Illustration

Oil prices dip as US sanctions on Iran ease war escalation fears

Oil prices declined as the US imposed new sanctions related to Iran, marking a diplomatic approach that sparked hopes for a negotiated settlement. This comes a day after President Donald Trump stated that it could take two weeks to decide on US involvement in the Israel-Iran conflict.

Brent crude oil fell by 1.84 USD or 2.33% to 77.01 USD per barrel. WTI crude oil decreased by 0.21 USD or 0.28% to 74.93 USD per barrel.

For the week, Brent crude rose by 3.6%, while WTI crude gained 2.7%.

The Trump administration announced new sanctions related to Iran. According to the Foreign Assets Control section of the Treasury Department, these sanctions target at least 20 entities, 5 individuals, and 3 vessels.

Oil prices surged by nearly 3% on Thursday after Israel bombed nuclear targets in Iran, while Iran, the third-largest producer in OPEC, fired missiles and drones into Israel. Neither side showed signs of backing down in the week-long war.

Brent crude prices dipped after the White House stated that Trump would decide whether the US would engage in the Israel-Iran conflict within the next two weeks.

Iran has previously threatened to block the Strait of Hormuz, a crucial route for Middle Eastern oil exports.

Giovanni Staunovo, an analyst at UBS, stated that oil exports have not been disrupted so far, and there is no shortage of supply.

An escalation of the conflict, such as Israel attacking export infrastructure or Iran disrupting transportation through the strait, could push oil prices to as high as 100 USD per barrel.

US energy companies cut oil and natural gas rigs for the eighth consecutive week, the first time since September 2023, according to energy service firm Baker Hughes. The number of oil and gas rigs fell by 1 this week to 554, the lowest since November 2021.

Gold prices steady after a week of decline

Gold prices remained stable on the last trading day of the week, marking a weekly decline after President Donald Trump delayed the decision to engage in the Israel-Iran conflict.

Spot gold was unchanged at 3,368.68 USD per ounce, the lowest since June 12, while falling by 1.8% for the week. Gold futures for August delivery closed down 0.7% to 3,385.7 USD.

Iran launched a series of new missiles early Friday morning, targeting residential apartments, office buildings, and industrial facilities in the southern city of Beersheba.

Gold is traditionally seen as a safe-haven asset during times of political and economic uncertainty.

Copper prices rebound

Copper prices recovered after President Donald Trump delayed the decision to involve US troops in the Israel-Iran conflict, but the gains were limited by uncertainties surrounding tariffs and Chinese demand.

Three-month copper on the London Metal Exchange rose by 0.3% to 9,642 USD per ton. Earlier, prices had hit their lowest since June 13 at 9,558.5 USD per ton.

Some metals gained along with the stock market after news that Trump would decide within two weeks whether the US would engage in the Israel-Iran airstrikes, and as Europe attempted to persuade Tehran to return to nuclear negotiations.

The 90-day tariff reprieve period granted by Trump will end next month.

The premium for LME copper forward contracts surged to its highest since October 2022 due to low inventories and large nearby spreads. LME copper stocks fell by more than 60% since mid-February to 99,200 tons, the lowest since August 2023.

COMEX copper declined by 0.9% to 4.81 USD per lb, putting the COMEX-LME copper spread at 964 USD per ton.

Dalian iron ore prices rise

Dalian iron ore prices increased, but they remained nearly unchanged for the week as investors weighed strong demand for the steelmaking raw material in China against the continuous downturn in the country’s real estate market.

The September iron ore contract on the Dalian Commodity Exchange closed up by 0.93% to 703 CNY per ton, falling by 0.07% for the week.

In Singapore, the July iron ore contract rose by 0.94% to 93.55 USD per ton, declining by 0.65% for the week.

According to data from consulting firm Mysteel, the operating rate of blast furnaces in China rose slightly this week, reaching 83.82%, an increase of about 0.4% from the previous week.

Spring is usually the peak construction season in China before the rainy season starts in June.

Analysts from ANZ stated that it is unlikely for steel and iron ore demand to grow significantly until there is an improvement in new construction activity.

In Shanghai, steel rebar gained 0.23%, hot-rolled coil rose by 0.39%, wire rod climbed by approximately 0.3%, while stainless steel fell by 0.44%.

Japanese rubber prices dip

Japanese rubber prices declined due to weak tire raw material demand in China, despite the fact that the futures contract posted a weekly gain as wet weather raised concerns about supply.

The November rubber contract on the Osaka Exchange closed down by 2.9 JPY or 0.97% to 295.4 JPY (2.03 USD) per kg. The contract rose by 1.1% for the week.

September rubber on the Shanghai Futures Exchange fell by 110 CNY or 0.79% to 13,900 CNY (1,934.72 USD) per ton.

Chinese commodity data provider Longzhong Information stated that rain in producing areas, both domestic and abroad, has impacted the mining and total output of the raw material in the short term.

Thailand’s meteorological agency, one of the top rubber-producing countries, warned of heavy rain that could cause flash floods and waterlogging from June 21 to 26, advising farmers to prepare for potential crop damage.

Coffee prices dip by 13% for the week

Robusta coffee closed down by 150 USD or 3.9% to 3,737 USD per ton, with the market dipping to a one-year low of 3,699 USD per ton. Prices fell by 13% for the week.

Harvesting in Brazil and Indonesia continues to boost supply and put downward pressure on prices, while reports of weak demand persist.

Trading house Icona Cafe stated that coffee trees in Vietnam are growing well as weather conditions remain favorable, indicating that the upcoming harvest could see a growth of about 10%.

Arabica coffee fell by 2.2% to 3,1505 USD per lb. During the session, prices dipped to 3,1185 USD, the lowest for 2025, and fell by 8.9% for the week.

Sugar prices fluctuate

Raw sugar closed up by 0.22 US cents or 1.4% to 16.10 US cents per lb, previously dipping to a four-year low of 15.8 US cents on June 18.

Sugar prices generally faced downward pressure due to the current Brazilian harvest, which appears to be favorable, while good weather indicates that prospects for the crop in India and Thailand will improve.

There are geopolitical price risks for sugar as the Iran-Israel war increases energy prices, leading Brazilian sugar mills to produce less sugar and more ethanol, a biofuel made from sugarcane.

White sugar fell by 1.5% to 475.10 USD per ton.

Corn, wheat, and soybean prices dip

Corn on the Chicago Board of Trade fell for the third time in four sessions, reaching a six-and-a-half-month low due to favorable weather for the Midwest farming belt.

CBOT July corn futures closed down 4-3/4 US cents to 4.28-3/4 USD per bushel after dipping to the lowest since December 5, 2024. The contract fell by 3.5% from a week earlier, marking the biggest weekly decline in six weeks.

Wheat prices declined due to profit-taking after rising more than 4% in the previous session, and as the US winter harvest progress boosted supply.

CBOT soft red winter wheat for July delivery closed down 6-1/2 US cents to 5.67-3/4 USD per bushel after reaching the highest since March 24. The contract rose by 4.2% for the week, the strongest weekly gain in ten weeks.

Soybean prices fell for the first time in five sessions due to profit-taking after reaching a five-and-a-half-week high, and as favorable weather conditions persisted.

CBOT July soybean futures fell by 6-3/4 US cents to 10.68 USD per bushel, previously rising to the highest since May 14. The contract fell by 0.2% for the week, the first weekly decline in three weeks.

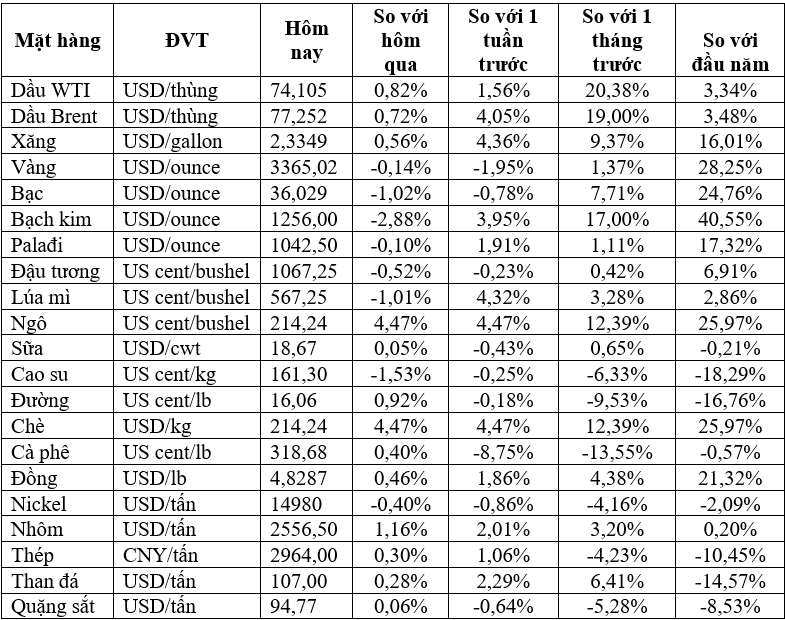

Prices of key commodities on June 21st, 2025

“Global Markets Rally: Oil Prices Surge and Iron Ore Rebounds”

“Oil prices surged nearly 3% on June 19 as the Israel-Iran conflict escalated, creating a ripple effect across global markets. This development overshadowed a relatively quiet day for other assets, with gold trading sideways, the dollar dipping to a weekly low, iron ore snapping a five-day losing streak, and Indian rice prices climbing on improved demand.”

“VPBank’s Expert Advice: Investors Should Buy on Dips and Avoid Chasing Strong Rallies”

“Despite the mounting geopolitical risks, global stock markets will always weather these storms and emerge resilient,” asserted Duc.