CEO Nguyen Duc Quan delivered a speech at APS’s 2025 Annual General Meeting on June 17th

|

Setting ambitious profit plans and restructuring operations

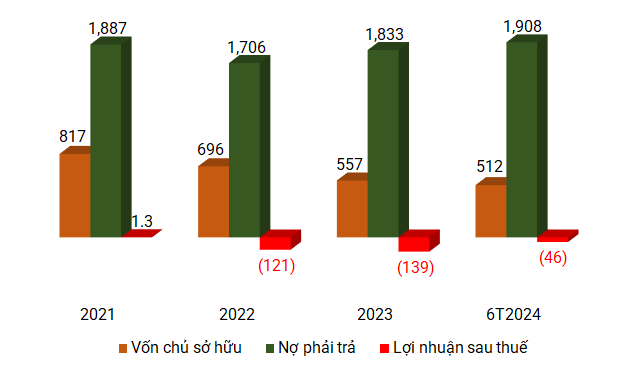

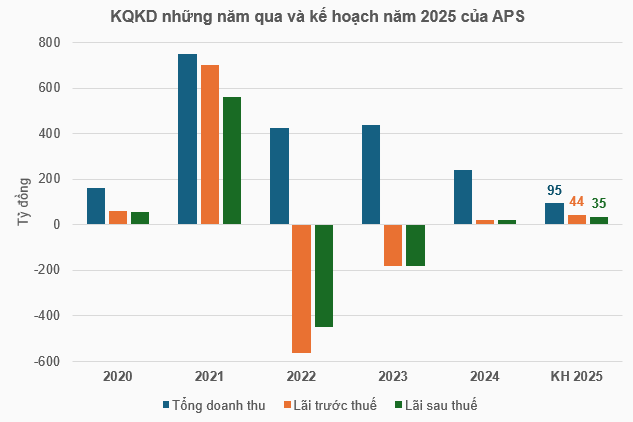

The meeting approved the 2025 business plan with total revenue of VND 94.8 billion, a 60% decrease compared to the same period last year. However, with expected cost-cutting measures, the company forecasts a respective pre-tax and post-tax profit of VND 44.3 billion and over VND 35.4 billion, marking a 116% and 63% increase.

This plan indicates that the company has a lot of work to do in the remaining three quarters to achieve its goals, especially after incurring a post-tax loss of nearly VND 25 billion in the first quarter.

Source: VietstockFinance

|

According to CEO Nguyen Duc Quan, the revenue structure in recent years has largely depended on proprietary trading as the company implemented a free trading policy for 1-2 years to attract new account openings and increase user numbers. However, the results fell short of expectations as the rate of new account openings remained low, impacting brokerage and margin lending revenue.

Mr. Quan also stated that the company will consider reintroducing products with trading fees to boost brokerage revenue, restructure operations, and strengthen capital mobilization from credit institutions to enhance profit sources.

Regarding dividend distribution, the company asked shareholders to wait until 2026 when financial performance is expected to improve.

Withdrawal from the underwriting business

The meeting also approved the withdrawal from the underwriting business, with the expected submission of relevant documents in Q3-Q4 2025. This strategy aligns with the Board of Directors’ plan to restructure the company’s service portfolio, enhance operational efficiency, and improve market adaptability.

According to the 2019 Securities Law and Government Decree 155, the underwriting business requires a high level of capital commitment, risk management, and a stringent process. APS shared that, for now, the company aims to focus its resources on core and highly effective businesses, such as proprietary trading.

CEO Nguyen Duc Quan explained that withdrawing from the underwriting business would reduce the demand for available capital and improve financial safety ratios, especially since the company has not engaged in any activities or contracts related to this business in the past year.

No concrete capital increase plan

The issue of capital became a heated topic at the meeting, with shareholders expressing concerns about APS’s competitiveness without a concrete capital increase plan, unlike many other companies.

CEO Nguyen Duc Quan acknowledged that while capital resources are modest compared to development needs, implementing a capital increase is challenging due to unfavorable stock price movements. With the market price being below par value, many shareholders would opt to purchase shares on the stock exchange instead of participating in the issuance.

In reality, APS’s stock price is currently below VND 6,000/share, far from the par value of VND 10,000/share. Since the beginning of 2025, APS’s stock price has dropped by nearly 11%. According to Mr. Quan, the stock price has been influenced by an event in 2023 that made investors cautious, among other reasons.

It is worth noting that 2023 was a challenging year for APS as Board member Nguyen Do Lang was arrested in June 2023 in connection with a securities manipulation case involving the APEC group.

[Securities Manipulation Case in the APEC Group: Mr. Nguyen Do Lang Arrested]

Another notable item on the agenda was the approval of the resignation of Mr. Ho Xuan Vinh from the Board of Directors for the 2024-2029 term. As a result, the company’s Board of Directors will operate with four members.

Huy Khai

– 14:00 21/06/2025

The City People’s Committee Proposes to Expand Leadership Roles at the Ward and Commune Levels

“Ho Chi Minh City has shortlisted 510 individuals for the positions of Chair and Vice-Chair of the People’s Committees in the newly established wards and communes. The city has also proposed the addition of one more Vice-Chair position to accommodate the efficient governance of these areas.”

“Streamlining Administrative Services: Prioritizing Accessibility for Citizens and Businesses in Ho Chi Minh City”

“Secretary of the Ho Chi Minh City Party Committee, Nguyen Van Nen, has emphasized the importance of meticulous execution in the process of auditing, inventorying, and transferring assets and documents. This ensures a seamless and comprehensive transition, with no disruption to regular operations. The emphasis is on convenience and ease of access for citizens and businesses alike, with the selection of administrative centers in new wards and communes being strategically located.”

“T-Cap: Unveiling a New Era of Financial Strategy”

The annual General Meeting of Shareholders of Tri Viet Securities Joint Stock Company (HOSE: TVB), held on June 07, 2025, approved a name change to T-Cap Securities. Amid challenging market conditions, the company has set conservative business targets for 2025 and plans to offer over 33.6 million shares to existing shareholders.

The New CEO of Sacombank: A Candid Conversation

“I embrace the responsibility of doing things differently, but with a deeper impact. It’s about delving into the heart of beliefs, processes, and the very essence of banking in an economy that is profoundly shaping an era of transformation.”