new challenges. Operating costs, including labor and airport fees, continue to rise. Additionally, a shortage of new aircraft is driving up leasing and maintenance costs.

Against this backdrop, Australian carrier Qantas has announced it will shut down Jetstar Asia—its low-cost, Singapore-based subsidiary—at the end of July, after two decades of operations.

Jetstar Asia has cited significant pressure from rising costs, including double-digit increases in fuel, airport, ground handling, and security fees in Singapore.

Sheldon Hee, IATA’s Vice President for Asia-Pacific, commented: “It’s a very thin cushion, and with such low profits, any cost increase could impact an airline’s viability.” He also emphasized the sharp rise in operating costs across the region.

In its February report, aviation data company OAG stated that Asia-Pacific is now the world’s most competitive aviation market. Expanding capacity is driving down airfares, which “could impact profitability” for carriers.

**

Go Big or Go Home

**

Southeast Asia currently has an unusually high density of international flights operated by low-cost carriers. According to data from the CAPA Center for Aviation, about two-thirds of international seats in the region this year are offered by budget airlines, compared to just about one-third globally.

Analysts say Qantas decided to pull Jetstar Asia out of Singapore to redeploy aircraft to the domestic markets of Australia and New Zealand, where operating costs are lower, rather than continue to incur losses in a fiercely competitive market.

Brendan Sobie, an independent aviation analyst in Asia, noted that low-cost carriers in Southeast Asia struggled to turn a profit even before the pandemic and are now facing additional pressure from escalating costs.

Budget airlines keep fares low by optimizing operating costs, and a large fleet of the same type of aircraft allows them to achieve high scale efficiency.

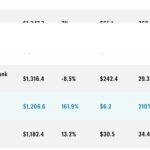

However, Jetstar Asia has only 13 aircraft—a much smaller fleet compared to its regional rivals. As of March 31, Scoot (Singapore Airlines’ low-cost subsidiary) operated 53 aircraft, AirAsia had 225, VietJet had 117 (including its Thai subsidiary), and Cebu Pacific (Philippines) had 99.

All four carriers have plans to expand their fleets this year and beyond. On Tuesday (June 17), VietJet signed a deal to purchase an additional 150 narrow-body Airbus aircraft at the Paris Air Show, marking the beginning of its long-term growth strategy. Just a few weeks earlier, the carrier also ordered 20 wide-body A330neo aircraft and is awaiting the delivery of a 200-plane order from Boeing.

AirAsia, with a current order book of at least 350 aircraft, is negotiating to buy another 50 to 70 narrow-body long-range jets and about 100 regional jets to expand its network.

“Ultimately, it’s go big or go home,” said Subhas Menon, Director-General of the Association of Asia-Pacific Airlines.

An An (Reuters)

Tasco Makes the Cut in the Fortune Southeast Asia 500 List

“Tasco’s debut on the Fortune Southeast Asia 500 list is a testament to its remarkable growth trajectory over the past year. The company’s inclusion in this prestigious ranking highlights its position as a prominent player in the region’s business landscape, showcasing its resilience and ability to thrive amidst challenges.”

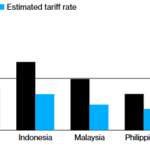

“Nomura: US May Impose Higher Tariffs on Asia to Curb Chinese ‘Roundabout’ Trade”

The United States could impose higher tariffs on Southeast Asian countries as China reroutes goods through the region to circumvent higher tariffs, according to Nomura Holdings. This potential move underscores the complex dynamics of global trade and the intricate web of supply chains that span across continents. With China at the epicenter of shifting trade policies, countries in the Southeast Asian region may find themselves in a delicate position, navigating the intricacies of international economics and geopolitics.

“The Rise of Vietnam’s Mega City: Envisioning a Southeast Asian Metropolis Grander than Shanghai”

The consolidation of these three provinces marks a pivotal turning point in the history of Vietnamese urban development, according to the General Secretary. This move is unprecedented and signifies a significant transformation in the country’s urban landscape.