In this context, open-ended equity funds emerge as an attractive option, offering significantly higher cumulative returns than traditional savings accounts, while being managed by professional fund management companies.

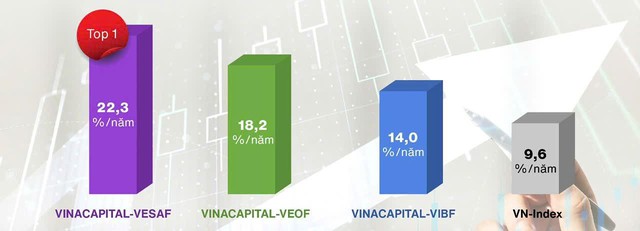

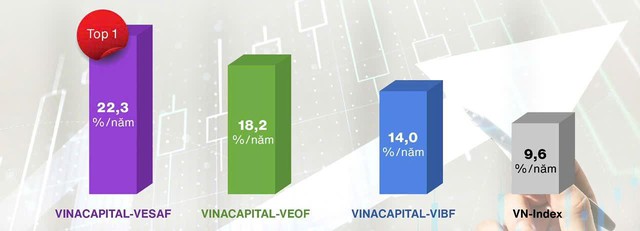

A good example of this is the open-ended funds managed by VinaCapital. As of June 15, 2025, the VINACAPITAL-VESAF equity fund recorded an average return of 22.3% per year over a five-year period, significantly outperforming the average growth of the VN-Index (approximately 9.6%/year).

The VINACAPITAL-VEOF equity fund also delivered an average performance of around 18.2%/year during the same period. These results were achieved amidst fluctuations in the Vietnamese stock market, from the Covid-19 pandemic to global inflationary waves and geopolitical turmoil, demonstrating the fund manager’s effective risk management and robust investment strategy.

Superior returns with controlled risk

According to Ms. Nguyen Hoai Thu, CFA, Deputy General Director of VinaCapital Fund Management Company, the secret lies in their strategy of focusing on businesses with sustainable long-term growth potential, purchased at reasonable valuations. It’s not just about picking good stocks; their investment team also allocates the portfolio according to economic cycles and macro trends, thereby optimizing returns.

Specifically, VinaCapital’s investment process consists of three main steps: stock screening, in-depth analysis, and portfolio construction. In the first step, VinaCapital starts with over 1,600 stocks in the market and narrows them down to approximately 120 potential candidates based on quantitative and qualitative criteria such as corporate governance quality, reliability of the management team, business operating efficiency, market capitalization, and liquidity.

Next, the company’s research and investment team collaborate to analyze macro, industry, and company-specific factors to select the 20-30 best stocks for the portfolio. During this phase, VinaCapital forecasts each company’s cash flow and profits for at least the next three years while also assessing financial risks and determining the current stock valuation to make informed investment decisions.

5-year average returns of equity and balanced funds managed by VinaCapital as of June 15, 2025. Source: VinaCapital

Additionally, to control risk, VinaCapital refrains from purchasing expensive stocks, even if the underlying business is strong. They also avoid investing in companies that lack transparency or have an unreliable management team.

“To achieve such positive investment results over the past five years, a stringent investment process has been crucial. Moreover, our success also stems from VinaCapital’s unique strength—our direct investments in various sectors such as technology, real estate, and energy, as well as our private equity investments in banking, consumer goods, and healthcare. This grants us deep and specialized insights across multiple industries,” she added.

The next five years—a “golden” period for smart wealth accumulation

With a positive mid-term outlook, Ms. Thu believes that the next five years will be a “golden” period for smart wealth accumulation through open-ended funds. The Vietnamese stock market is entering a new recovery cycle as the economy stabilizes, inflation is curbed, and low-interest rates support consumption and investment. Meanwhile, FDI continues to pour into production and infrastructure.

Simultaneously, the real estate market is gradually emerging from its slump, presenting opportunities for listed companies and long-term-oriented investors. In this context, investing in open-ended funds is not only a choice for individual investors with limited time but also an increasingly popular asset management tool for businesses and professional financial managers.

Open-ended funds offer flexibility in investment and easy capital withdrawal at regular intervals. They are also transparent and regularly updated, leveraging the in-depth analytical capabilities of investment experts. Regular investments in these funds, even with small monthly amounts, can help investors effectively accumulate wealth over the long term without the need for frequent trading or constant market monitoring.

VinaCapital’s statistics show that in the first five months of 2025, the VN-Index rose by 5.2%, or 66 points. Notably, the Vingroup conglomerate’s stocks, including VIC, VHM, and VRE, contributed 94 points to the VN-Index. This means that without these stocks, the index would have declined instead of rising.

“This indicates that many stocks in the market have yet to rise and are still attractively valued. There are plenty of opportunities to invest in growth stocks. Many of these are held by VinaCapital’s funds, presenting prospects for positive investment outcomes in the future,” concluded the VinaCapital expert.

Unleashing the Dragon: Dragon Capital Divests 1.1 Million Shares of Nha Khang Dien

Dragon Capital has successfully offloaded 1.1 million KDH shares, thereby reducing its ownership stake in Nha Khang Dien to 8.9765%.

Unleashing Vietnam’s Private Sector: Vinacapital Expert Weighs in on Resolution 68

“The core vision of Resolution 68, according to the director of VinaCapital, is to foster a dynamic, robust, high-quality private economic sector with a global competitive edge. This resolution aims to empower private enterprises to become key drivers of Vietnam’s economic growth and transformation.”

The Grand Ho Tram Launches Construction on New 35-Hectare Phase

The Grand Ho Tram reaches a pivotal moment with the groundbreaking ceremony of its new 35-ha expansion. This momentous occasion marks a strategic milestone in the journey towards developing a world-class, integrated tourism complex in Vietnam.