The market failed to advance higher during the afternoon session, with the VN-Index even slipping lower, while breadth narrowed on declining liquidity. However, some strong pillars remained to influence the market.

The most impressive was VHM, one of the few large-cap stocks that continued to climb higher in the afternoon. In fact, by the end of the continuous matching session, the stock had fallen to 76,800 dong, which was lower than the morning session (76,900 dong). But in the closing auction session, it was pulled up to 77,300 dong, a 4.46% gain compared to the reference price.

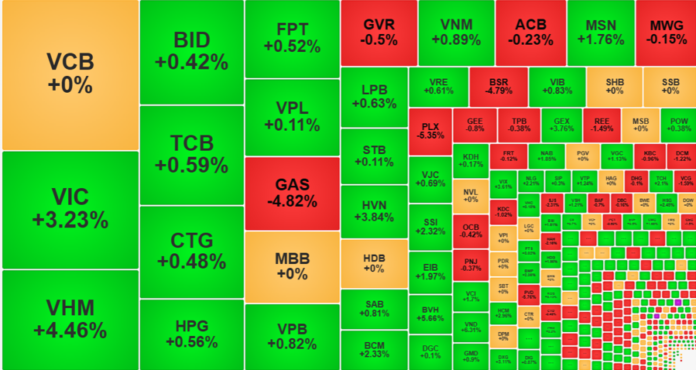

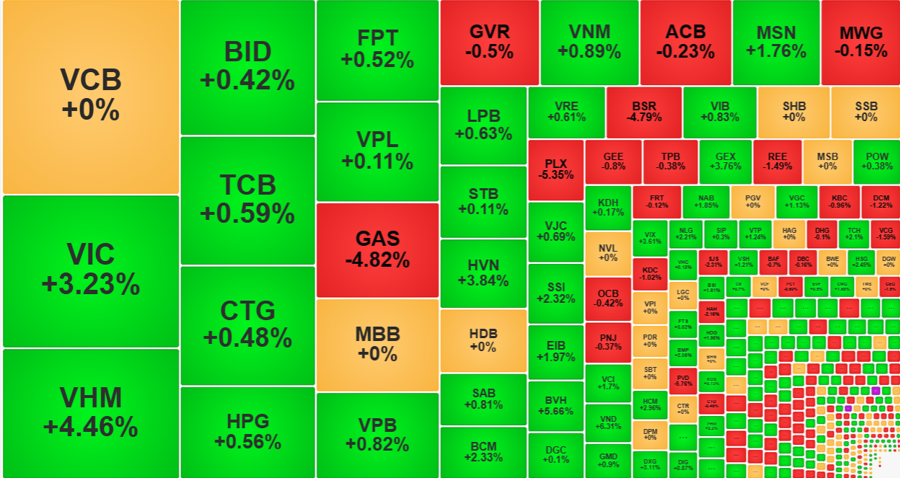

VIC closed up 3.23% and was also a strong pillar, but it actually weakened in the afternoon. At the end of the morning session, VIC was up 4.42%, meaning it slipped about 1.14% in the afternoon. TCB also performed poorly, falling 1.45% from its morning high and closing only slightly higher by 0.59%. Other large-cap stocks, including HPG, GAS, and MBB, also showed weakness.

Statistics show that only 5 stocks in the VN30 basket maintained their intraday highs until the close, namely BCM, BVH, SAB, VHM, and VJC, while the rest slipped with varying margins. Nearly half of the basket (14 stocks) fell by at least 1% from their intraday peaks.

While prices lacked vigor, the strength of the pillars was sufficient to support the index. VIC and VHM alone contributed 5.8 points to the VN-Index’s total gain of 8.59 points. These two stocks also helped the VN30-Index outperform with a 1% gain, equivalent to 14.48 points, with VIC and VHM contributing 9.5 points. While the breadth of this blue-chip basket ended with 6 decliners and 19 advancers, the number of strong gainers was limited. Besides VIC and VHM, BVH rose 5.66%, BCM gained 2.33%, SSI was up 2.32%, and MSN climbed 1.76% notably.

Expanding to the full HoSE floor, the price slippage was also prevalent. About 45% of the stocks on this exchange fell by at least 1% from their morning highs. Only about 60 stocks closed at their intraday highs, but only half (36) managed to finish above the reference price.

The afternoon’s price weakness was accompanied by declining liquidity. HoSE’s matched trade value in the afternoon was nearly 13% lower than in the morning, and when including HNX, liquidity declined by 13.3%. This indicates a weakening in buying demand, which couldn’t sustain prices, despite a significant number of gainers.

Among the 174 gainers of the VN-Index, 81 rose more than 1% (down from 94 in the morning). Almost all of these also weakened slightly towards the close. For instance, SSI, despite having the highest liquidity in the market at 1,177.8 billion dong and a 2.32% gain, slipped by around 1.02% from its intraday peak. Several securities stocks that were very strong in the morning and closed robustly, such as VIX, HCM, FTS, and VCI, also generally retreated by 1%-2% with liquidity above 100 billion dong.

Due to selling pressure, today’s breakout session, despite having better liquidity, saw the VN-Index surpass 1460 points but still exhibited clear differentiation in strength. In reality, the index hitting a new high doesn’t mean individual stocks will follow suit. The increasing selling pressure indicates that investors are still basing their trading decisions on the fluctuations of their respective holdings.

Foreign investors were a small surprise in the afternoon as they turned net buyers again. In the morning, they net sold 340 billion dong, but in the afternoon, they net bought 570 billion dong, reversing their overall position to net buy about 230 billion dong. This was due to an 80% jump in their buying compared to the morning, reaching 1,851 billion dong. The most heavily purchased stocks were DGW (+218.9 billion dong), VND (+213.4 billion dong), SSI (+150.4 billion dong), HPG (+135.4 billion dong), VHM (+72.4 billion dong), and FPT (+45.5 billion dong). On the net selling side, HCM (-115.3 billion dong), VPB (-79.6 billion dong), VCB (-76.7 billion dong), STB (-61 billion dong), GEX (-57.8 billion dong), and VRE (-56.3 billion dong) saw outflows.

The Highest Score in 3 Years, Shares Still in the Red, Individuals Net Sell over VND 550 Billion

Today, individual investors net-sold VND 497.3 billion, including VND 554.2 billion in matched orders.

Stock Market Insights: Strong Cash Flows, Index Breaks Out on Key Support

The market witnessed a significant surge, surpassing the mid-term peak of the VNI index, with outstanding performances from VHM and VIC. Trading liquidity also impressively rose to over 24.2k billion matched orders on the two exchanges. This indicates a strong return of cash flow, signaling renewed investor confidence and a potential shift in market dynamics.

The Highest Liquidity in 7 Sessions: Has the Cash Flow Been Convinced?

The VN-Index witnessed a decisive morning surge, breaking through the mid-term peak with a 0.85% gain to reach 1369.68. What sets this upward movement apart is the broad-based participation of stocks and a seven-session high in liquidity, marking a notable shift in the market dynamics.

“Stalling Momentum: The Impact of Weak Support and Declining Funds”

The reversal of the two major stocks, VIC and VHM, has significantly slowed down the VN-Index’s upward trajectory this morning. While the weakening of the cash flow also played a significant role, with HoSE’s liquidity decreasing by 32% compared to yesterday’s morning session. Although the breadth remained tilted towards gainers, most stocks witnessed only minor fluctuations.