Dragon Vietnam Securities has recently updated its fertilizer industry outlook, emphasizing that Middle East tensions are pushing up fertilizer prices, especially in the short term.

The impact depends on the conflict’s developments and varies between fertilizer types. If the war escalates, rising oil prices will affect gas and urea prices, creating a domino effect on other fertilizers due to their link with urea. However, urea is the most affected, while other fertilizers like phosphate and NPK are less volatile.

As a result, the urea segment is expected to benefit more than other fertilizer segments. In the short term, Middle East tensions will have a more significant impact on the selling prices of urea-focused companies like DCM and DPM than phosphate-based companies like DDV, LAS, and NPK-focused companies like BFC.

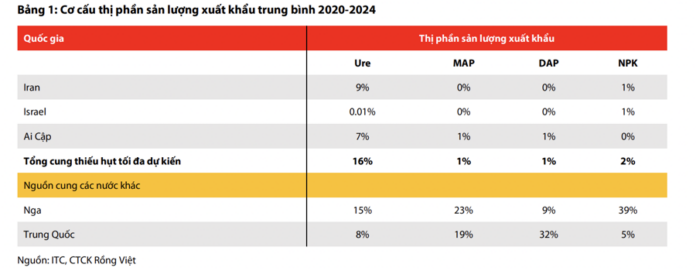

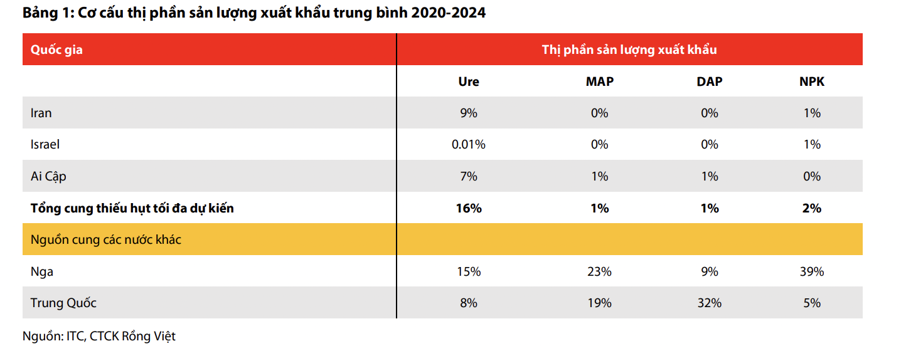

DCM and DPM benefit from escalating wars due to rising input gas prices and a shortage of approximately 16% of total exported urea supply from Egypt (7%) and Iran (9%). Egypt is not directly involved in the war but has temporarily halted production due to the conflict, as 60% of its gas reserves for urea production come from Israel.

The upcoming impact depends on the conflict’s evolution. If tensions rise, soaring oil prices will drive up gas and urea prices. Compared to the Russia-Ukraine conflict (2/2022), when Russia reduced gas supplies to the EU, the current situation is less severe as China has resumed exports, and it is not yet a peak season.

DCM and DPM stock prices will be influenced by urea price fluctuations in the short term, given the high correlation (0.7) between their stock prices and urea prices from January 2019 to February 2025.

Next is phosphate-based fertilizer (MAP, DAP). The impact is lower than the urea group, as input costs don’t fluctuate much when escalating Middle East tensions cause an increase in ammonia costs, offset by a potential decrease in sulfuric acid prices.

In the composition of phosphate fertilizers like DAP, sulfuric acid accounts for 29%, ammonia 25%, and apatite ore 43%. For MAP fertilizer, the composition changes with a higher proportion of apatite ore due to the use of ore with a P2O5 content of 50% instead of 46% in DAP.

DAP prices have risen sharply recently due to China’s export restrictions and high Chinese DAP prices resulting from increased sulfuric acid input costs. Sulfuric acid prices have climbed due to higher sulfur prices in Canada (China’s main import source), combined with strong demand from China, Morocco, and sulfur plant maintenance in China. When Brent oil prices rise, sulfur prices are expected to fall as Canada increases production.

In contrast, falling oil prices will slow down sulfur production and keep sulfur prices high.

Sulfur prices have already dropped to 257 USD/ton, a 260% increase over the same period last year, from a peak of 281 USD/ton. This will lead to lower sulfuric acid prices in China in the future. Ammonia liquid prices in China remain stable at 2,378-2,400 RMB/ton (according to Sunsir). Due to limited data, we use Middle Eastern ammonia prices as a reference for trends (as China imports ammonia from Indonesia). Currently, Middle Eastern ammonia liquid prices are 5% lower than the same period last year.

Finally, companies trading in NPK fertilizers have also seen their selling prices increase due to cost-push factors from single and double fertilizers as inputs. However, as the prices of single and double fertilizers (urea, DAP, and potassium SA) have risen faster than NPK selling prices, the benefits are lower.

NPK selling prices are challenging to increase due to intense domestic market competition and exporters like China and Russia. Additionally, from July 1, 2025, the 40% EU import tax on Russia will push Russia to divert exports to other markets like Vietnam.

Is China’s Ure Exports a Concern? How Will It Impact Fertilizer Prices?

“The recent announcement of China’s plans to resume exports of urea and phosphate through Q3 2025 could temporarily ease global fertilizer prices. With China’s selling prices currently lower than the global urea prices, this development may bring some short-term relief to the market.”