MBS Securities (MBS) has released a forecast for the steel industry’s profit landscape in Q2 2025 and the full year 2025.

According to MBS, the domestic market in Q2 2025 is expected to witness a growth in steel consumption of approximately 22% year-over-year, reaching 7.1 million tons, with 60% contributed by construction steel and HRC.

In Q2 2025, domestic steel prices remained stable due to high demand and positive impacts from anti-dumping taxes. Construction steel prices were stagnant compared to the same period last year but showed a slight increase of 1% from the previous quarter. Meanwhile, HRC prices remained steady thanks to robust consumption growth.

On the other hand, MBS Research indicates that coal and ore prices continued to decline, falling by 4% and 3%, respectively, in Q2 compared to the same period last year, due to excess supply in Australia and Brazil, coupled with China’s production cuts.

As a result, manufacturing enterprises such as HPG are expected to benefit from lower raw material prices and stable selling prices. For domestic galvanized steel companies like HSG, stable HRC prices can enable the company to reverse provisions made in previous quarters, thereby improving the company’s gross profit. MBS forecasts that thanks to lower input prices and stable selling prices, the industry’s gross profit margin will witness an improvement in this Q2.

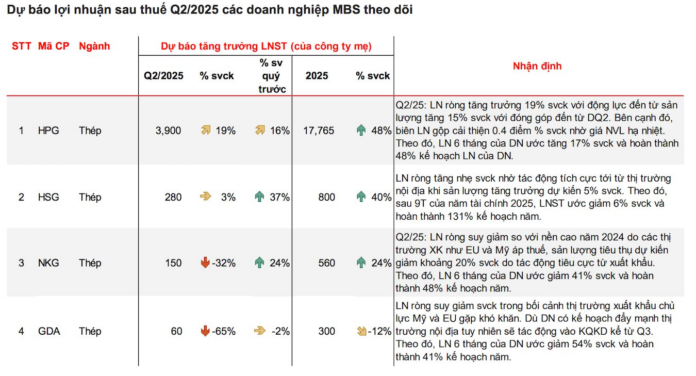

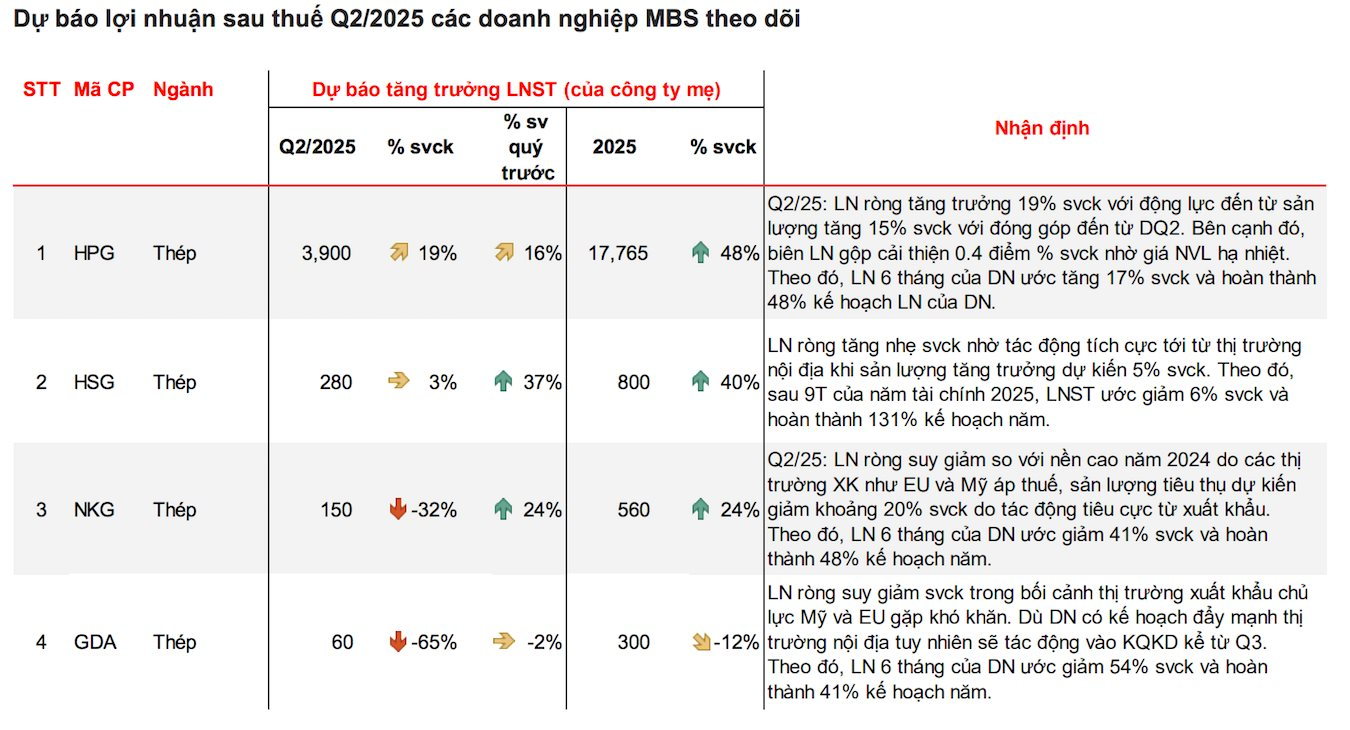

Specifically:

The MBS Analytics team predicts that Hoa Phat Group (HPG)‘s net profit in Q2 2025 may increase by 19% year-over-year, driven by a 15% growth in output, with contributions from Dung Quat 2.

According to HPG, consumption demand has outpaced production, and the company has now sold off its inventory from the previous quarter. We assess that strong consumption demand will continue to be a driving force for domestic steel prices in the second half of 2025, despite no signs of recovery in Chinese steel prices.

MBS believes that domestic steel prices could increase from Q3 onwards due to robust consumption demand and easing pressure from Chinese steel, as China cuts production.

Additionally, the gross profit margin improved by 0.4 percentage points svck thanks to lower raw material prices. Consequently, the company’s profit for the first six months is estimated to increase by 17% svck, completing 48% of the profit plan.

For Hoa Sen Group (HSG), MBS projects a slight increase in net profit in Q2 compared to the previous year, owing to positive developments in the domestic market, with expected production growth of 5%. Thus, after nine months of the 2025 financial year, net profit is estimated to decrease by 6% year-on-year, completing 131% of the yearly plan.

According to MBS, Nam Kim Steel (NKG)‘s profit in Q2 2025 is expected to reach VND 150 billion, while Dong A Steel (GDA) is projected to earn VND 60 billion, representing decreases of 32% and 65%, respectively.

However, for the full year 2025, Nam Kim’s profit is still expected to grow by 24%, while Dong A Steel’s profit is projected to decline by 12%.

“Walking the Talk: Bầu Đức Acquires 10 Million HAG Shares”

The HAGL stock closed at a share price of VND 12,950 on June 19, marking yet another pivotal moment for the company on the stock market.

The Ultimate Vietnamese Delicacy: China Takes the Lion’s Share with a Whopping 97% of Exports

The provincial leader urged Chinese traders to continue their support and actively consume products from local farmers.