BETA’s 2025 Annual General Meeting Took Place on June 20

|

For the 2025 stock market forecast, BETA believes that the stability of the macro-economic foundation, along with supportive policies from the government and sustained investment flows, will continue to be key drivers for the market. The company expects improvements in both the VN-Index score and trading liquidity. However, international factors, particularly the US’s trade policies and tariff actions, will play an increasingly important role in shaping market trends.

As such, several parameters need to be closely monitored in 2025, including the impact of US trade and tariff policies on import and export activities, the Fed’s interest rate decisions, the progress of public investment disbursement, exchange rate movements under pressure from global trade, market upgrade efforts, and the 2025 financial performance of listed companies.

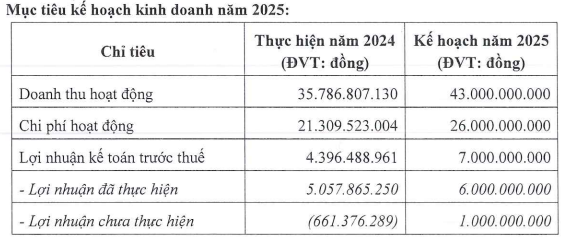

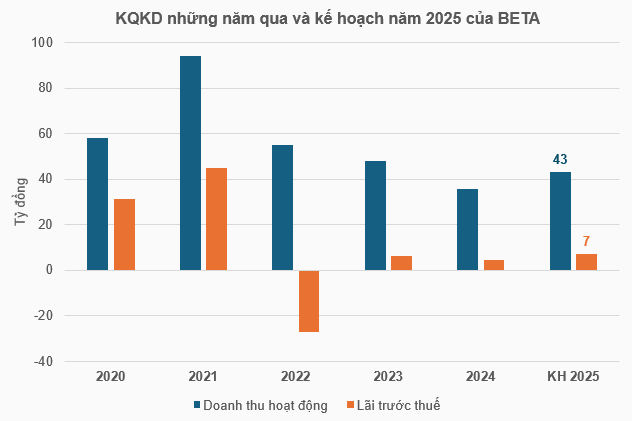

In 2025, BETA aims to achieve 43 billion VND in operating revenue and 7 billion VND in pre-tax profits, representing a 20% and 59% increase, respectively, compared to 2024. Of the pre-tax profit figure, 6 billion VND has already been realized, with the remaining 1 billion VND yet to be realized.

The company has outlined four solutions to achieve its goals: shifting the business model towards digitization, focusing on expanding brokerage services for individual customers, boosting investment banking activities, and enhancing governance, human resource quality, and workflow optimization.

Source: BETA Securities

|

Source: VietstockFinance

|

Regarding profit distribution plans, with an expected post-tax profit of 5.6 billion VND for 2025, the company will allocate 280 million VND to the reward and welfare fund. There was no mention of dividend payments. For 2024, the company allocated 250 million VND to the reward and welfare fund and paid a 5% cash dividend, totaling 20 billion VND.

Another resolution passed at the meeting was to transfer the entire remaining balance of the development investment fund, amounting to nearly 2.5 billion VND, to the realized post-tax profit account.

– 6:00 PM, June 21, 2025

The World Mobile Leadership Sells its Stake: Unveiling the Reasons Behind the Move.

Mr. Pham Van Trong, a Board member and the CEO of Bach Hoa Xanh – a subsidiary of Mobile World Investment Corporation (MWG), has recently sold 94,700 MWG shares, reducing his ownership to 0.21% of the charter capital. This move by Mr. Trong, a key stakeholder in the company, has sparked interest and raised questions among investors and industry observers alike.

“Cautious Outlook for Gemadept’s Second Half: Plans to Purchase 21 Million Treasury Shares”

Despite a promising financial performance in the first half of 2025, the leadership team at Gemadept Joint Stock Company (HOSE: GMD) remains cautious in their outlook for the remaining six months. They anticipate a period of heightened volatility and uncertainty, with potential risks of a global supply chain freeze.

“Weak Demand Thwarts VN-Index’s Uptrend”

The selling pressure witnessed a significant surge during today’s afternoon session, causing a rapid contraction in the market breadth and a continuous slide in the VN-Index, while turnover climbed nearly 28% from the morning session. In a fortunate last-minute twist, VHM and VIC witnessed an upward surge, but it wasn’t enough to push the index towards the reference point.