As of June 2025, Saigon-Hanoi Commercial Joint Stock Bank (SHB) continues to apply an interest rate for individual customers ranging from 0.5% to 5.8% per annum, with interest paid at the end of the term.

SHB counter deposit interest rates for June 2025

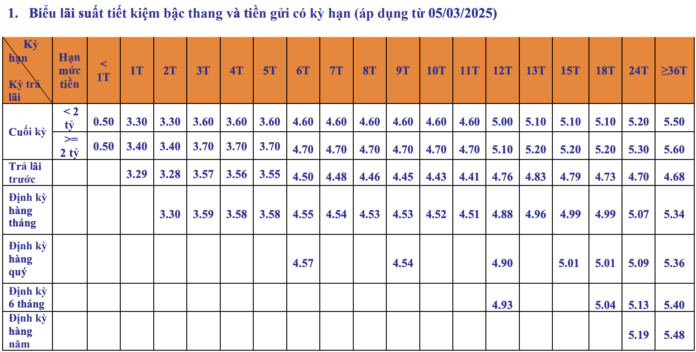

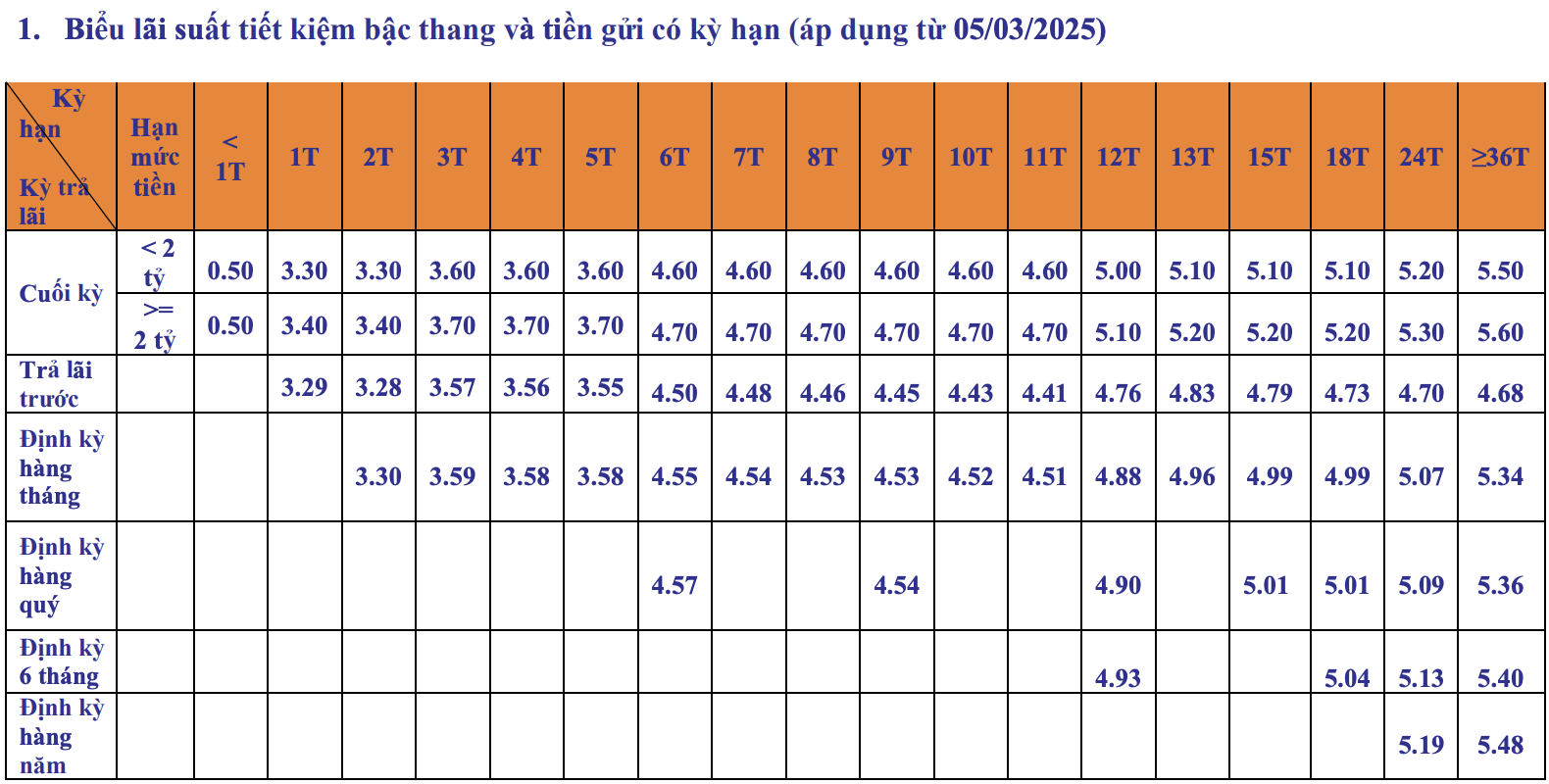

For customers depositing at the counter with a step-up savings product and interest paid at the end of the term, SHB will apply interest rates based on two deposit amounts: Below VND 2 billion and VND 2 billion or more.

For deposits below VND 2 billion, the interest rate ranges from 0.5% to 5.5% per annum. Specifically, for a tenor of less than 1 month, the interest rate is 0.5%/year; for 1-2 months 3.3%/year; 3-5 months 3.6%/year; 6-11 months 4.6%/year; 12 months 5.0%/year; 13-18 months 5.1%/year; 24 months 5.2%/year; and for tenors of 36 months or more, the highest interest rate is 5.5%/year.

SHB counter deposit interest rate table for June 2025

For deposits of VND 2 billion or more, the interest rate ranges from 0.5% to 5.6% per annum. Specifically, for a tenor of less than 1 month, the interest rate is 0.5%/year; for 1-2 months 3.4%/year; 3-5 months 3.7%/year; 6-11 months 4.7%/year; 12 months 5.1%/year; 13-18 months 5.2%/year; 24 months 5.3%/year; and for tenors of 36 months or more, the highest interest rate is 5.6%/year.

In addition to interest paid at the end of the term, customers can choose from various other interest payment options: Interest paid in advance; Interest paid monthly; Interest paid quarterly; Interest paid semi-annually; Interest paid annually.

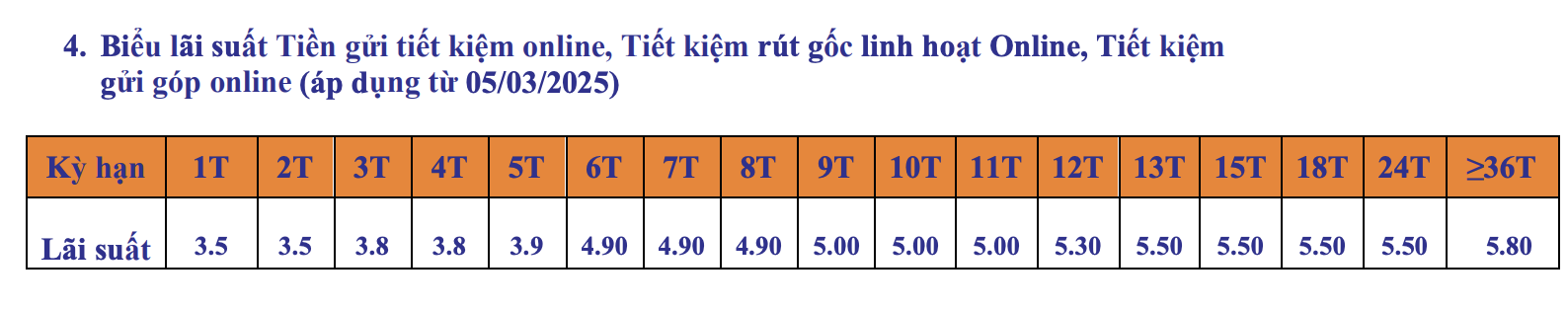

SHB online deposit interest rates for June 2025

For online deposits, SHB offers interest rates ranging from 3.5% to 5.8% per annum.

Specifically, the interest rate for a tenor of 1-2 months is 3.5%/year; 3-4 months 3.8%/year; 5 months 3.9%/year; 6-8 months 4.9%/year; 9-11 months 5.0%/year; 12 months 5.3%/year; 13-24 months 5.5%/year; and for tenors of 36 months or more, the highest interest rate is 5.8%/year.

SHB online savings interest rate table for June 2025