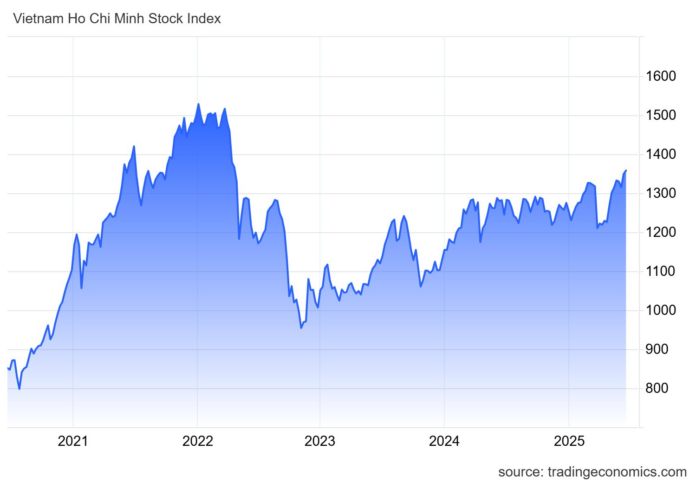

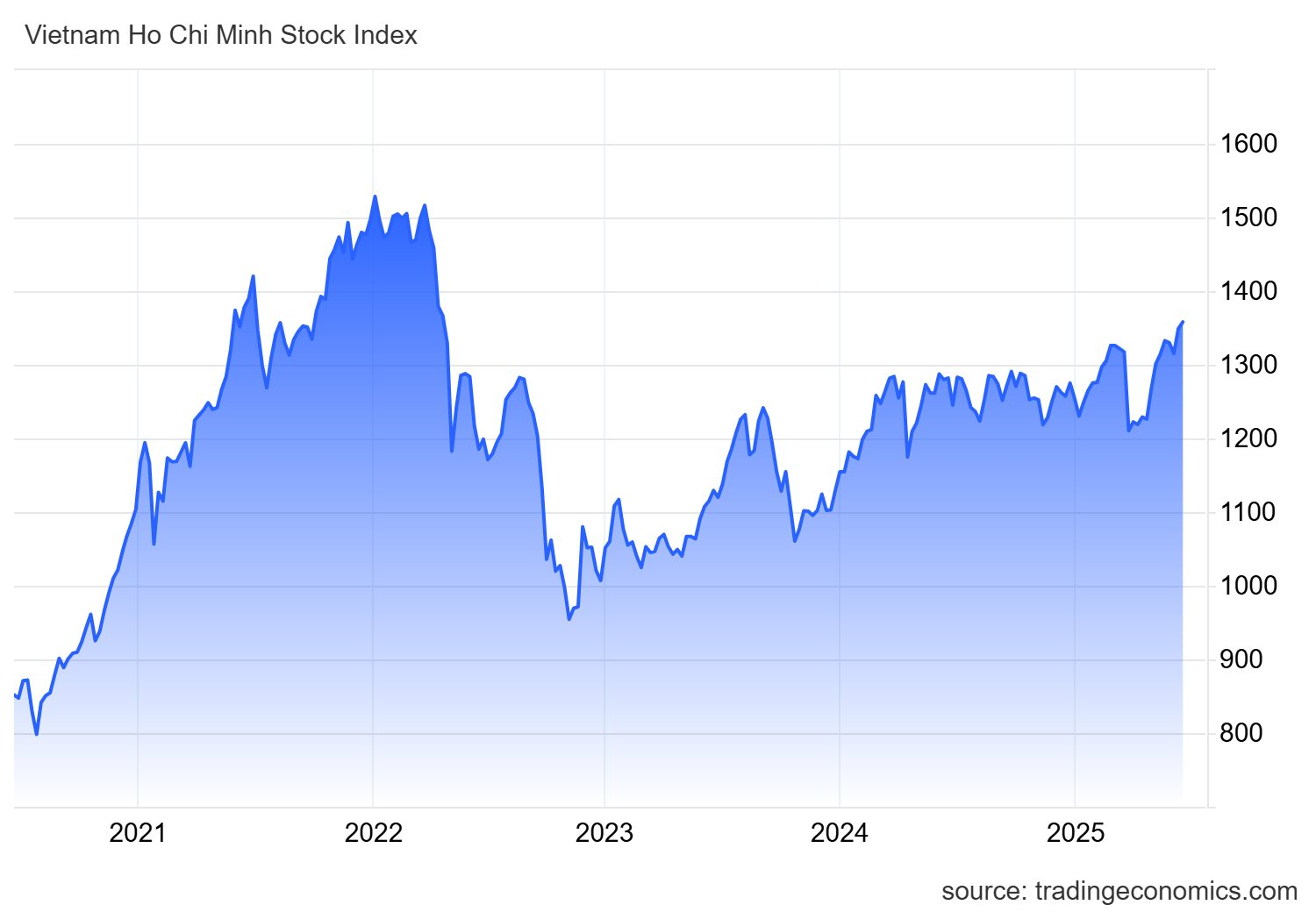

The Vietnamese stock market just witnessed a vibrant trading session, allaying concerns over tensions in the Middle East. The VN-Index closed at 1,358.18 on June 23, marking a notable surge of 8.83 points and reaching its highest level since the beginning of this year. Notably, this also surpasses the peak witnessed over three years ago, specifically more than 1,100 days ago (since the session on May 5, 2022).

Large-cap stocks, particularly those of the Vingroup and energy sectors, served as the primary catalysts for this market rally. Specifically, the VIC stock, which soared to the ceiling price, contributed over four points to the VN-Index’s ascent, closely followed by VHM, which added approximately two points to the index’s gains.

Behind this impressive market recovery lie several positive macroeconomic indicators:

Firstly, domestic investor sentiment has witnessed a marked improvement, largely due to the government’s pro-growth policy stance, bolstering expectations of robust financial performance from listed companies this year. Economic stimulus measures, encompassing enhanced public spending and support for the private sector as outlined in Resolution 68-NQ/TW 2025, have injected significant momentum into the stock market.

Secondly, the Vietnamese stock market is deemed attractive in terms of valuation when compared to other regional markets. With the VN-Index’s P/E ratio hovering around 15-16 times, significantly lower than that of India or South Korea, Vietnam remains an enticing prospect for long-term investors.

Regarding the tariff situation, Vietnam has been proactive in its response, striving to mitigate the impact of retaliatory tariffs. Initial concerns about high tariffs have been assuaged as negotiations progress with a strong consensus on principles, approaches, orientations, and negotiation plans, paving the way for subsequent productive discussions.

As the August 7 deadline for the postponement of retaliatory tariffs draws nearer, numerous global experts and organizations predict that the US will refrain from reinstating peak tariffs.

Sharing this perspective, Mr. Nguyen Trong Dinh Tam, Deputy Director of Analysis at Asean Securities JSC (Aseansc), forecasts that the US will adjust and reduce the retaliatory tariff rate from the previously announced 46% for Vietnam, given the country’s ongoing efforts. These include commitments to increase purchases of American goods, ongoing negotiations between the two nations, and Vietnam’s inherent advantages.

Nonetheless, various risk factors persist, especially the unpredictable conflict in the Middle East, which could potentially escalate into a regional conflict. Mr. Dinh Quang Hinh, Head of Macroeconomics and Market Strategy at VNDirect, recommends that investors maintain a balanced portfolio and refrain from significantly increasing their equity exposure.

Looking ahead to this week, Mr. Hinh anticipates the market to continue testing supply strength around the 1,350-point peak. Should the VN-Index firmly hold above this level, the short-term uptrend will be reinforced, paving the way for potential advances towards the 1,380-1,400-point zone.

“Risk management remains key, even as the market conveys more positive signals,” Mr. Hinh asserted. “Liquid stocks with stable business prospects and limited exposure to geopolitical tensions, such as those in retail, technology, and real estate, are preferable holdings during this phase.”

The New Oil Boom: How Middle Eastern Turmoil is Sending Shockwaves Through the Energy Sector

The energy sector stocks, including prominent players such as GAS, PLX, PVS, PVD, and BSR, witnessed a remarkable surge, even reaching ceiling limits, as crude oil prices skyrocketed, creating a ripple effect across the industry.

Expert Insights: Equities May Witness a Correction; Seize Opportunities in Cash-Attractive Stocks with Positive Outlook

“Liquidity and stability are key in the current market climate, and astute investors are turning their attention to stocks in the retail, technology, and real estate sectors. These sectors offer a reprieve from the geo-political tensions that are impacting other industries. With their robust business models and steady growth prospects, these stocks are a safe haven for those seeking to weather the storm.”

The Foreign Buying Frenzy: Institutional Investors Pour Over $30 Million into Vietnam’s Top 4 Blue-chip Stocks

The Ho Chi Minh City stock market faced a challenging day with the highest sell-off across the board, amounting to a substantial 115 billion VND.