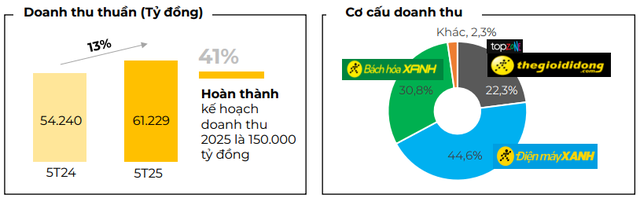

The combined revenue of the two chains reached nearly VND 41,000 billion in the first five months of the year, up 11% compared to the same period in 2024. Existing stores’ growth increased by over 11%.

In May 2025, the total revenue of TGDĐ and ĐMX reached VND 8,400 billion, the highest since the Lunar New Year, continuing to grow compared to April 2025 and up 13% over the same period. Despite the early arrival of the rainy season this year, which affected the consumption of cooling appliances, the company maintained its growth momentum thanks to the strong performance of its core product categories:

– Impressive growth in mobile phones, tablets, and laptops, ranging from 20% to 50% compared to the same period last year.

– TVs continued their recovery with single-digit growth over the five months.

– Washing machines, home appliances, and other product categories grew by single to double digits compared to the same period.

– These positive results stem from offering a diverse product portfolio, coupled with superior services and tailored financial solutions that meet customer needs.

The online channel accounted for nearly VND 2,600 billion in revenue in the first five months, maintaining a 6% contribution to the total revenue of the two chains.

BHX Chain:

In the first five months, the Bach Hoa Xanh chain achieved nearly VND 18,900 billion in revenue, an increase of over 19% compared to the same period last year. This growth came from both main product categories: fresh food and FMCG.

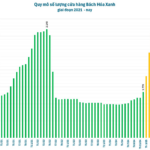

As of the end of May, the chain opened 410 new stores, exceeding the plan set at the beginning of the year to open 200-400 new stores. More than 50% of these new stores are located in the Central region. These new stores recorded positive total profits at the store level, after deducting all direct operating expenses.

Since May, revenue has tended to stabilize compared to the previous month due to the onset of the rainy season. In parallel with the expansion, the chain focused on optimizing operations and controlling costs at the stores, significantly improving operational efficiency.

The Green Grocery Juggernaut: Over 400 New Stores Launched This Year, Setting a Record-Breaking Pace

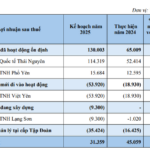

According to VCBS, from the second quarter onwards, as investment costs decrease and new stores contribute stable revenue, Bach Hoa Xanh can attain net profits of approximately VND 120 billion each quarter, thereby driving growth for MWG.

“PVCFC Annual General Meeting 2025: A Prosperous Gathering with a 20% Dividend Payout”

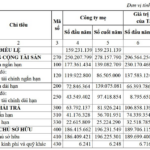

The Ca Mau Petrochemical Fertilizer Joint Stock Company (PVCFC), under the stock code DCM, convened its 2025 Annual General Meeting of Shareholders (AGM) at its headquarters in Ca Mau City. The event seamlessly blended in-person and virtual attendance, complemented by electronic voting to enhance transparency and convenience for distant shareholders.

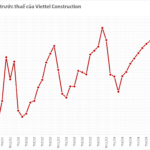

A “They” Company: Viettel Rakes in Over $1.5 Million Daily

With a remarkable pre-tax profit of 56 billion VND in May, we’ve witnessed a remarkable third consecutive month of growth.