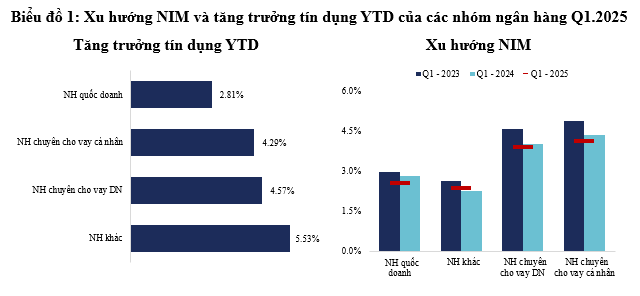

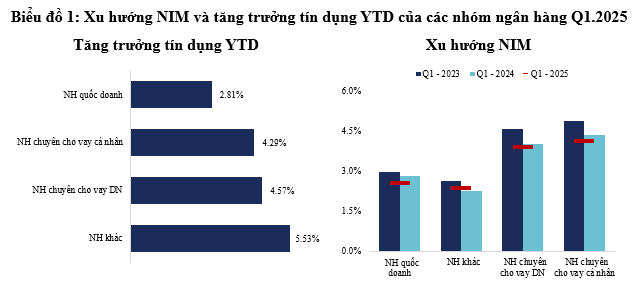

The first-quarter credit picture showed a clear positive signal as the industry’s growth reached 3.8%, a significant improvement from the previous year’s 2.1%. Surprisingly, small-scale banks recorded the highest credit growth in the industry. This development offers a new perspective on the prospects of small-scale banks, which have often been overlooked in the past.

Despite their notable progress, the question arises whether small-scale banks can sustain their growth momentum in the medium to long term. While their modest size offers more room for expansion compared to larger banks, the determining factors lie not only in growth potential but also in their ability to formulate flexible strategies, restructure timely, and effectively exploit niche markets that larger banks tend to neglect. These elements will create a distinct differentiation within this group and are crucial for their future growth and long-term sustainability in the increasingly competitive banking industry.

Prospects for Small-Scale Banks

For many years, the genuine growth prospects of small-scale banks have been a significant question in the market, especially amid intensifying competition in the banking system. The challenge of expanding their core corporate customer base has led banks to seek growth beyond traditional client segments, greatly impacting smaller banks that face more disadvantages. The drawbacks of this group of banks result in lower financial metrics compared to their larger counterparts, including credit growth, bad debt control, low-cost capital mobilization, and profitability. Therefore, identifying genuinely promising small-scale banks requires a deeper insight into their operational strategies, transformation capabilities, and ability to create differentiation, rather than solely relying on current financial figures.

The first-quarter financial results of 2025 indicate a notable shift for small-scale banks, with credit growth reaching 5.5% compared to the end of 2024—the highest in the industry and the fastest pace in the last five years for this group. In previous years, their first-quarter credit growth was below 4%, highlighting the current turnaround and warranting a re-evaluation of their growth potential.

Source: Consolidated

|

Notably, the competitive advantage of small banks lies in their ability to effectively access and exploit niche markets or specific customer segments that larger banks have not heavily invested in or optimized their services for. Small banks often focus on higher-risk industries or less prioritized geographical areas, creating some credit growth opportunities. Moreover, due to their smaller scale, these banks have more room to expand credit and grow. In contrast, the same growth rate for larger banks would entail more pressure and the need for more substantial disbursement amounts and higher risk management capabilities. This situation presents an opportunity for small banks to improve their profits and gradually enhance their competitive position if they can capitalize on it effectively.

However, the growth path for small-scale banks is fraught with challenges. Non-performing loan ratios have always been a significant hurdle, especially when serving higher-risk customer segments. The ability to effectively manage asset quality and handle bad debts is crucial for ensuring sustainability. Additionally, the inability to mobilize low-cost capital results in higher funding costs, impacting their net interest margin (NIM). Notably, while the industry’s NIM has declined, small-scale banks have maintained relatively stable NIMs, and their current NIM has improved significantly compared to the previous year.

Individual Prospects of Small-Scale Banks

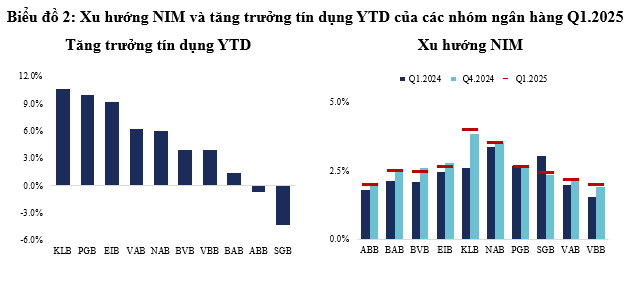

While small-scale banks, as a group, presented a brighter financial picture in the last quarter, there was still significant differentiation among them due to the diversity of strategies and the ability to execute niche strategies effectively.

One of the standout performers is Kienlongbank, with a credit growth rate of 10.6% in the first quarter—nearly three times the industry average. This growth was mainly driven by retail and wholesale lending and construction financing, with these two segments contributing over 60% of its credit portfolio and exhibiting outstanding growth compared to industry averages. With a focus on becoming a pure retail bank in second-tier urban areas, Kienlongbank caters to customers in the Mekong Delta region, targeting traditional segments such as agriculture, rural areas, and business households. Its small scale allows for more flexibility in deploying credit, and there is still room for future expansion. Notably, Kienlongbank is one of the few banks that has not experienced a decline in NIM over the past two years, maintaining a significantly higher NIM than its similarly-sized peers.

Source: Consolidated

|

PGBank is another notable name in terms of credit growth in the first quarter of 2025, mainly driven by wholesale, retail, and construction lending. Previously, PGBank had planned to merge with VietinBank, but the deal was stalled due to ownership transfer complexities as both banks had high state ownership ratios, requiring multiple layers of complex approvals. However, a turning point came at the end of 2023 when Petrolimex divested, and PGBank officially completed the transfer to a new group of shareholders related to the Thanh Cong (TC) Group. This change opened new doors for PGBank as it began to leverage the TC Group’s ecosystem, becoming a significant credit partner for companies like DSC Securities and Viet Hung Industrial Park Development JSC. This close relationship indicates a clear strategic shift towards wholesale banking, focusing on chain financing and corporate lending. Future potential will depend on effectively leveraging these new connections to expand into growth areas within the strategic shareholder’s ecosystem.

Eximbank, with its long-standing strength in trade finance and international payments, is actively restructuring for recovery and sustainable development. Additionally, Eximbank is pushing into retail lending, notably with a program supporting young people in purchasing homes, even with limited income and savings. In the first quarter of 2025, the bank achieved an impressive 9.2% credit growth rate. While they did not disclose industry-specific loan balances, their deployed programs and 2024 financial reports suggest that individual home loans were the primary growth driver. This activity also helped Eximbank maintain its position as the bank with the best NIM in this group, although still below the industry average.

VietABank and Nam A Bank recorded promising credit growth in the first quarter of 2025 but showed distinct differences in net interest margins (NIM). While Nam A Bank pursues a retail banking strategy in the southern region, focusing on lending to small businesses, VietABank opts for providing short-term preferential loan packages and actively connecting with local business associations. Identifying potential business customers within these associations not only helps VietABank achieve efficient credit growth but also contributes to maintaining a low non-performing loan ratio. BVBank, Vietbank, and Bac A Bank experienced moderate credit growth, with a high proportion of personal loans (50-70%), making them susceptible to weak individual credit demand. While these banks improved their NIM compared to the previous year, there are signs of stagnation compared to the end of 2024. ABBank and Saigonbank were the only banks with negative credit growth, similar to the previous year, reflecting their seasonal nature. Moreover, their NIMs are among the lowest in the industry, indicating challenges in maintaining business efficiency and short-term growth.

The diversity of strategies and the low valuation of this group of banks compared to the overall market will create short-term investment opportunities for investors who can assess the feasibility of each bank’s strategy. As large banks continue their cautious growth approach, significant shifts in the macroeconomic environment will present opportunities for small-scale banks that can effectively leverage niche markets or efficiently restructure their business models.

Le Hoai An, CFA – Nguyen Thi Ngoc An (HUB)

– 08:01 23/06/2025

The Top 11 Banks to Watch: Will Sacombank, VietinBank, MB, VPBank, and BIDV See Double-Digit Profit Growth in Q2?

“All banks in the aforementioned list are expected to witness positive growth in their pre-tax profits for the second quarter and the full year of 2025, as per VCBS forecasts.”

Unlocking Capital: Vietbank Launches a 2,000 Billion VND Interest-Free Loan Package

“Vietbank is proud to announce an exclusive promotional program, offering an incredible 0% interest rate on loans to our valued customers. With a substantial 2,000 billion VND in funding, we’re here to support your financial journey and help unlock your potential. It’s time to take advantage of this opportunity and set your plans in motion with Vietbank’s ‘Super-Charged Loan Program: 0% Interest, Unlocking Endless Possibilities’.”