At the seminar “Household businesses facing the issue of counterfeit goods and tax compliance” organized by the Enterprise and Integration Journal, Dr. Vo Tri Thanh, Director of the Institute for Brand and Competition Strategy Research, made notable remarks about the role of household businesses in the economy and tax policy orientations for the next period.

According to him, there are still about 2 million unregistered individual businesses that operate without official registration, tax declaration, or support from the state. Notably, some of these businesses operate on a larger scale than traditional household businesses but are completely outside the legal framework.

Dr. Thanh believes that it is time for Vietnam to have a new definition of household businesses. “We cannot continue to view household businesses as mere grocery stores or sidewalk stalls. Today, they also include freelancers writing software, influencers making money online, and artisans taking creative orders online… These people have income and influence but are outside the legal framework,” he said.

He emphasized the need to develop a separate law for household businesses, not to tighten control, but to “name and guide them appropriately.” This system must be flexible, classified by scale and industry, to support the transparency process.

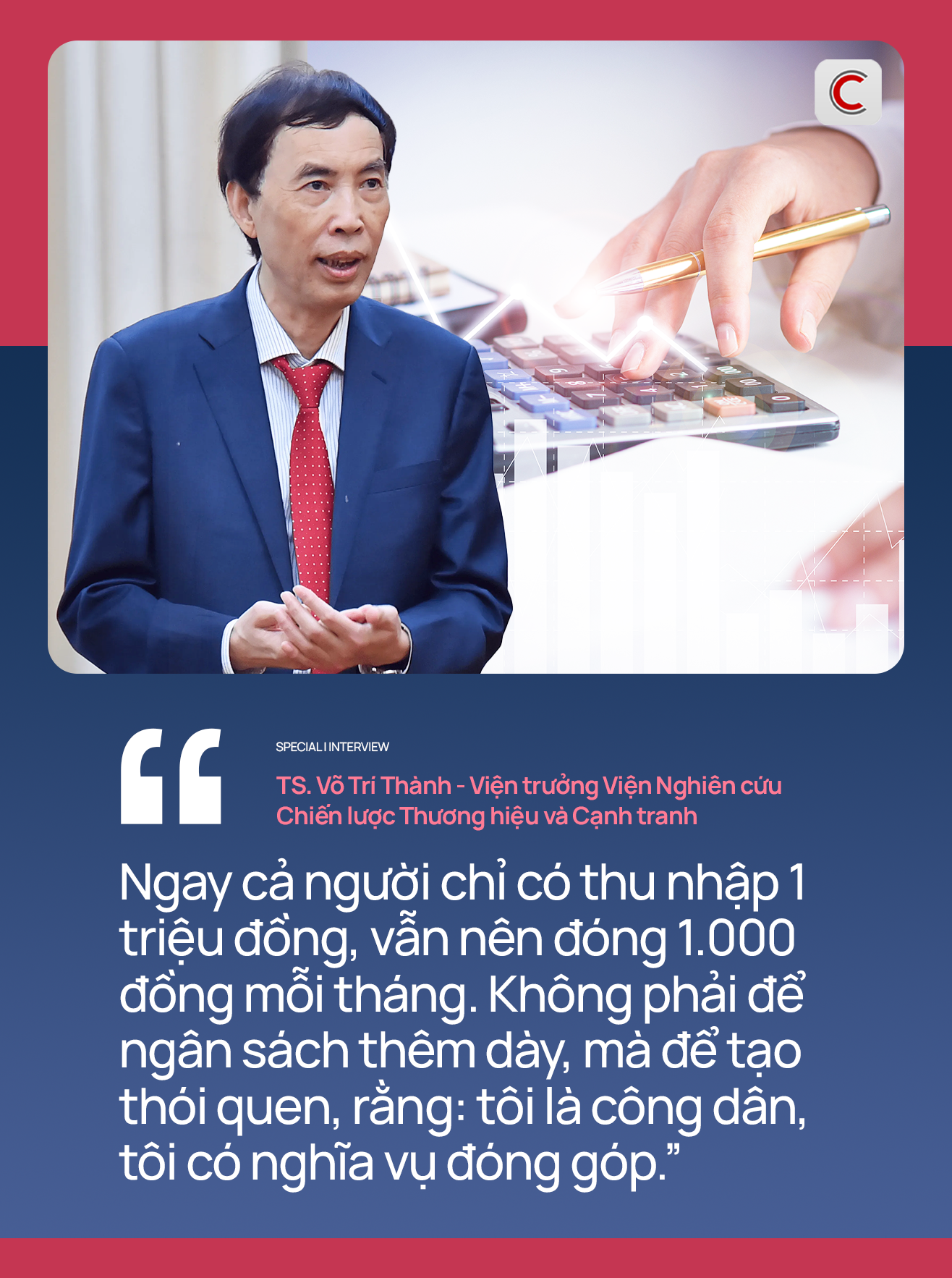

Delving into the tax issue, Dr. Vo Tri Thanh stated that the core essence now is not about increasing budget revenues but about “rehearsing” social behavior.

He affirmed: “Even those with an income of 1 million VND should still pay 1,000 VND per month. Not to make the budget thicker, but to develop a habit, that: I am a citizen, I have an obligation to contribute.”

According to him, when people start to get used to bookkeeping and declaring their income, it will lay the foundation for them to gradually transform into professional business entities. At the same time, the state also needs to change its management mindset from “inspection and punishment” to “guidance and companionship.”

Regarding the new tax policy, Dr. Thanh supported the principle of no retroactive collection when switching from the quota tax to e-invoices. He considered this a necessary step to build trust and encourage businesses to “step out of their comfort zone.”

“Without a clear statement, the increase in revenue after using invoices could be seen as a sign of fraud. This makes people hesitant and even react negatively to the policy,” he warned.

However, he also emphasized that not collecting taxes retroactively does not mean leniency in the future. The tax system needs to strengthen management using digital data, connecting with e-commerce platforms, banks, transportation, etc., to manage in real-time and ensure fairness.

He also proposed a flexible approach in the initial stage, such as piloting e-invoices, providing free software, conducting direct training, or tax exemptions to reassure people.

Finally, Dr. Vo Tri Thanh concluded: “We cannot operate a modern digital economy with the mindset of last-century traders. Let’s let household businesses ‘learn to walk’ before forcing them to ‘run.’ And above all, let’s shift the policy mindset – from risk management to trust creation.”

“Streamlining Administrative Codes: A Proposal for 34 Merged Provinces and Cities”

Introducing the dynamic trio of Vietnam’s metropolitan areas, each with their unique codes: Hanoi, with its sleek and sophisticated code of 01, sets the standard for the north. Moving down the coast, we have the enchanting Danang with code 48, a gateway to central Vietnam’s charm. And last but not least, the vibrant Ho Chi Minh City, coded as 79, pulses with energy in the south. These codes are more than just numbers; they represent the heartbeat of each city, reflecting their distinct character and allure.

The Soaring Surge of USD in Vietnam

The USD exchange rate has soared to unprecedented heights, breaching the 26,300 VND mark. This record-breaking surge has sent shockwaves through the market, leaving individuals and businesses alike scrambling to adapt to the new financial landscape. As the value of the USD continues to climb, the question on everyone’s mind is: How high will it go, and what does this mean for the global economy?

“Unleashing the Potential: Bolstering Investment Appeal for the Real Estate Sector”

The new policy is a strategic shift that elevates Vietnam’s position in the global value chain, enhancing its investment competitiveness and marking a significant leap forward.