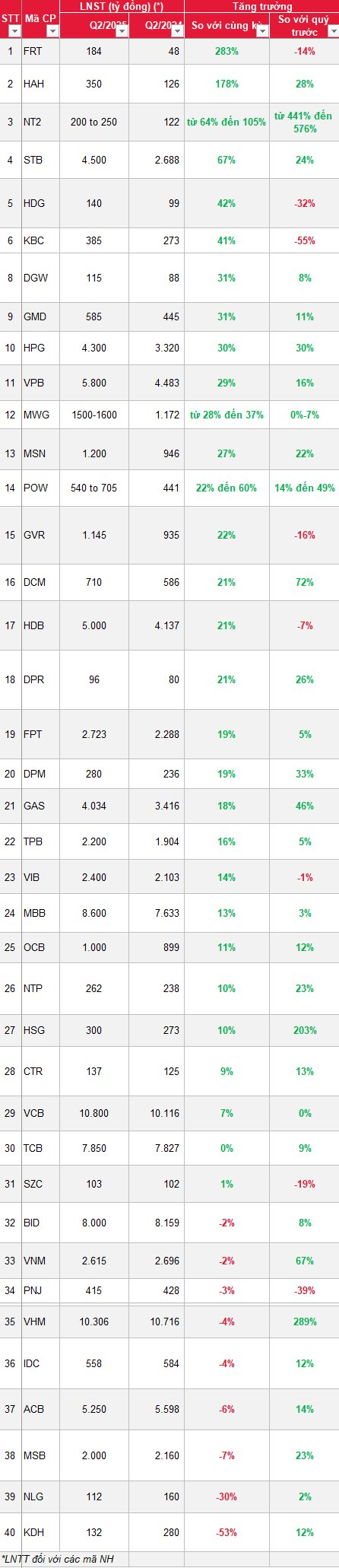

SSI Securities (SSI Research) has released its estimated business results for the second quarter of 2025 for 40 enterprises. Out of these, SSI forecasts 31 enterprises to witness positive profit growth compared to the same period last year, while the remaining 9 enterprises are expected to face a decline in profits this quarter.

Specifically, the companies expected to experience positive profit growth include: FRT, HAH, NT2, STB, HDG, KBC, DGW, GMD, HPG, VPB, MWG, MSN, POW, GVR, DCM, HDB, DPR, FPT, DPM, GAS, TPB, VIB, MBB, OCB, NTP, HSG, CTR, VCB, TCB, and SZC.

The enterprises estimated to have negative profit growth are: BID, VNM, PNJ, VHM, IDC, ACB, MSB, NLG, and KDH.

Regarding FPT Retail (FRT), SSI Research anticipates that the Long Chau pharmacy chain’s continued improvement in profits, along with reduced losses at the FPT Shop chain, will be the primary contributors to profit growth in the second quarter of 2025. Estimated net profit is expected to reach VND 184 billion, marking a 283% increase compared to the previous year.

SSI Research forecasts a significant profit of VND 350 billion for Hai An (HAH), representing a 178% surge compared to the same period last year and a 28% increase from the previous quarter. This impressive growth is attributed to the renewal of multiple ship leasing contracts with rental rates 50-60% higher than previous contracts. Spot freight rates and shipping volumes are also on the rise due to stockpiling activities.

For NT2, estimated net profit for the second quarter of 2025 is expected to range from VND 200 billion to VND 250 billion, indicating a remarkable growth of 64% to 105% compared to the previous year. SSI predicts a 12% to 17% decrease in electricity output compared to the same period last year, mainly due to unfavorable market electricity prices (FMP). However, a higher allocation of contracted output (Qc) is expected to support profits.

SSI Research anticipates that Sacombank (STB) will likely record a substantial reversal of provisions in the second quarter of 2025, coupled with improved management costs, thereby strongly boosting the bank’s profit growth trajectory. As a result, estimated net profit before tax could reach VND 4,500 billion, reflecting a 67% increase compared to the previous year and a 24% rise from the previous quarter.

For FPT, a net profit of VND 3,200 billion is forecasted, representing a 19% increase compared to the previous year, mainly driven by the telecommunications and technology sectors. We expect a modest growth in overseas IT business due to international clients’ cautious approach to IT spending.

In the case of Kinh Bac (KBC), SSI Research predicts a significant profit increase for the second quarter of 2025 compared to the previous year, mainly due to land sales in the Nam Son Hap Linh Industrial Park.

In the retail sector, The Gioi Di Dong (MWG) is expected to witness a net profit increase of approximately 28-37% in the second quarter of 2025 compared to the same period last year, reaching VND 1,500-1,600 billion. This growth is attributed to improved demand for mobile phones due to the replacement cycle, along with increased profits in the grocery sector.

For Hoa Sen (HSG), SSI Research estimates a net profit of VND 300 billion for the second quarter of 2025, representing a 10% increase compared to the previous year and a remarkable surge of over 200% from the previous quarter. Specifically, net profit for the period of April-May reached approximately VND 200 billion, thanks to effective cost control and stable domestic selling prices, a trend that is expected to continue in June.

Regarding Vinhomes (VHM), SSI Research predicts that profit in the second quarter will be driven by the progress of deliveries at Ocean Park 2, Ocean Park 3, and Royal Island, potentially increasing by 289% compared to the previous quarter, reaching VND 10,306 billion.

SSI Research anticipates that Vinamilk (VNM)‘s revenue and profit may recover from the lows of the first quarter due to improved distribution efficiency and enhanced performance of the sales team. However, net profit is expected to decrease by 2% compared to the previous year, amounting to VND 2,615 billion, due to high comparative figures in the second quarter of 2024 and increased input costs.

Khang Dien (KDH)’s profit is estimated to reach VND 132 billion, a 53% decrease compared to the previous year. Profit is expected to be supported by the delivery of the remaining 20 units at The Privia and the transfer of several land lots. KDH has no new projects scheduled for delivery in the second quarter of this year.

SSI Research projects that PNJ’s net profit will remain low in the second quarter, possibly reaching VND 415 billion, as the company continues to face challenges in securing gold raw material sources.

The Ultimate Guide to Q2 2025: Unveiling the Performance of Leading Real Estate Enterprises

“With a strong pipeline of new project deliveries, MBS foresees a positive outlook for the real estate industry’s leading players in 2025. The company anticipates that these timely handovers will be a pivotal factor in driving success for the sector in the coming year.”

Vinatex Profits Soar to $23.5 Million in H1 2025, No Hurry to Change Stock Exchange Listing

Despite the volatile global textile market, Vinatex has recorded a remarkable consolidated profit for the first six months of the year, almost doubling the figure from the same period last year to 556 billion VND. Alongside this impressive financial performance, Vinatex has also revealed that they are in no rush to change their stock exchange listing, citing concerns about stock price fluctuations that may not accurately reflect the company’s intrinsic value.

“Cà Mau Protein Payout: Shareholders Reap Rewards with a Whopping 1.058 Trillion VND Dividend.”

“Đạm Cà Mau announces an impressive dividend payout of VND 1,058.8 billion for its shareholders. The company has declared a 20% dividend, to be paid out on July 15, 2025. Shareholders on the registry as of June 30, 2025, will be eligible to receive this substantial cash dividend, reflecting the company’s strong performance and commitment to returning value to its investors.”

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)