According to VPBankS experts, forecasting global oil prices is no easy task. A review of oil price forecasts reveals a range of scenarios. Notably, JP Morgan presents a worst-case scenario, predicting oil prices could soar to 120 USD per barrel.

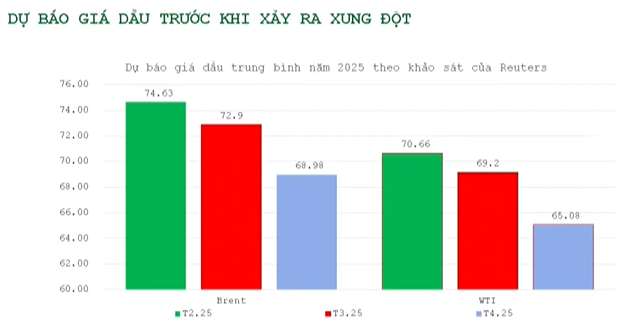

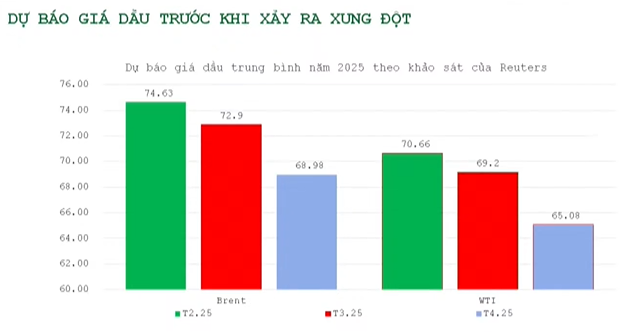

Looking back at the forecasts from earlier this year, the average prediction by Reuters in February was over 74 USD. This decreased to above 70 USD in March and further dropped to nearly 70 USD for Brent crude and 65.08 USD for WTI in April. These figures indicate that, barring any conflicts, oil supply was expected to exceed demand. The planned increase in OPEC’s output from June onwards is anticipated to put considerable pressure on oil supply by the year’s end. The average price is forecasted to be around 70 USD, approximately 2 USD lower than the same period in 2024, representing a 3% decrease.

Source: VPBankS

|

However, the conflict has caused oil prices to react swiftly. Brent crude oil prices surged from 65-66 USD to 76-77 USD, a significant increase compared to the first quarter. Nonetheless, these prices are on par with the average during the second and third quarters of 2024.

Source: VPBankS

|

There are concerns about the impact on global oil production. Iran currently produces approximately 3.4 million barrels per day, with exports ranging from 1.6 to 1.7 million barrels daily. With this production level, Iran accounts for about 3.4% of global oil consumption. The majority of these exports are destined for China, accounting for 80-90%.

When analyzing supply and demand, with global consumption at roughly 102.6 million barrels per day and production at 103.4 million barrels per day, even a slight imbalance of 1 million barrels can significantly influence prices.

The second noteworthy point is that not only Iran but also the Strait of Hormuz is crucial in this scenario. If the worst-case scenario unfolds and the strait is blocked, global oil supply and transportation routes will be severely disrupted.

Mr. Duong highlighted two critical aspects regarding oil prices. Firstly, the current average price is comparable to the latter half of 2024, so it is not exceptionally high. Secondly, the factors influencing oil supply due to the conflict are short-term considerations. Iran heavily relies on oil exports, so any conflict affecting supply and demand would also impact Iran’s economy, which has limited resilience. Thus, all parties involved would ideally want to avoid such a scenario.

Regarding Vietnam, during the first half of 2025, when oil prices dipped below 70 USD and forecasts appeared weak compared to 2024, the oil and gas stock sector experienced a more significant decline than the VN-Index, even during the index’s adjustment due to tariff shocks. Subsequently, as the market recovered, oil and gas stocks failed to rebound to their previous levels.

The oil and gas sector’s valuation is generally attractive, having been deeply discounted. The market has factored in oil price forecasts since the beginning of the year, reflected in stock prices. Consequently, the decline in oil prices has not significantly affected the expected business performance of listed companies in the industry. These factors attracted substantial investment in the oil and gas sector last week.

Source: VPBankS

|

Mr. Duong emphasized the multifaceted impact of oil prices on businesses in the industry. While high oil prices generally benefit oil and gas stocks, they also lead to higher inflation, hindering economic growth and triggering monetary policy adjustments. Additionally, market valuations change.

“We shouldn’t assume that extremely high oil prices will necessarily benefit oil and gas stocks. That’s not entirely accurate”, stated Mr. Duong.

According to Mr. Duong, sustained high oil prices over an extended period are required to directly influence oil and gas companies. “For instance, PLX will undoubtedly be positively impacted, and upstream GAS will be affected by gas prices. However, for PVD, we must wait to see if there will be significant changes in rig rental rates, which usually takes some time to materialize. Similarly, for BSR, we need to monitor if there will be any changes in “cracking spread”, he explained.

Essentially, the fundamental narratives within each oil and gas company remain unchanged since the beginning of the year. The only difference is that stock prices are now at more attractive levels.

– 19:00 23/06/2025