Kinh Bac Urban Development Corporation (stock code: KBC) has just announced the resolution of its Board of Directors regarding the handling of remaining shares from the private placement of the company’s shares.

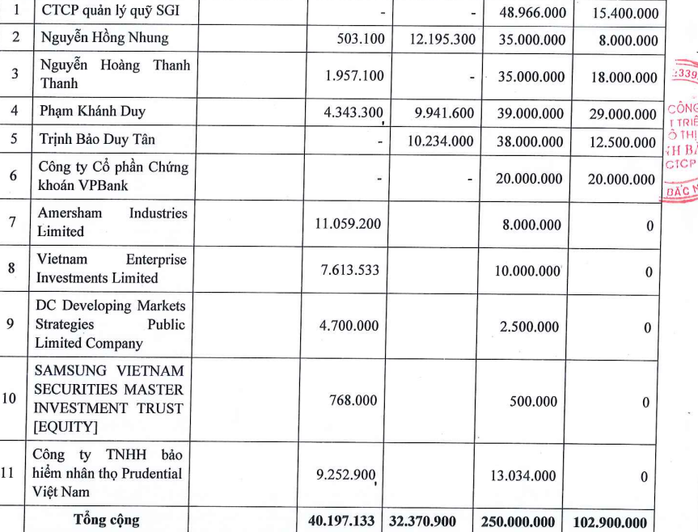

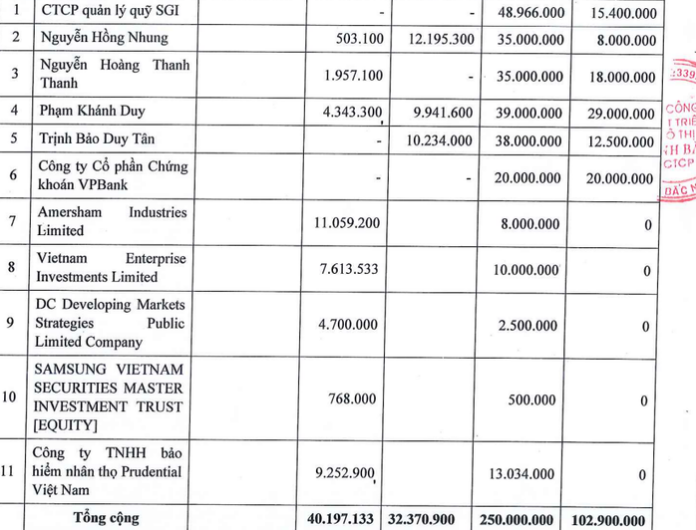

Specifically, out of the 11 pre-registered investors, only six investors submitted payments for the purchase of 102.9 million shares during the offering of 250 million shares by Kinh Bac. The total amount of money received for the share purchase exceeded VND 2,459 billion.

Notably, only VPBank Securities Joint Stock Company (VPBankS) purchased the intended 20 million shares, while the remaining five investors bought only a portion of their registered amount. The Dragon Capital and Prudential Vietnam-related groups did not purchase any shares, despite their initial registration.

For the remaining 147.1 million shares, KBC stated that they will continue the offering to domestic professional securities investors at a price of VND 23,900 per share.

VPBank Securities Joint Stock Company was the only investor to purchase the intended 20 million shares

The shares distributed in this continued offering will be restricted from transfer for one year from the date of the offering’s conclusion.

According to plans, if the private placement of 250 million shares is completed, Kinh Bac will increase its circulating shares from over 767.6 million to over 1.01 billion, equivalent to a charter capital of VND 10,176 billion.

In the market, KBC shares closed on June 24 at VND 25,800 per share, 7% higher than the offering price. Compared to the beginning of June, the shares have decreased by nearly 2%, but compared to the beginning of 2025, they have dropped by more than 5%.

In a separate move, Kinh Bac also sent a document to the Ho Chi Minh City Stock Exchange regarding the use of related party assets to secure credit obligations.

Accordingly, Kinh Bac’s Board of Directors approved the use of assets of Trang Cat Urban Development One-Member Limited Company to secure the company’s credit obligations at a financial institution. Specific details of the assets were not disclosed by the company.

Trang Cat is the investor of the Trang Cat Urban Area and Services project located in Trang Cat Ward, Hai An District, Hai Phong City, with an area of over 584.9 hectares. The products include 8,655 land-attached houses, 3,256 villas, 7,178 apartments, and 5,941 social houses.

This enterprise is a subsidiary of Kinh Bac. Currently, Mr. Dang Thanh Tam is the Chairman of the Board of Directors of Kinh Bac and also holds the position of General Director and legal representative of Trang Cat Urban Development.

Who Poured Nearly 4.2 Trillion VND in KBC’s Capital Increase?

The Urban Development and Investment Corporation (UDIC) successfully offloaded over 174.1 million shares, equivalent to nearly 70% of the initial offering, to nine institutional and professional individual investors across two tranches. This resulted in a substantial increase in charter capital, surging to over VND 9.4 trillion.

“Accelerating the International Finance Center’s Progress.”

“Ho Chi Minh City and Da Nang are expediting the development of international financial centers. Both cities are racing to establish themselves as premier financial hubs, attracting domestic and foreign investments and fostering economic growth.”

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)