Opportunities for Tax-Compliant Businesses

According to the latest consumer industry report from SSI Research, enhanced control over counterfeit goods and the encouragement of household businesses to transform into enterprises may pose short-term challenges for the consumer industry and the overall economy. However, it also presents opportunities for tax-compliant businesses, mainly in the modern trade channel, to expand their market share.

Large-scale crackdowns on counterfeit goods, including milk, pharmaceuticals, and cosmetics, have raised public concerns about product authenticity and safety. This drives consumers towards more reliable retail formats, such as modern trade chains.

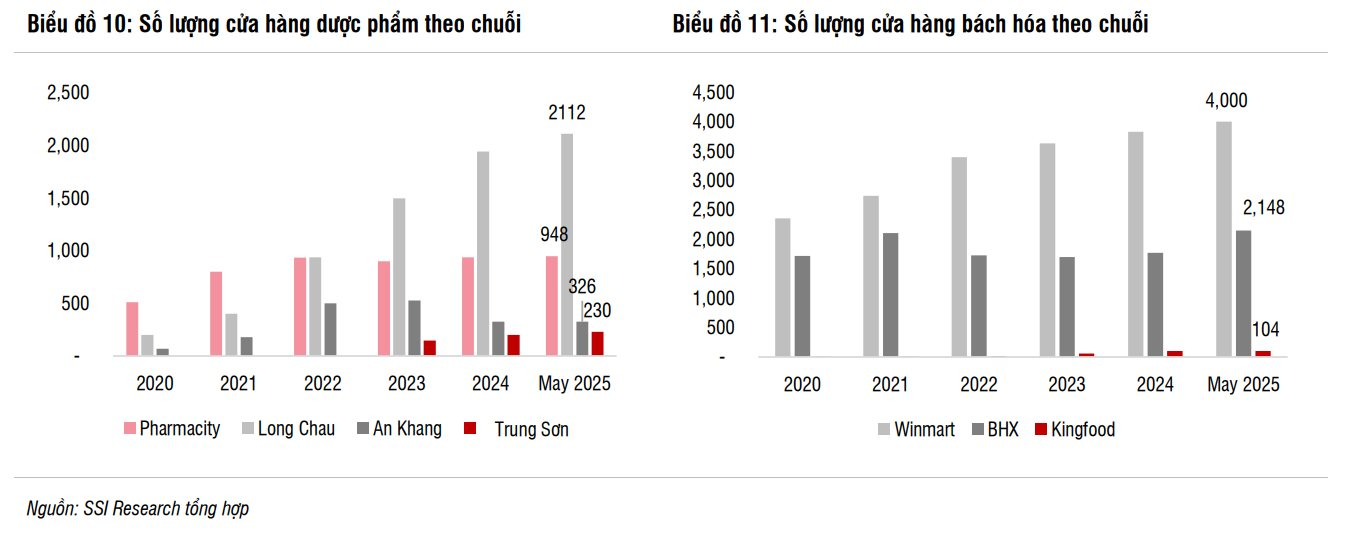

Modern trade chains, especially drugstore and supermarket chains, are the primary beneficiaries of this trend due to their strong brands, transparent supply, and stringent quality control processes.

Decree 70/2025/NĐCP, effective from June 1, 2025, mandates that all household businesses with annual revenue above 1 billion VND (estimated at 37,000 nationwide) must issue invoices at the point of sale. This marks the first step in transitioning from a lump-sum tax to a revenue-based tax, aiming to curb tax evasion among non-compliant enterprises.

The increased tax burden on non-compliant household businesses will narrow the price gap between traditional and modern channels, making modern retail more appealing. Modern department store chains are expected to benefit the most from this change due to improved price competitiveness and consumer confidence.

Additionally, according to Resolution 198/2025/QH15, from January 1, 2026, household businesses with annual revenue above 200 million VND will be subject to taxes based on their actual revenue.

Some small household businesses, particularly in rural areas, may need to temporarily cease operations due to difficulties in adapting to the new legal framework. Others will face higher tax burdens, potentially leading to increased prices for consumers, further narrowing the price gap between traditional and modern channels and making modern retail even more attractive.

The transition from lump-sum tax to revenue-based tax may also reduce the price competitiveness of the grey market (unofficial imports) sector, which previously evaded import taxes. Under the new legal framework, sellers of these products must use third-party logistics services for import procedures and pay relevant import taxes, resulting in higher final selling prices.

Commonly affected products include dietary supplements, cosmetics, kitchen appliances, and certain phone models like Xiaomi and Apple iPhone. Therefore, tax-compliant retailers are expected to benefit the most in a tighter regulatory environment.

Simultaneously, recent legal changes in Vietnam’s e-commerce sector are contributing to a more level playing field, reducing competitive pressure from non-compliant sellers and solidifying the position of tax-compliant enterprises.

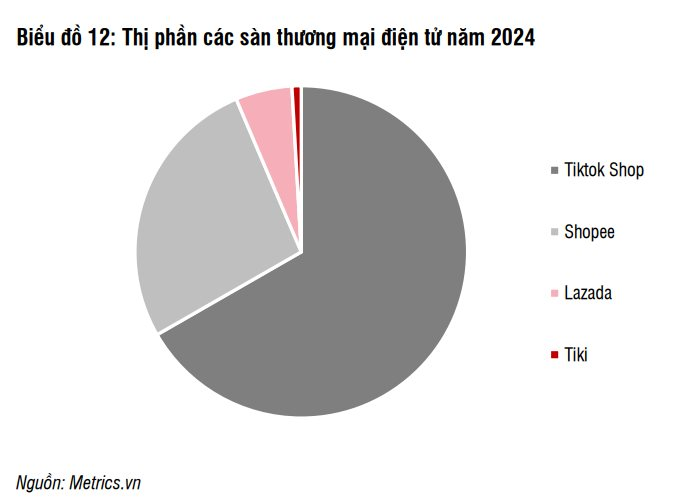

As of April 1, 2025, Shopee and TikTok Shop, Vietnam’s two largest e-commerce platforms, with over 90% market share in 2024, simultaneously increased their commission fees. This could reduce the price competitiveness of online platform products compared to traditional retail stores.

Overall, recent policy changes contribute to a more transparent and fair competitive environment by diminishing the price advantage of non-compliant sellers. Legitimate enterprises are expected to benefit as price competition eases and consumer trust shifts towards compliant retailers.

Notable beneficiaries include The Gioi Di Dong (MWG), FPT Retail (FRT), Digiworld (DGW), and Winmart (under Masan – MSN).

Benefits for Modern Jewelry Retailers

Additionally, efforts to liberalize the gold market facilitate the participation of private enterprises and financial institutions on a larger scale, benefiting modern jewelry retailers.

On June 12, 2025, the State Bank of Vietnam (SBV) announced a draft amendment to Decree 24/2012/NĐ-CP, regulating gold trading activities in the country. This marks a significant step towards gold market liberalization, allowing private enterprises and financial institutions to engage in the gold market.

Since 2012, domestic gold supply has remained stagnant while demand has continuously expanded, leading to an increase in gold smuggling. The proposed amendment to Decree 24 aims to improve legal gold supply to curb smuggling and address the market’s gold shortage. Key proposals in the draft include:

Eliminating the state monopoly on gold bar production

Allowing private enterprises to import gold materials for domestic gold bar and jewelry production, subject to quotas allocated by the SBV.

Introducing gold derivatives in commercial banks to reduce physical gold demand

Requiring transactions above 20 million VND to be conducted via bank transfers to enhance transparency and safety in large financial transactions.

Potential beneficiaries include modern jewelry retail chains (PNJ, DOJI, and other brands) that may be granted licenses to import gold materials and produce gold bars.

However, SSI notes that the government is conducting inspections of gold trading activities, which could create short-term pressure on PNJ.

The Green Tick Initiative: Empowering Supermarkets to Take the Lead

The Ho Chi Minh City Department of Industry and Trade has successfully persuaded four major e-commerce platforms to join the “Tick Green Responsibility” initiative.

The Commerce Ministry Explains Why Many Stores and Businesses Have Shut Down.

“On the evening of June 19, at the Ministry of Industry and Trade’s regular press briefing for the second quarter, Mr. Hoang Anh Duong, Deputy Director of the Department of Domestic Market Management and Development, elucidated the reasons behind the closure of thousands of shops and businesses on streets and in traditional markets across the country.”

Counterfeit Goods: A Tough Escape

The aggressive crackdown on counterfeit and pirated goods presents a prime opportunity to purge the market of illicit activities and foster the growth of legitimate businesses. This decisive action sends a clear message that only those who operate within the confines of the law will thrive, creating a level playing field for all law-abiding enterprises.

“Grilling the Secretary of Finance: How to Get Small Businesses Excited About Paying Taxes?”

The proposed amendments to the Law on Tax Administration and the Law on Personal Income Tax by the Ministry of Finance aim to revolutionize tax management. The new model strives for a streamlined, transparent, and user-friendly tax declaration process.