The collateral for the bonds is secured by shares owned by FECON, Chairman of the Board of Directors, Pham Viet Khoa, and FECON Investment Joint Stock Company (a subsidiary of FCN). The initial announced guarantee ratio is 210%.

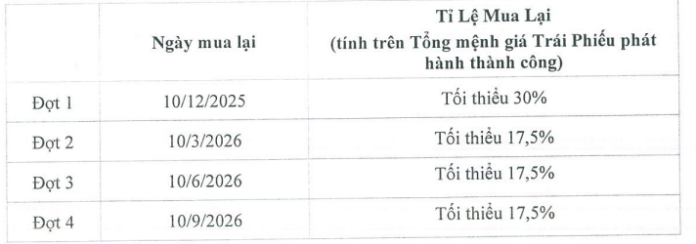

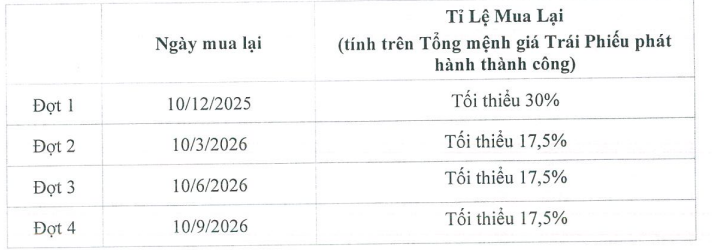

The company also plans to repurchase this bond lot in 4 tranches, with the first tranche repurchasing a minimum of 30% on December 10, 2025, and the remaining 3 tranches at 17.5% each.

|

Repurchase schedule of FCN bonds

Source: FCN

|

According to HNX, FECON currently has a bond lot FCNH2426001 worth VND 120 billion, issued on October 21, 2024, with a term of 18 months and an issuance interest rate of 11% per annum. The collateral includes 500,000 FCN shares, nearly 15 million shares of FECON Energy Joint Stock Company (FCP), and over 15.6 million shares of FECON Underground Works Joint Stock Company (FRU), all of which are subsidiaries of FCN.

On April 21, 2025, the Company spent VND 17 billion to repurchase the above bond lot, leaving a remaining value of VND 103 billion.

As of the end of the first quarter of 2025, FCN’s total assets were nearly VND 9,905 billion, up 2% from the beginning of the year. Of this, payables were nearly VND 6,547 billion, up 3%, with financial debt of over VND 4,020 billion, up 3% from the beginning of the year and accounting for 61% of total debt.

In another development, the FCN Board of Directors has just approved the appointment of Mr. Nguyen Thanh Tung (born in 1981) – Executive General Director to the position of FECON General Director, effective from the beginning of July 2025 until the end of the 2024-2029 term.

Chairman Pham Viet Khoa: FCN is discussing the TOD segment with Chinese and Japanese partners

– 11:43 24/06/2025

“FECON Consortium Bags a New Contract Worth VND 1,000 Billion at My Thuy Port Project”

The My Thuy Port project is an ambitious undertaking with a total investment of approximately VND 15,000 billion. This state-of-the-art port facility will boast 10 berths, accommodating container ships, bulk carriers of up to 100,000 tons, and LNG vessels up to 150,000 tons. With this significant investment and scale, the My Thuy Port project is poised to become a pivotal maritime gateway, facilitating trade and contributing to the economic growth of the region.

Is FECON’s 200 Billion Profit Goal at Risk Due to Consecutive Losses in the First Quarter?

FECON Corporation (HOSE: FCN) reported a 34% increase in revenue for the first quarter of 2025, however, the company still incurred a loss of VND 7 billion, marking the second consecutive quarter of losses as financial expenses continue to weigh heavily. This puts the company’s target of VND 200 billion in profits for the year at a more challenging position.

Government Provides Strong Financial Support, Public Investment Group Stocks Still Show “Weak” Momentum

The construction stock group has failed to meet the expectations of stock investors, despite the strong impact of public investment disbursement in the Q4/2023 financial report. Most stocks still have a weaker performance compared to the VN-Index since the beginning of 2024 until the session on 23/2.