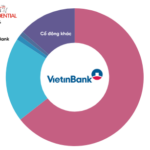

VietinBank, the Joint Stock Commercial Bank of Vietnam, discloses information on shareholders owning over 1% of its charter capital.

According to the announcement, the State Bank of Vietnam, as the representative of the State owner, holds 3,461,676,283 CTG shares, accounting for 64.46%. MUFG Bank owns 1,059,477,261 shares, equivalent to 19.73%. The VietinBank Trade Union holds 61,633,846 shares, representing 1.15%.

Lastly, Prudential Vietnam Assurance Private Limited Company holds 57,619,985 CTG shares, equivalent to 1.07% of the charter capital.

On May 15, the State Bank of Vietnam appointed Mr. Nguyen Van Anh, a member of the CTG Board of Directors for the 2024-2029 term, as the representative of the State capital at CTG, replacing Mr. Nguyen Duc Thanh, CTG Deputy General Director and former member of the CTG Board of Directors for the 2024-2029 term.

In the stock market, CTG shares are currently trading at VND 41,1500 per share, a slight decrease of 0.36%. At this price, the value of CTG shares held by Prudential Vietnam is estimated to be over VND 2,371 billion.

Previously, VCSC maintained a “buy” recommendation for VietinBank (CTG) and increased its target price by 4.0% to VND 52,000 per share after updating its valuation model to mid-2026. This positive impact was partly offset by a downward adjustment of 2.8% in the total profit forecast for the period 2025-2029 (with respective adjustments of -1.3%/ -2.8%/ -3.3%/ -2.7%/ -3.3% for the 2025/26/27/28/29 forecasts).

In addition, VCSC’s downward revision of profit forecasts for 2025-2029 was mainly due to a 2.6% decrease in net interest income (NII) assumptions, based on a more cautious NIM outlook, and a 10.9% decrease in non-interest income (NOII) assumptions, based on lower service fee/FX income assumptions following the less favorable results in Q1/2025.

According to VCSC, these factors were partially offset by an 8.7% decrease in loan loss provision estimates for 2025-2029, due to a lower loan loss coverage ratio assumption (an average of 150% for 2025-2029, compared to 166% previously), and a 2.5% decrease in operating expense (OPEX) estimates for 2025-2029.

According to VCSC’s adjusted forecasts, CTG is expected to achieve a compound annual growth rate (CAGR) of nearly 18% in profit over the next three years, driven by strong credit growth, declining credit costs, and lower-than-expected NIM and higher-than-expected non-performing loan ratio.

MBS Securities forecasts CTG’s net profit in Q2/2025 to reach approximately VND 8,000 billion, unchanged from the previous quarter and slightly higher than the same period last year. The six-month profit in 2025 is expected to increase by 22.3% year-on-year.

“A Life Insurance Giant Holds Over 57 Million VietinBank Shares, Valued at Nearly VND 2.4 Trillion”

Introducing VietinBank: A Leading Financial Institution in Vietnam

The Vietnam Joint Stock Commercial Bank for Industry and Trade, widely known as VietinBank (CTG), has recently disclosed information regarding its shareholders. In a notable development, the bank has announced that one of its shareholders now holds over 1% of its chartered capital.

KDH Repays Over VND 318 Billion in Bond Principal and Interest

Let me know if you would like me to generate any additional content or provide further revisions.

As per the 2024 financial report, the company currently has two bond issues maturing in 2025, with outstanding debt of VND 1,100 billion. The company’s management has assured that they have prepared the necessary funds to make timely payments for these bond issues, with one maturing in June and the other in August 2025. Furthermore, the company has no plans to issue additional bonds this year.

Which Bank Had the Highest Profit Before Provisions?

Before accounting for credit risk provisions, 10 out of the surveyed banks witnessed profit growth in Q1 2025 compared to the previous quarter (Q4 2024), whereas 17 banks experienced a decline during this period.