According to data updated as of June 17, issuers have paid a total of VND 67.3 trillion in principal and interest on corporate bonds since the beginning of 2025, equivalent to 23% of the total amount due for the year, according to FiinTrade statistics.

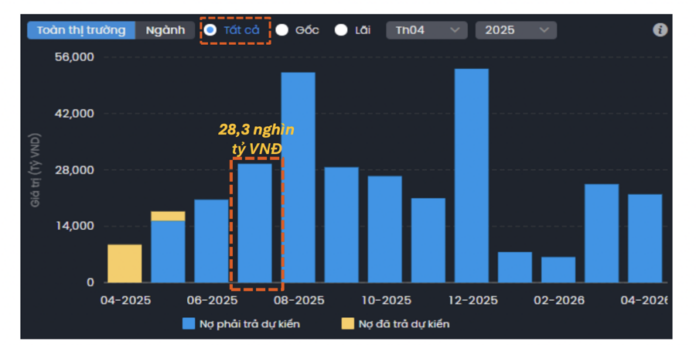

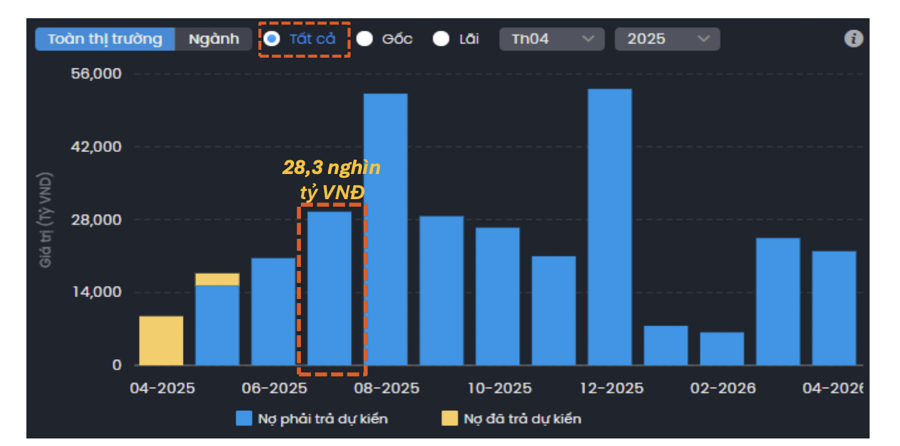

The expected bond payments, including principal and interest, amount to approximately VND 25 trillion in June and VND 28.3 trillion in July.

All bonds maturing in July 2025 are from the Non-bank group, indicating significant repayment pressure. Specifically, for July 2025, the total principal amount of corporate bonds due for the Non-bank group is estimated at VND 19.2 trillion, a substantial increase of 67% compared to the VND 11.5 trillion recorded in June.

Real estate continues to dominate (62.8%) with about VND 12 trillion in bonds maturing in July, double the scale of maturities in June. Some notable companies with large bond maturities include Hoang Phu Vuong (VND 4.7 trillion) and Hoa Phu Thinh JSC (VND 3.1 trillion), both associated with the Van Thinh Phat and Tan Hoang Minh groups.

From the beginning of June to the end of 2025, the total value of corporate bonds maturing for the Non-bank group is estimated at VND 106.5 trillion, of which real estate accounts for 65%, or VND 68.9 trillion.

In July 2025, interest payments on bonds in the Non-bank group are expected to exceed VND 5.4 trillion, a 22% decrease from the previous month, indicating a slight easing of interest rate pressure compared to May and June.

Real estate continues to account for a significant proportion, approximately 34% of the total interest expenses for July in the Non-bank group. Additionally, several other sectors contribute significantly to the total interest payments, including Tourism and Entertainment (6.7%), Construction and Materials (6%), and Financial Services (4.5%).

From June 2025 to the end of the year, the Non-bank group is expected to pay approximately VND 41.1 trillion in bond interest. Real estate alone accounts for more than 53% of this amount, reflecting considerable cash flow pressure amid a wave of maturities.

As of the end of May 2025, the total value of corporate bonds in circulation in the market reached VND 1,300 trillion, a slight increase of 2.9% compared to the end of April 2025.

Specifically, the issuance of new corporate bonds surged in May 2025, reaching VND 66.5 trillion, with all of it coming from private placements. Banks led the issuance, accounting for nearly 73% of the total volume for the month. In the Non-bank group, most of the new issuances belonged to the Vingroup conglomerate, including Vingroup and VinFast. Despite the improving issuance activities, the market sentiment remains cautious due to the transitional legal environment.

A notable highlight in May 2025 was the early repurchase of corporate bonds in the real estate sector, totaling VND 9.5 trillion, 2.5 times higher than the previous month. Cumulatively, in the first five months of 2025, real estate enterprises repurchased VND 24.7 trillion in corporate bonds early, a 1% increase, with Novaland (NVL) leading the way with a repurchase volume of VND 6.7 trillion, equivalent to 30.7% of NVL’s corporate bonds in circulation at the end of 2024.

Great Opportunities for Patient Investors Holding onto Nhon Trach (Dong Nai) Land

Although not officially merged with Ho Chi Minh City, Nhon Trach in Dong Nai province has maintained stable growth in the real estate market over time. Its strategic “gateway” location, offering direct trade links to both Ho Chi Minh City and Ba Ria-Vung Tau, coupled with continuous advancements in transportation infrastructure, has kept the area thriving.

An Unparalleled Project Adjacent to Two Metro Stations in Binh Duong and Dong Nai

With the advantage of being adjacent to two metro stations, S0 and S2.1, The Gió Riverside is poised to become a promising destination, leading the trend of inter-regional metro infrastructure development. This strategic location unlocks enhanced connectivity within the eastern region, fostering evident medium- to long-term price appreciation potential.

The Merger: A Historic Boost for Yen Bai’s Real Estate

The merger of Yen Bai and Lao Cai provinces has reshaped the administrative map and ushered in a new era of development for the northern midland and mountainous regions. Yen Bai, with its abundant land resources, strategic location, and enhanced infrastructure, has emerged as a focal point for real estate investment, offering a wealth of opportunities for those seeking to capitalize on this burgeoning market.