In a stunning display of strength, VinGroup’s stocks rallied, with the index rising solely due to the stellar performance of VIC and VHM. While the Vn-Index hovered around the reference point for most of the session, a surge of cash flow into VinGroup stocks in the afternoon pushed VIC to its daily limit, up 10%, while VHM gained 5.41%. These two stocks alone contributed almost 9 points to the market, matching the Vn-Index’s exact gain.

At the close, the VN-Index approached the 1,358-point level, a three-year high, despite a negative breadth with 205 declining stocks versus 120 gainers. In the real estate sector, in addition to VinGroup, industrial zone stocks also performed well, with BCM up 2.56%, SIP up 4.85%, KBC up over 1%, and IDC up 2.9% on positive trade negotiation prospects as the US deadline for postponing retaliatory tariffs on Vietnam looms.

Contrary to concerns, the market reacted positively to the risks associated with tariffs and escalating tensions in the Middle East. Oil and gas stocks witnessed a rally today, with PVC surging to its daily limit, up nearly 10%, PVS gaining 1.15%, PVD climbing 3.09%, and PVB rising 1.94% on expectations of higher oil prices.

On the flip side, banks, securities, food, telecommunications, and information technology stocks witnessed a sell-off. Despite the upcoming earnings season, which is predicted to bring robust profits for banks, their stocks turned south. Securities stocks followed a similar trend, with numerous stocks declining by an average of 1.5%, while only a handful rose marginally.

Overall, the market is being driven by VinGroup stocks, resulting in a situation where the Vn-Index is in the green, but individual stocks are falling. On a positive note, liquidity increased towards the end of the session, with the three exchanges recording a combined trading value of VND23,400 billion, including net foreign selling of VND226.4 billion. Specifically, in matched orders, foreign investors sold a net VND141.8 billion.

Foreign investors’ main net-buying on the matched orders side was in the Retail and Basic Resources sectors. The top net-bought stocks by foreign investors on a matched orders basis included VIC, HPG, GEX, MWG, VHM, DBC, FPT, GEE, DCM, and SSI.

On the net-selling side, foreign investors focused on the Banking sector. The top net-sold stocks by foreign investors on a matched orders basis included VCI, VNM, EIB, SHB, ACB, VPB, HCM, VRE, and HVN.

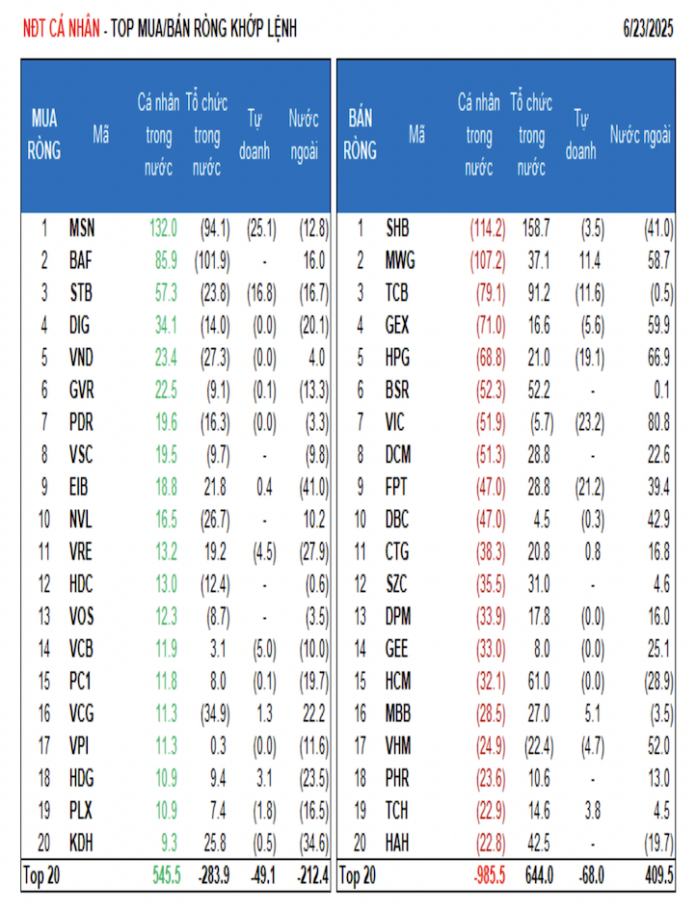

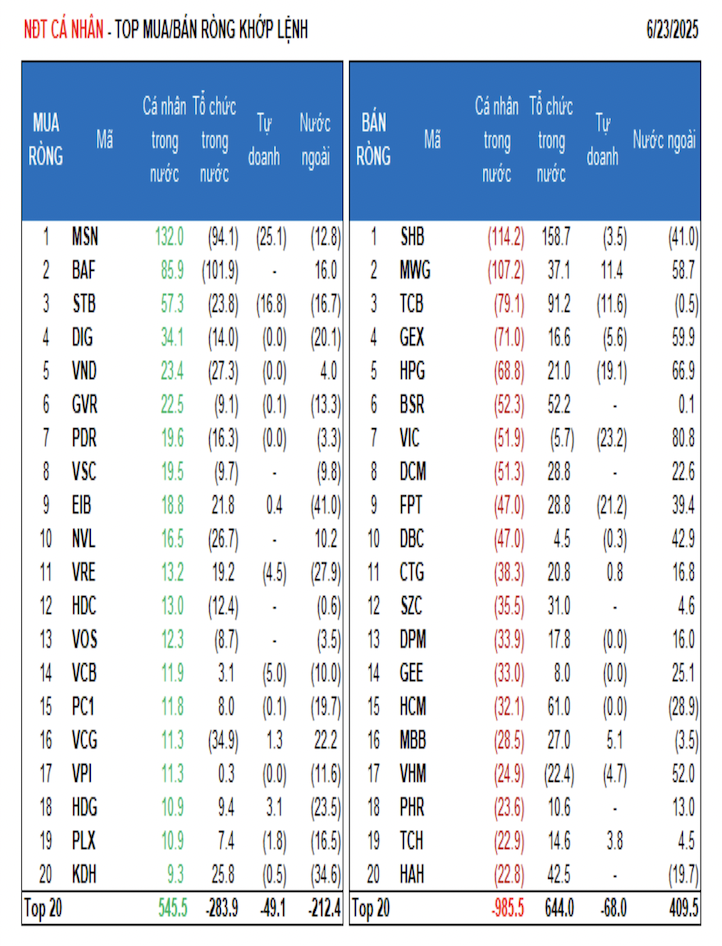

Individual investors net sold VND497.3 billion, including net selling of VND554.2 billion in matched orders. In terms of matched orders, they net bought 5 out of 18 sectors, mainly in the Food and Beverage sector. The top net bought stocks by individual investors included MSN, BAF, STB, DIG, VND, GVR, PDR, VSC, EIB, and NVL.

On the net-selling side in matched orders, they net sold 13 out of 18 sectors, mainly in the Banking and Retail sectors. The top net sold stocks included SHB, MWG, TCB, GEX, HPG, BSR, DCM, FPT, and DBC.

Proprietary trading accounts net bought VND358.0 billion in total, including net selling of VND77.5 billion in matched orders. In terms of matched orders, proprietary trading accounts net bought 6 out of 18 sectors. The most net bought sector was Financial Services, followed by Banking. The top net bought stocks by proprietary trading accounts in today’s session included ACB, E1VFVN30, MWG, MBB, FUEVFVND, TCH, HDG, REE, VCG, and VTP. The top net sold sector was Real Estate. The top net sold stocks included MSN, VIC, FPT, KBC, HPG, STB, VNM, TCB, LPB, and HDB.

Local institutional investors net bought VND305.4 billion in total, including net buying of VND773.5 billion in matched orders. In terms of matched orders, local institutions net sold 4 out of 18 sectors, with the largest net selling in the Food and Beverage sector. The top net sold stocks included BAF, MSN, ACB, VCG, VND, NVL, STB, VHM, HHS, and PDR. The largest net buying was in the Banking sector. The top net bought stocks included SHB, TCB, HCM, VCI, BSR, VNM, HAH, MWG, SZC, and HVN.

Proprietary trading accounts net bought VND358.0 billion in total, including net selling of VND77.5 billion in matched orders. Focusing on matched orders, proprietary trading accounts net bought 6 out of 18 sectors. The most net bought sector was Financial Services, followed by Banking. The top net bought stocks by proprietary trading accounts in today’s session included ACB, E1VFVN30, MWG, MBB, FUEVFVND, TCH, HDG, REE, VCG, and VTP. The top net sold sector was Real Estate, with the top net sold stocks being MSN, VIC, FPT, KBC, HPG, STB, VNM, TCB, LPB, and HDB.

Local institutional investors net bought VND305.4 billion in total, including net buying of VND773.5 billion in matched orders. In terms of matched orders, local institutions net sold 4 out of 18 sectors, with the largest net selling in the Food & Beverage sector. The top net sold stocks included BAF, MSN, ACB, VCG, VND, NVL, STB, VHM, HHS, and PDR. Net buying was most prominent in the Banking sector. The top net bought stocks included SHB, TCB, HCM, VCI, BSR, VNM, HAH, MWG, SZC, and HVN.

Today’s matched orders trading value reached VND3,710.2 billion, up 68.9% from the previous session, contributing 15.3% to the total trading value. Notable matched orders transactions were observed in KDC, with over 3 million shares (worth VND182.3 billion) changing hands between individual investors, and nearly 2.2 million shares (worth VND128.9 billion) traded between domestic institutions.

A sector analysis reveals an increase in cash flow allocation to Securities, Construction, Chemicals, Agriculture & Seafood, Retail, Electrical Equipment, and Oil & Gas, while a decrease is seen in Real Estate, Banking, Food, Warehousing, and Logistics.

Focusing on matched orders, cash flow allocation increased for mid-cap (VNMID) and small-cap (VNSML) stocks while decreasing for large-cap (VN30) stocks.

The Savvy Investor’s Take: Net Selling by Individuals, Prop Traders Accumulate

Today, individual investors net-sold 431.5 billion VND worth of stocks, while their net buy-value on matched orders was 25.1 billion VND.

“Stalling Momentum: The Impact of Weak Support and Declining Funds”

The reversal of the two major stocks, VIC and VHM, has significantly slowed down the VN-Index’s upward trajectory this morning. While the weakening of the cash flow also played a significant role, with HoSE’s liquidity decreasing by 32% compared to yesterday’s morning session. Although the breadth remained tilted towards gainers, most stocks witnessed only minor fluctuations.

The Sorrow of Provincial Land Investors: Bought a Plot for Nearly VND 3 Billion, After 4 Years of Investment Someone Offered to Buy it for VND 2 Billion and Walked Away, Leaving the Owner Devastated

For years, peripheral provinces have witnessed a stagnant landscape for agricultural land transactions. While residential land has seen a gradual recovery in certain areas, investors holding onto garden land continue to await a return to the market conditions of 4-5 years ago.

East Anh: Land Adjacent to the Mega Vinhomes Co Loa Project Reaches 250-260 million VND per sq. meter, Many Landowners Withhold Sales

According to Batdongsan.com.vn, land adjacent to the mega-project Vinhomes Co Loa, with a business frontage in Trung Thon village, is currently priced at 250-260 million VND per square meter. Owing to its prime location, adjacent to a large-scale development, many landowners are not looking to sell, instead choosing to await the area’s future growth.