According to the Vietnam Bond Market Association, as of June 13, 2025, there have been 13 corporate bond issuances recorded in June 2025, with a total value of VND 15,109 billion. Of this, bonds issued by commercial banks accounted for VND 13,889 billion, or nearly 92% of the total issuance value in the bond market. Cumulatively, from the beginning of the year, the total value of corporate bond issuances stood at VND 157,536 billion, a 71% increase compared to the same period last year. Bank bonds have dominated this market.

From the beginning of the year to mid-June 2025, the total value of bank bonds issued amounted to approximately VND 114,000 billion, double the figure from the same period last year.

Experts attribute this trend to the prevailing low-interest-rate environment, with banks seeking to bolster credit growth and enhance financial safety indicators such as capital adequacy ratios, while also curbing the use of short-term capital for medium and long-term loans.

The latest statistics from the State Bank of Vietnam show that as of the end of May 2025, credit growth in the economy stood at 6.52%. In contrast, customer deposits, including individuals and economic organizations, at credit institutions reached nearly VND 15 million billion by the end of March 2025, a 1.8% increase compared to the previous month. The capital mobilization growth of the banks is lagging far behind the credit growth rate.

The banking industry has maintained its pivotal role in the corporate bond market.

Indeed, the banking industry has been pivotal to the corporate bond market. According to MBS data, in 2024, the total value of corporate bonds issued exceeded VND 472,100 billion, a 49% increase compared to 2023. The banking industry accounted for more than VND 318,400 billion, or 67%, of this total.

In 2025, banks are expected to continue this trend of increasing bond issuance to supplement Tier 2 capital and boost medium and long-term capital sources to meet credit demands. VIS Rating forecasts that, over the next 1-3 years, banks will need to raise approximately VND 283,000 billion through bond issuance to augment Tier 2 capital. This will enable banks to bolster their internal capital and maintain capital adequacy ratios.

In a recently released report, FiinRattings projected a 15-20% increase in the outstanding balance of the corporate bond market in 2025. Commercial banks are expected to continue augmenting their Tier 2 capital through corporate bond issuance.

Several banks have already announced plans for bond issuances in the near future. For instance, ACB has unveiled a plan for the second private bond issuance of 2025, intending to offer a maximum of 200,000 bonds, each with a par value of VND 100 million, raising a total of up to VND 20,000 billion. These are non-convertible, non-warrant-attached, unsecured, and non-subordinated debts of the issuing organization. The bond term is a maximum of five years, and interest will be paid annually. The issuance is expected to be divided into 20 batches.

Agribank also intends to issue a maximum of 100 million bonds with a par value of VND 100,000 each, equivalent to a value of VND 10,000 billion. These bonds have a 10-year term and a floating interest rate based on the reference rate plus a margin at the decision of the bank’s general director. These are non-convertible, unsecured, non-warrant-attached debts that meet the conditions to be considered Tier 2 capital. The bond offering is expected to take place from the second quarter to the fourth quarter of 2025, after Agribank obtains the registration certificate for public bond offering from the State Securities Commission.

TPBank has also successfully issued multiple batches of 10-year bonds with interest rates ranging from 6.78% to 7.28% per annum. Since the beginning of June, TPBank has issued a total of six batches of bonds worth approximately VND 4,853 billion. Notably, during this period, the bank has also actively repurchased bonds ahead of schedule to restructure its debt portfolio.

Experts believe that the new regulations on private placement and public offering of bonds, expected to come into effect in the second half of 2025, will enhance the quality of bond offerings and attract investors to this investment channel, especially given the prevailing low savings interest rates. Bank bonds, in particular, are anticipated to remain attractive to investors due to their reliability and flexibility.

“A Life Insurance Giant Holds Over 57 Million VietinBank Shares, Valued at Nearly VND 2.4 Trillion”

Introducing VietinBank: A Leading Financial Institution in Vietnam

The Vietnam Joint Stock Commercial Bank for Industry and Trade, widely known as VietinBank (CTG), has recently disclosed information regarding its shareholders. In a notable development, the bank has announced that one of its shareholders now holds over 1% of its chartered capital.

5 Banks Project Profit of Over 30,000 Billion VND in 2025

“In addition to the aforementioned top five banks, Agribank and VPBank are also aiming high with plans to achieve profits of approximately $1 billion each in 2025. These ambitious targets showcase the growth trajectory of Vietnam’s banking sector and the potential for significant financial gains in the coming years.”

The Do’s and Don’ts of Small-Scale Banking

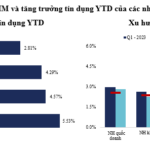

The Q1 financial results and year-to-date stock growth figures have shed light on an intriguing development: the performance of smaller-scale banks, which are often overlooked in industry-wide comparisons. This prompts a re-evaluation of the prospects for this group of financial institutions, especially amidst a backdrop of dynamic macroeconomic conditions, characterized by both positive shifts and lingering uncertainties.