Hanoi Stock Exchange (HNX) has announced that it will continue to restrict trading in CAD shares of Cadovimex JSC, a processed and export seafood company. This is due to the auditor’s refusal to express an opinion on the 2024 financial statements and the company’s negative equity position.

Shares drop to VND 500/share as auditors refuse to sign off

As a result, nearly 8.8 million CAD shares will only be traded on Fridays. Previously, CAD was placed on a warning list since July 2024 due to delays in organizing the annual general meeting beyond the regulated timeframe.

On the stock exchange, CAD shares are currently trading at VND 500 each, equivalent to a market capitalization of just VND 4.4 billion. This price has dropped by 17% in a month and over 44% in a year.

Regarding the 2024 audited financial statements, the auditor refused to sign off due to an inability to obtain evidence verifying the existence and value of inventory worth over VND 40 billion. This includes finished goods stored in the US since 2006 valued at VND 33.7 billion and VND 6.4 billion worth of inventory in cold storage since 2013.

Additionally, cash, fixed assets, accounts receivable and payable, and interest expenses were also not confirmed by the auditor due to missing documents and vouchers.

From a leading seafood company to continuous losses and negative equity of over VND 1,506 billion

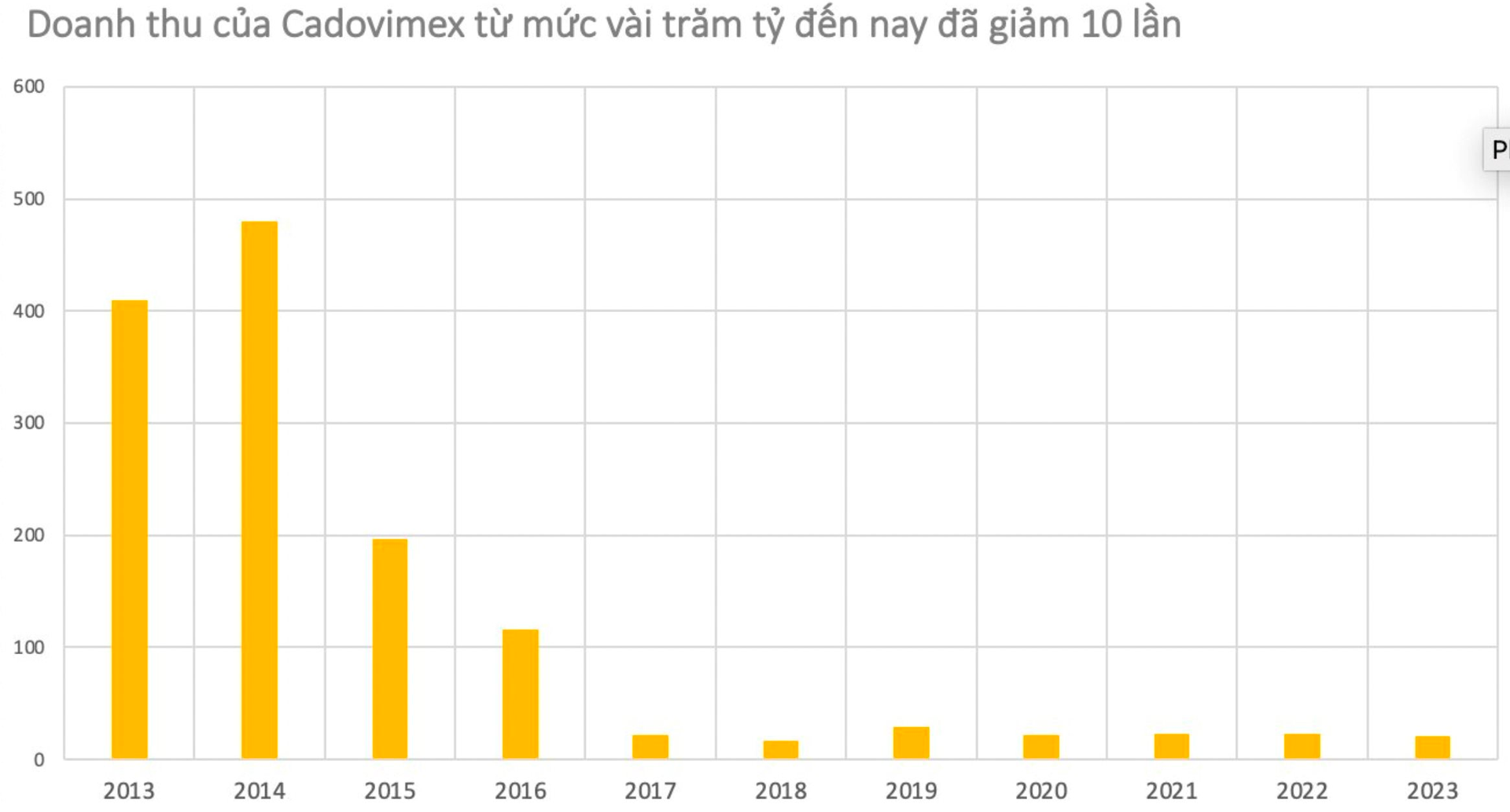

Once a prominent seafood company (established in 1985) with revenues often reaching thousands of billions of VND, Cadovimex is now facing a decline due to various reasons such as difficult-to-recover debts, heavy loan burdens, and challenges in export markets. The company’s revenue dropped from VND 480 billion in 2014 to VND 196 billion in 2015, with a net profit of less than VND 0.4 billion.

From 2016 to 2024, the company incurred continuous losses. As of the end of 2024, the company had accumulated losses of VND 1,701 billion, with negative equity of VND 1,506 billion.

Former Chairman arrested and charged with “occupying” thousands of billions from Agribank, BIDV, Vietcombank, MB…

Notably, in June 2025, the Military Court of the 9th Military Region opened a trial for 20 defendants involved in a fraud case at Cadovimex, including charges of “fraudulent appropriation of property”, “violating lending regulations”, and “irresponsibility causing serious consequences”. Among the defendants were nine former leaders of Cadovimex, including Mr. Vo Thanh Tien, Ngo Van Phang, and Pham Thi Huong, along with several bank officers. Two other defendants, Nguyen Huu Cuong and Le Kim Hung, are currently at large.

According to the indictment, during the period of 2008-2015, the group of leaders of Cadovimex created fraudulent loan applications using repeated invoices, repeated collateral assets, and fake documents to borrow and roll over debts amounting to thousands of billions of VND. The total amount appropriated from MB, VDB, and Agribank exceeded VND 1,000 billion, of which MB suffered a loss of more than VND 202 billion. While a portion has been repaid, the actual loss remains significant.

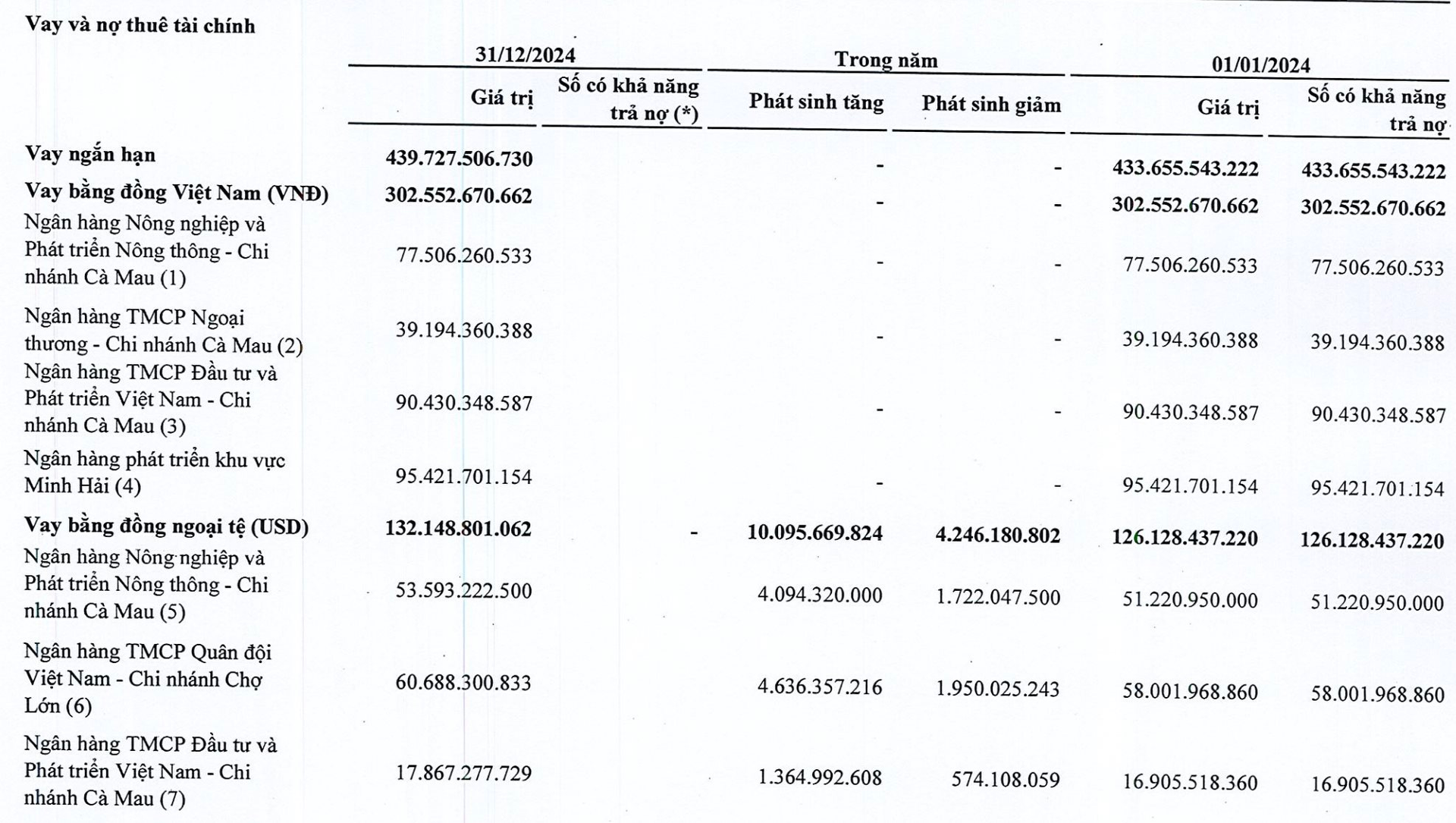

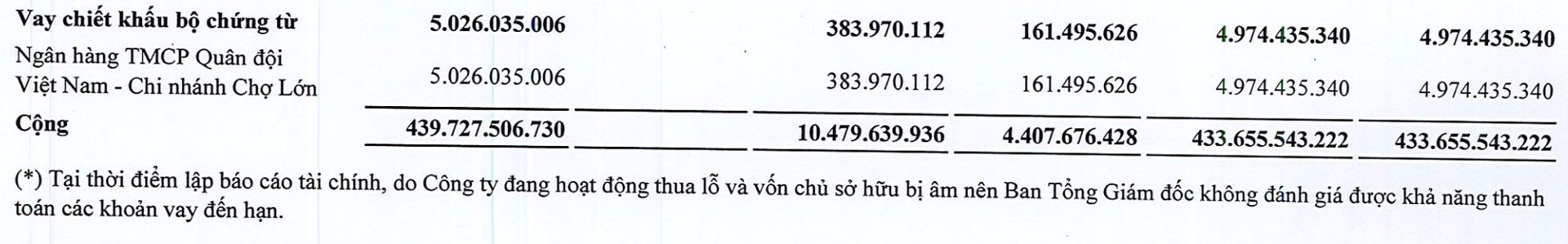

As per the 2024 audited financial statements, the company still has outstanding loans of VND 440 billion with various banks. The company’s management emphasized that they could not assess the ability to repay these loans due to continuous losses and negative equity.

Desire to file for bankruptcy but unable to do so

According to the minutes of Cadovimex’s annual general meeting last year, Mr. Nguyen Van Chinh, a member of the company’s board of directors, stated that the company is currently in a severe decline in all aspects. Despite changes in leadership over the years, the company has been unable to recover its business operations due to accumulated difficulties from previous years.

The leader also mentioned that Cadovimex has completed the necessary legal procedures to initiate bankruptcy proceedings in accordance with legal regulations.

It is understood that at previous meetings, the company had approved the proposal to initiate bankruptcy proceedings. However, due to an ongoing criminal investigation into the case, the court has not yet accepted the application.

Deceptive Tactics: Exploiting a Defunct Company’s Name to Dupe Over 100 Customers

“Meet the enigmatic entrepreneur, Trần Tâm Tuấn, whose journey began with a design and printing company that faced setbacks and eventually ceased operations. Unfazed by adversity, Tuấn reinvented himself by leveraging social media to target individuals and businesses seeking packaging and paper bag solutions. With a charismatic online presence, he enticed over a hundred victims with his deceptive schemes, luring them with false promises and stealing their deposit money.”

The Crafty Con: How a Female Ex-Bank Manager from Binh Duong Swindled Many.

As the deputy manager of a prominent bank branch in Binh Duong, this woman fabricated documents and bank loan maturity profiles, ensnaring numerous victims in her deceitful web and defrauding them of billions of dong. She eventually resigned from her position and confessed to her fraudulent actions.

“Authorities Seek Victims in Case Involving Mr. Nguyen Ngoc Thuy”

The Ministry of Public Security (MPS) invites victims of the case involving Mr. Nguyen Ngoc Thuy to come forward and provide information and documents before the investigation concludes on July 1st.