The Vietnamese economy has shown notable signs of recovery in the first five months of 2025, with domestic consumption catching up with production, as observed by SSI Securities Corporation.

Notably, enhanced control over counterfeit consumer goods is reshaping the competitive landscape, creating opportunities for modern retail channels to gain market share.

Retail goods growth rate compared to the same period in previous years in Vietnam (Source: Fiin Pro, VCBS Synthesis)

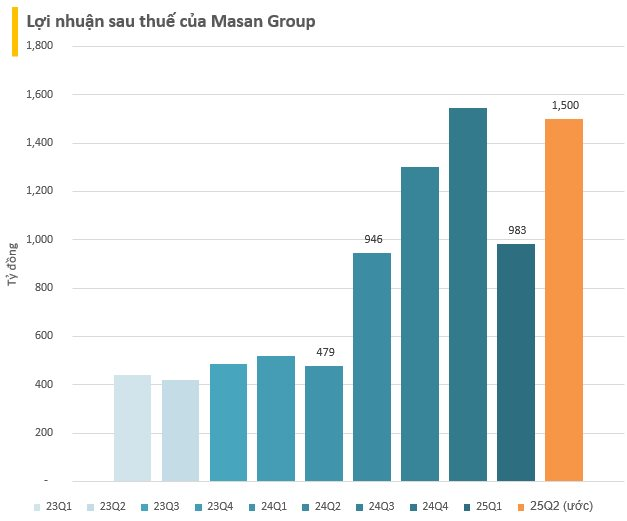

In the second quarter of 2025, Masan Group (MSN) is estimated to have achieved VND 1,500 billion in after-tax profit, a remarkable increase of over 50% compared to the same period last year’s figure of VND 946 billion.

This result far exceeded VCBS Securities Company’s estimate of approximately VND 1,200 billion in Masan Group’s second-quarter profit, as projected at the beginning of June. Previously, in the first quarter of the year, Masan Group’s profit also doubled compared to the same period last year, reaching VND 983 billion.

According to assessments from securities companies, this growth is driven by two core business segments: retail, led by WinCommerce (WCM), and consumer goods, driven by Masan Consumer Holdings (MCH).

The effective utilization of the shift towards modern retail channels, coupled with the rising demand for safe and convenient food in Vietnam, has yielded positive results.

Moreover, other prominent business segments, such as meat products by Masan MEATLife (MML) and minerals by Masan High-Tech Materials (MHT), have also shown significant improvements.

Recognizing these positive developments, VCBS first evaluates Wincommerce’s successful restructuring and entry into a phase of robust growth with stable profits. Specifically, in the first quarter of 2025, WinCommerce’s revenue grew by 10% to VND 8,785 billion. The EBITDA margin improved from 3.14% to 4.12%, an increase of 98 basis points, indicating enhanced operational efficiency. This success is attributed to three key factors:

+ First , efficient restructuring: WinCommerce has refined its business model, particularly in rural areas, where new stores have achieved store-level profitability.

+ Second , integrated ecosystem: With 11 million WIN Membership members as of the end of 2024, WinCommerce has leveraged this program to increase revenue, with 55% of sales coming from members. Average revenue per store increased by 34% for Masan Consumer products and 28% for fresh meat from Masan MEATLife.

+ Third , expansion plans: WinCommerce aims to open an additional 600 stores in 2025, with an investment of approximately VND 1 billion per store. Average revenue per store per month remains stable at VND 720 million, thanks to effective management of new stores.

WinCommerce’s Financial Statements (Source: SSI)

With approximately 84% of the market share still belonging to traditional channels, modern stores like WinCommerce have ample room for expansion. The system is expected to maintain its expansion pace of 400-700 stores per year, focusing on cost efficiency and accessibility in both rural and urban areas. Winmart reaching breakeven in 2024 sets a solid foundation for accelerating store network expansion and fostering long-term growth.

For 2025, WinCommerce is projected to achieve a 16% revenue growth, with the retail industry’s growth rate maintained at 10-12%, supported by stable macroeconomic conditions and improved purchasing power, particularly in rural areas.

Number of stores opened according to WinCommerce’s new model (Source: MSN, VCBS Synthesis)

Moving on, with its expanding market share in the consumer goods sector, Masan Consumer Holdings (MCH) recorded a first-quarter revenue of VND 7,578 billion in 2025, a 12.6% increase compared to VND 6,730 billion in the same period in 2024.

This substantial revenue growth is attributed to strong contributions from various product categories: Spices (+15.9%), Bottled Beverages (+8.7%), Coffee (+39.8%), HPC (+13.0%), and International Business (+73.2%), mainly from China, Japan, South Korea, and Southeast Asia, while the US market still accounts for less than 1% of MCH’s revenue.

Additionally, the premiumization strategy has yielded significant results, with the Omachi product line witnessing a 20% growth rate.

Masan Consumer’s Business Segments Performance (Source: MSN, KBSV Synthesis)

Overall, in the first five months of 2025, retail and consumer goods experienced a 9.8% YoY increase due to (1) peak seasons like Tet Holiday and other festive occasions, (2) inflation remaining low at around 3%, and (3) the maintenance of loose fiscal and monetary policies.

In the next phase, consumer sentiment and income expectations are expected to be significantly impacted by the policy changes regarding tariffs from the United States, as assessed by KBSV Securities Company.

KBSV anticipates a likely slowdown in growth, particularly for non-essential items. Therefore, KBSV views Masan Group as a defensive choice in a challenging economic environment due to its ownership of the direct retail system, WCM, and the essential and diverse product portfolio of MCH, allowing for flexible adjustments to their offerings.

WinCommerce: New Stores Openings This Year Have Been Profitable Ventures.

With a clear improvement in business efficiency and long-term growth potential, WinCommerce is modernizing Vietnamese retail, especially in rural areas. The company has continued its double-digit growth trajectory and accelerated its expansion in the first five months of this year.

The Blue-Chip Stocks

The year 2025 has been a period of significant macroeconomic shifts and impending tariff storms. This year’s annual general meeting season goes beyond procedural formalities as investors arrive with a different mindset. They are here to take the pulse of businesses, reassess investments, and reshape strategies for the upcoming period. Notably, some “national” stock codes have become hotspots, with shareholders filling up the halls, numbering in the thousands.

A Silver Lining in the Economic Cloud: The First Half Review

The Vietnamese economy witnessed numerous positive signals in the first half of 2025, indicating robust growth across various sectors. The country’s GDP experienced a significant surge, accompanied by thriving manufacturing, bustling import-export activities, robust public investment, and vibrant FDI inflows. These multifaceted indicators paint a promising picture of Vietnam’s economic landscape, setting the stage for further prosperity in the latter half of the year and beyond.