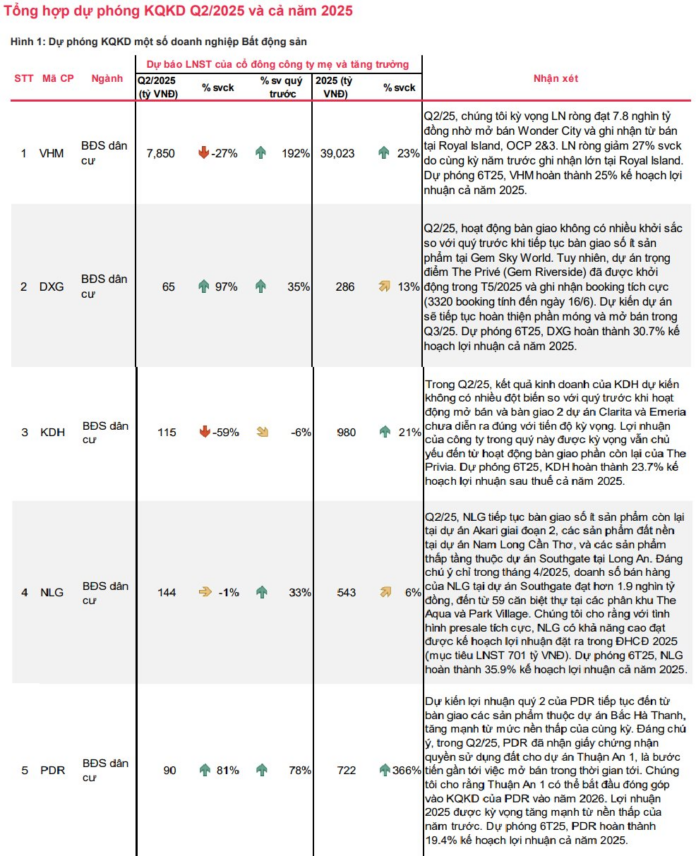

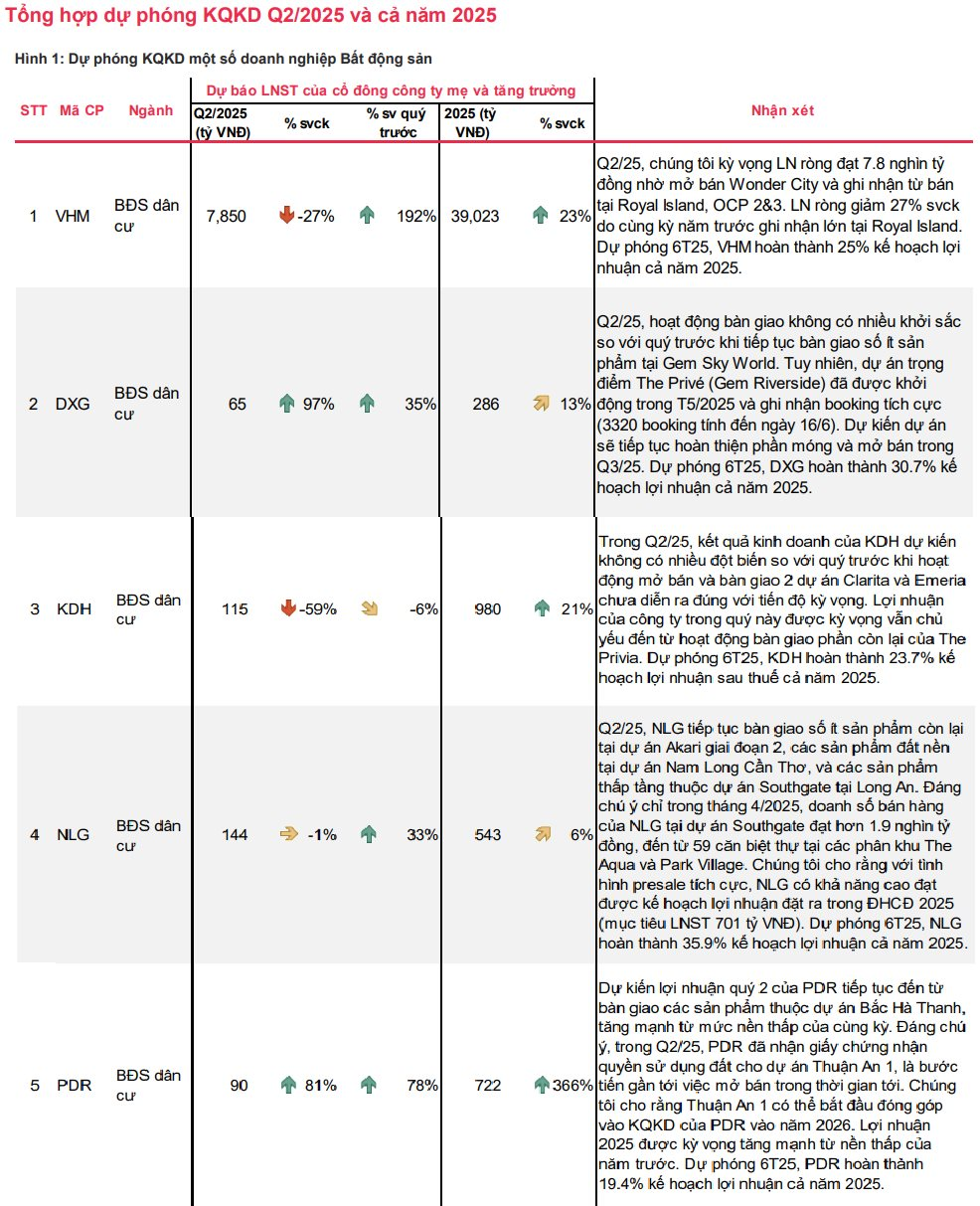

MBS Securities (MBS) has released a forecast for the residential real estate sector’s profit landscape in Q2 2025 and the full year 2025.

According to MBS Research, the Q2 2025 financial results of the residential real estate companies under its coverage are not expected to show significant improvements, as there were no new project handovers, and performance was mainly driven by the continued handover of remaining products from previous projects (NLG: Akari Phase 2 & Nam Long Can Tho, KDH: The Privia, DXG: Gem Skyworld, PDR: Bac Ha Thanh).

However, the Q2 2025 results do not imply a low likelihood of these companies achieving their full-year profit plans or recording profit growth in 2025. These companies have upcoming projects expected to be handed over in the second half of 2025 (NLG: Park Village and The Aqua at Southgate, KDH: The Foresta, PDR: Thuan An 1&2).

MBS believes that the handover activities at these new projects will lay the foundation for positive expectations for the performance of leading companies in the real estate sector in 2025.

Among the companies, Dat Xanh Group (code: DXG) is expected to achieve the highest growth rate in Q2 2025, with a forecasted after-tax profit of VND 65 billion, up 97% over the same period in 2024. Although the handover activities did not show much improvement from the previous quarter, with only a few products handed over at Gem Sky World, the key project, The Privé (Gem Riverside), was launched in May 2025 and has received positive booking numbers (3,320 bookings as of June 16).

According to the analysts, the project will continue with foundation work and is expected to be launched in Q3 2025. For the first half of 2025, DXG is projected to have completed 30.7% of its full-year profit plan.

Similarly, the after-tax profit of Phat Dat Real Estate Development Joint Stock Company (code: PDR) is forecasted to increase by 81% compared to the same period last year, reaching VND 90 billion. The significant increase in Q2 profit is attributed to the continued handover of products from the Bac Ha Thanh project, building on the low base from the previous year. Notably, in Q2 2025, PDR received the land use right certificate for the Thuan An 1 project, moving closer to its launch in the near future.

MBS expects Thuan An 1 to start contributing to PDR’s business results in 2026. The company’s profit for 2025 is projected to increase significantly from the low base of the previous year. For the first half of 2025, PDR is estimated to have completed 19.4% of its full-year profit plan.

Regarding Nam Long (code: NLG), the analysts believe that with positive presale performance, NLG is highly likely to achieve the profit plan set at the 2025 Annual General Meeting (target after-tax profit of VND 701 billion). However, NLG’s profit in Q2 2025 is expected to remain relatively unchanged from the same period last year. For the first half of 2025, NLG is projected to have completed 36% of its full-year profit plan.

On the other hand, MBS forecasts that Khang Dien House (code: KDH) will not show significant improvements in Q2 2025 compared to the previous quarter, as the launch and handover of two projects, Clarita and Emeria, have not progressed as expected. The company’s profit in this quarter is expected to mainly come from the handover of the remaining units of The Privia, forecasted to decrease by 59% to VND 115 billion in Q2 2025. For the first half of 2025, KDH is estimated to have completed 23.7% of its full-year after-tax profit plan.

MBS Research also predicts that Vinhomes’ (code: VHM) net profit will reach VND 7,800 billion, thanks to the launch of Wonder City and sales recognition from Royal Island, OCP 2&3.