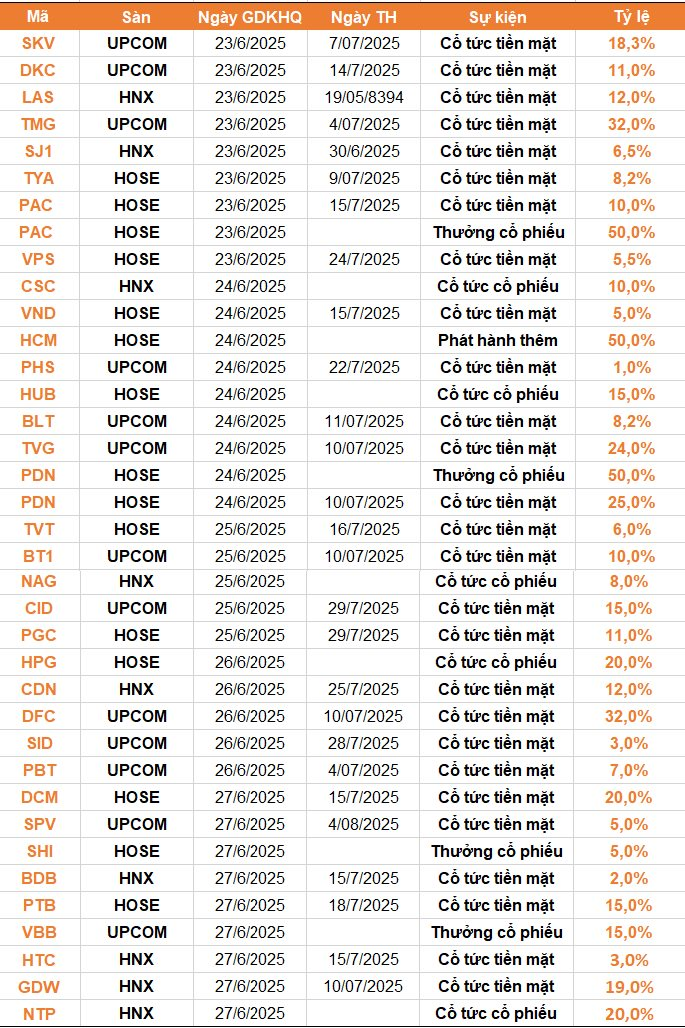

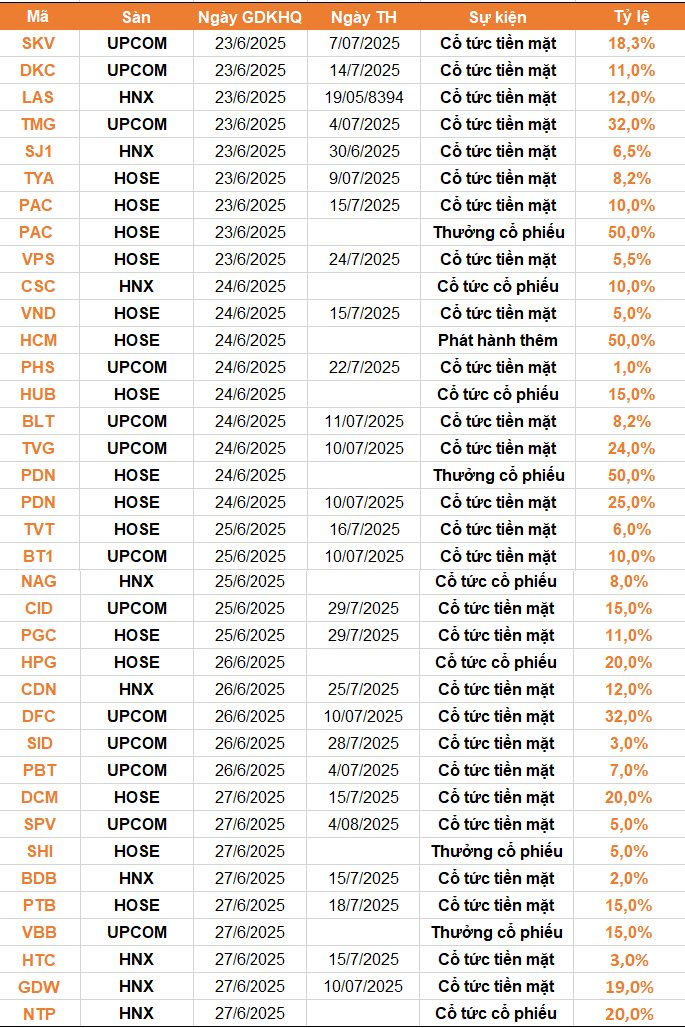

According to statistics, 35 companies announced dividend lock-in during the week of June 23-27, with 25 companies paying cash dividends. The highest rate was 32%, and the lowest was 1%.

In addition, five companies paid stock dividends, one company issued additional shares, two companies offered bonus shares, and two companies paid mixed dividends.

On June 24,

Khanh Hoa Bird’s Nest Beverage Joint Stock Company (code: SKV)

will finalize the list of shareholders to implement the payment of 2024 financial year dividends in cash at a rate of 18.3%, equivalent to VND 1,830 per share). The payment is expected to be made from July 7, 2025. With 23 million shares circulating, SKV will need to spend VND 42 billion to pay its shareholders.

Thai Nguyen Non-Ferrous Metal Joint Stock Company – Vimico (code: TMG)

announced that June 23 is the ex-dividend date for receiving 2024 dividends in cash. The expected payment date is from July 4.

With a dividend ratio of 32% (equivalent to VND 3,200/share) and 18 million circulating shares, TMG will spend approximately VND 58 billion to pay dividends to its shareholders.

Southern Battery Joint Stock Company (Pinaco, code: PAC)

announced that June 23 is the ex-dividend date for receiving the second phase of 2024 cash dividends and bonus shares to increase capital from owner’s equity.

Specifically, for cash dividends, Pinaco will pay a rate of 10%, equivalent to VND 1,000/share. The total expected expenditure is approximately VND 46.5 billion, with a payment date of July 15. Major shareholders will directly benefit, including the Vietnam Chemical Corporation (Vinachem) – the parent company holding 51.43% of PAC’s capital, and The Furukawa Battery Co., Ltd., owning 10.54%.

Simultaneously, the Company will issue more than 23.2 million bonus shares in a ratio of 2:1 (holding 2 shares will receive 1 new share), equivalent to a 50% issuance ratio. The capital source for this issuance will come from the investment development fund recorded in the audited financial statements for 2024. After this issuance, Pinaco’s charter capital is expected to increase to more than VND 697 billion.

Hoa Phat Group Joint Stock Company (code: HPG)

announced that June 27 will be the record date for finalizing the list of shareholders to receive 2024 dividends in shares, with a ratio of 20% (shareholders owning 5 shares will receive 1 new share). June 26 is the ex-dividend date.

With nearly 6.4 billion circulating shares, Hoa Phat is expected to issue an additional 1.28 billion new shares, equivalent to a value of VND 12,793 billion based on par value. The source of this issuance will come from undistributed post-tax profits in the audited financial statements for 2024.

After this issuance, Hoa Phat’s charter capital will increase to VND 76,755 billion, the largest among non-financial enterprises on the stock exchange. This number is even lower than only a few top banks.

On June 30,

Ca Mau Fertilizer Joint Stock Company (Mardfert – code: DCM)

will finalize the list of shareholders to implement the 2024 dividend rights with a ratio of 20% in cash (1 share receives VND 2,000). With more than 529 million circulating shares, Ca Mau Fertilizer plans to spend nearly VND 1,059 billion for this dividend payment. The ex-dividend date is June 27, and the expected payment date is July 15.

The Vietnam National Energy Industry Group (PVN) is the parent company holding more than 400 million DCM shares (a stake of 75.56%) and will receive more than VND 800 billion. Another major shareholder is the Petroleum Finance Management Fund, owning 8.52% of the shares and expected to receive over VND 90 billion.

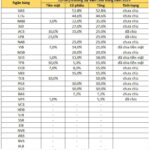

“MIC Announces 10% Dividend Payout for 2024”

Military Insurance Company (MIC) is proud to announce its planned dividend distribution for the year 2024. The company intends to share its success with its valued shareholders through a dividend payout comprising a healthy mix of cash and stock. This planned dividend distribution strategy includes a 5% cash dividend and a 5% stock dividend, with the payout expected to take place in the third quarter of 2025. This approach showcases MIC’s commitment to rewarding investors while also strengthening its capital structure for continued growth and stability.

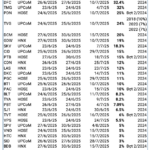

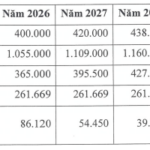

“Noibai Cargo Services Aims High: Targets 2.14 Trillion VND in Profit Before Tax Over Next 5 Years”

In 2025, Noi Bai Cargo Services Joint Stock Company (HOSE: NCT) aims to handle a cargo volume of 382,000 tons, generating approximately VND 1 trillion in revenue, a remarkable surge of over 9% from the previous year. The company has set its sights on a net profit target of VND 271 billion, reflecting a 2% increase.

“Viettel’s Subsidiary Offers Lucrative 15% Cash Dividend to Shareholders”

Viettel Consulting and Services Joint Stock Company (UPCoM: VTK), a subsidiary of the Military – Telecom Industry Corporation (Viettel), announces a cash dividend for 2024 with a ratio of 15% (equivalent to VND 1,500/share). The ex-dividend date is July 3rd, and the expected payment date is July 15th.