Mr. Thuan is the longest-serving member of ITD’s current Board of Directors, having joined on June 23, 2016.

Mr. Nguyen Vinh Thuan (second from right) at the 2024 ITD Annual General Meeting of Shareholders

|

He holds a degree in Electrical Engineering and Automation and a Master’s in Business Administration. He joined the ITA Executive Committee in August 2017 and became CEO on August 1, 2023. On April 1, 2025, he stepped down as CEO to make way for Mr. Nguyen Ngoc Trung.

Mr. Thuan’s successive resignations from key positions came just before ITD’s 2025 Annual General Meeting of Shareholders on June 26. Notably, he was recently elected as the Vice Chairman of the ITD Board of Directors, effective April 1.

On June 20, the ITD Board of Directors approved Mr. Thuan’s resignation and decided to include the election of a new board member for the 2024-2028 term in the Annual General Meeting agenda.

Currently, there is only one candidate for the position, Mr. Vo Xuan Vinh, nominated by a group of shareholders representing 11.8% of ITD’s capital. Mr. Vinh holds a Ph.D. in Applied Finance from the University of New South Wales, Australia, and is a Professor. He is known for his role as Director of cooperation programs between the University of Economics Ho Chi Minh City (UEH) and various universities in the UK, including Lincoln, Leicester, and Huddersfield.

In addition, he is a member of several associations and research institutes, including the Director of the Institute for Business Research (UEH), a Board member of the Asia Economic and Legal Association and the Asian Finance Association, and a member of the Asian Financial Policy Research Committee.

Prof. Dr. Vo Xuan Vinh

|

Capital Increase and Company Name Change

In the documents submitted to the Annual General Meeting, the ITD Board of Directors assessed that the market conditions remain challenging and that there are many fluctuations in the domestic political and economic situation. Therefore, the Company proposes consolidated business targets for 2025 with net revenue of VND 1,000 billion and net profit of VND 40 billion, an increase of 33% in revenue but a decrease of 15% in profit compared to the 2024 performance.

Nevertheless, the ITD management proposes to issue nearly 9.6 million shares to increase charter capital through dividend payment in shares for 2024 (over 1.7 million shares) and offering shares to existing shareholders (nearly 7.9 million shares). If successful, the company’s charter capital will increase from over VND 245 billion to nearly VND 341 billion.

Specifically, ITD plans to issue shares for dividend payment at a ratio of 100:7, and offer shares to existing shareholders at a ratio of 10:3, with a minimum price of VND 10,000/share.

Based on the minimum selling price of VND 10,000/share, ITD expects to raise nearly VND 79 billion from the offering to existing shareholders. The company intends to use VND 30 billion to increase its ownership in Global Electrical Engineering JSC, a subsidiary of ITD, and VND 40 billion to contribute capital to establish/increase charter capital for ITD Global JSC.

Notably, at this General Meeting, the ITD management proposes to change the company’s name from “Tien Phong Technology Joint Stock Company” to “ITD Technology Joint Stock Company.” This change is intended to facilitate international transactions and align with the company’s long-term development orientation, market expansion, and investment attraction.

– 09:33 23/06/2025

BCM is About to Release Nearly 114 Million Shares as 2024 Dividend Payout

The Board of Directors of Becamex IDC, a leading industrial investment and development corporation listed on the Ho Chi Minh Stock Exchange (HOSE: BCM), has approved a plan to issue bonus shares as a dividend for the year 2024. The company intends to distribute a generous 11% dividend to its shareholders, with the issuance expected to take place in the second or third quarter of 2025.

DXG Issues Over 148 Million Bonus Shares, Increasing Charter Capital to Over VND 10,206 Billion

Are there any other adjustments or refinements you would like to make?

“Issuing a source capital of over VND 1,480 billion, with VND 1,200 billion derived from undistributed post-tax profits on the 2024 audited financial statements, and over VND 280 billion sourced from share capital surplus on the separate 2024 audited financial statements, we aim to make a powerful impact.”

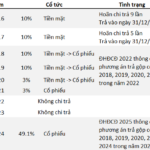

A Real Estate Firm Compounds Dividends with a 5-Year Stock Payout Strategy

The Ho Chi Minh City Stock Exchange-listed SJ Group Joint Stock Company (HOSE: SJS) has unveiled a plan to issue bonus shares and pay dividends in shares with a payout ratio of 159%. The issuance ratio relative to the number of shares currently in circulation stands at 160.33%, with the company holding nearly 1 million treasury shares.