For 2025, the Company targets 4,850 billion VND in revenue and 1,800 billion VND in pre-tax profits from business operations, a slight increase from the previous year. At the shareholder meeting on the morning of June 24th, the Management Board announced that in the first six months, an estimated 2,760 billion VND in revenue and 1,100 billion VND in pre-tax profits were achieved, respectively executing 57% and 61% of the yearly plan.

CEO Nguyen Thanh Binh shared that despite the positive results in the first half, the remaining period may face uncertainties, especially after the US tax policy adjustments in April. “The issue is not just about the reduction in numbers, but the risk of a comprehensive standstill if the supply chain is interrupted. We ask shareholders to remain cautious in the coming time,” he said.

In this context, GMD attracted attention with its plan to repurchase 21 million treasury shares, equivalent to 5% of the circulating volume. The chartered capital after the transaction is expected to decrease to below 4,000 billion VND. According to the Company, the repurchase will be executed when the market price of shares is lower than 1.5 times the book value and approved by the Securities Commission. The goal is to ensure shareholder interests and accurately reflect the enterprise value during the unstable market phase.

GMD hosted the annual general meeting on the morning of June 24th. Photo: Tu Kinh

|

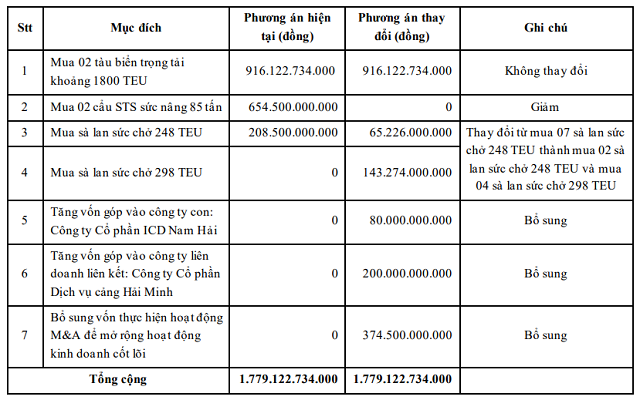

Regarding the utilization of over 3,000 billion VND obtained from the issuance in 2024, GMD has disbursed more than 1,200 billion VND so far, including 540 billion VND in additional capital for Nam Dinh Vu Port, 230 billion VND in bank loan repayment, and over 460 billion VND in accordance with the adjusted plan at the beginning of 2025. The remainder, approximately 1,780 billion VND, is intended for ship and barge purchases and M&A activities.

The meeting also approved adjustments to certain investment items. The Company maintains its plan to purchase 2 ships of 1,800 TEU but halts the acquisition of STS cranes, opting instead to increase capital in related companies and supplement the budget for M&A activities. The barge purchase plan is also modified from 7 barges of 248 TEU to 2 barges of 248 TEU and 4 barges of 298 TEU to enhance operational efficiency.

GMD adjusts its capital usage plan. Source: GMD

|

In terms of operations, the third phase of Nam Dinh Vu Port is expected to commence operations by the end of this year, with an initial capacity of 400,000 TEU in 2026, increasing to 600,000-650,000 TEU in 2027. Meanwhile, Gemalink is projected to attain a volume of 1.7-1.8 million TEU this year and will welcome at least one new service line.

The Company’s leaders repeatedly emphasized that inland water transport is a crucial component of GMD’s logistics ecosystem. With the new generation of barges capable of carrying up to 300 TEU, operating costs have significantly decreased compared to the past. Implementing direct transshipment from barges to mother ships shortens the time and eliminates the intermediary stage, maintaining an advantage over road transport, even with improved highway infrastructure.

In addition, GMD is actively applying technology in its operations, from port management software and optimized stacking diagrams to process automation at ICDs and deep-water ports.

Concerning pricing policies, GMD’s leaders shared that the current handling charges of deep-water ports in Vietnam are only about 60% of those in the region. Meanwhile, to meet the increasingly stringent standards for greening and digitalization in the global supply chain, ports require substantial investment. Therefore, enterprises have proposed adjusting the price framework to create financial leeway. The Maritime Administration has organized two meetings to gather opinions, and if favorable, the adjustment could be implemented as early as the fourth quarter.

Regarding long-term investments, Gemalink phase 2A will commence construction in Q4 2025 and is expected to be operational by 2027. Phase 2B will be initiated when phase 2A reaches 85% capacity. According to the Management Board, container volume in the Cai Mep – Thi Vai area is growing by double digits annually, providing favorable conditions for Gemalink’s rapid expansion.

As for the Lach Huyen area – which is witnessing the addition of more berths, increasing competition with Nam Dinh Vu – GMD assesses that there are still limitations in accommodating large vessels. Despite the design upgrade to 150,000-160,000 DWT, this location remains unsuitable for vessels of 20,000 TEU or more, typically operating on European routes. In contrast, Nam Dinh Vu offers costs that are three to four times lower and is suitable for feeder vessels and intra-Asian routes – a rapidly developing market, including Japan, South Korea, India, and Australia.

CEO Nguyen Thanh Binh expressed caution about potential uncertainties in the second half of the year. Photo: Tu Kinh

|

GMD is also expanding its collaboration with shipping company CMA CGM to launch the first electric barge line connecting Binh Duong and Gemalink. Simultaneously, the Company is accessing green capital from banks like HSBC, BIDV, and Vietcombank to invest in ESG projects, particularly in port equipment electrification.

In the aviation sector, GMD confirms its participation in investing in and operating a cargo terminal at Long Thanh Airport through its associated unit, Saigon Cargo Service Corporation (SCSC, HOSE: SCS), which holds 46% of the warehouse market share at Tan Son Nhat Airport. The Company affirms its financial and human resource readiness to undertake Terminal 2 if selected.

In terms of market strategy, GMD is proactively reducing its dependence on the US route (currently accounting for about 32% at Gemalink) by adding new services to Europe, Canada, West Africa, and South America – all non-US routes with mother vessels calling at the port directly.

Additionally, the enterprise is considering opportunities to participate in national-level projects such as the Cai Mep Ha logistics center, Nam Do Son Port, Lien Chieu Port, etc., but will carefully select projects that align with its implementation capabilities.

The meeting also approved the election of Mr. Iida Shuntaro, a Japanese national, to the Board of Directors, replacing Mr. Shinya Hosoi, who has resigned. Mr. Shuntaro is currently the CEO of SSJ Consulting (Vietnam), a major shareholder holding nearly 7% of GMD’s capital, and has nearly 30 years of experience at the Sumitomo Group, managing numerous large-scale port projects in Japan and Brazil.

Tu Kinh

– 17:36 24/06/2025

“Ricons Postpones IPO Again, Eyes Infrastructure Expansion”

The leadership team at the Construction Investment Joint Stock Company, Ricons, expresses optimism about growth prospects and opportunities arising from significant infrastructure projects. However, they remain cautious about the cash flow situation in the real estate industry. The contractor has also deferred its IPO plans until market conditions become more favorable.

“Noibai Cargo Services Aims High: Targets 2.14 Trillion VND in Profit Before Tax Over Next 5 Years”

In 2025, Noi Bai Cargo Services Joint Stock Company (HOSE: NCT) aims to handle a cargo volume of 382,000 tons, generating approximately VND 1 trillion in revenue, a remarkable surge of over 9% from the previous year. The company has set its sights on a net profit target of VND 271 billion, reflecting a 2% increase.

“Viettel’s Subsidiary Offers Lucrative 15% Cash Dividend to Shareholders”

Viettel Consulting and Services Joint Stock Company (UPCoM: VTK), a subsidiary of the Military – Telecom Industry Corporation (Viettel), announces a cash dividend for 2024 with a ratio of 15% (equivalent to VND 1,500/share). The ex-dividend date is July 3rd, and the expected payment date is July 15th.

5 Banks Project Profit of Over 30,000 Billion VND in 2025

“In addition to the aforementioned top five banks, Agribank and VPBank are also aiming high with plans to achieve profits of approximately $1 billion each in 2025. These ambitious targets showcase the growth trajectory of Vietnam’s banking sector and the potential for significant financial gains in the coming years.”