Real Estate Credit is Making a Comeback

One of the key factors in bringing capital back to the real estate market is the accelerated progress in legal completion. Photo: Le Vu |

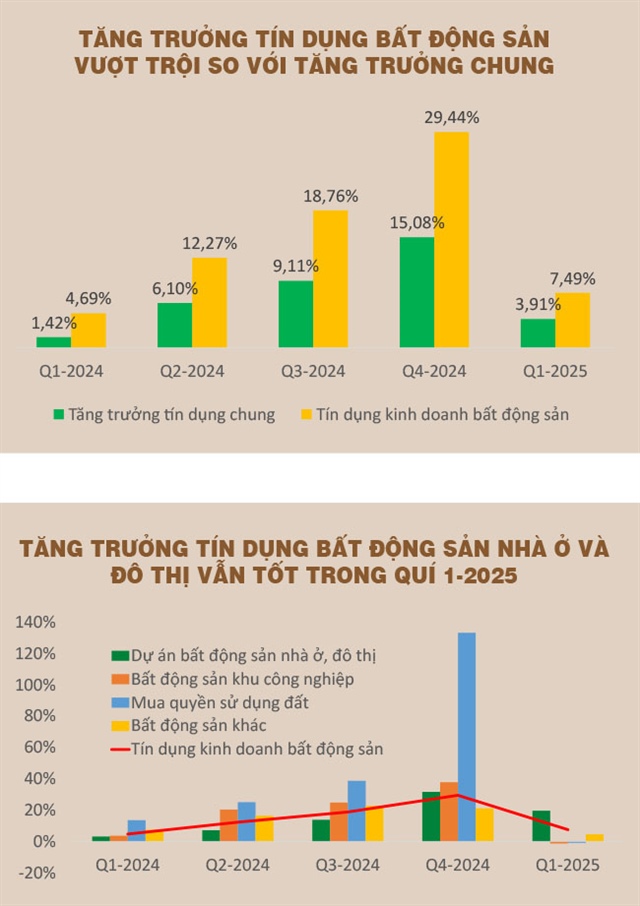

Credit growth in the first five months of 2025 is estimated at approximately 6.7%, nearly double that of the same period last year. According to data from the Ministry of Construction and the author’s calculations, real estate credit growth in Q1-2025 stood at 7.49%, significantly higher than the overall market growth of 3.91%. This positive momentum reflects simultaneous improvements in both supply and demand, as lending rates remain at low levels.

A crucial factor in attracting capital back to the real estate sector is the accelerated progress in legal completion. Several important draft laws, including the Land Law (amended), the Real Estate Business Law, and the Housing Law, have been passed by the National Assembly to create a synchronized legal framework. These laws provide clear guidelines for enterprises to determine land values, develop land funds, and expedite project implementation.

In 2024, credit for the real estate business sector increased by 29.4%, far surpassing the overall credit growth of 15.08%. Notably, credit for land use rights purchases surged by 133%, while credit for housing and urban development increased by 31.6%. In Q1-2025, credit for housing and urban development remained a bright spot, rising by 19.6% compared to the end of 2024, outperforming the industry average of 7.49% and the overall market growth of 3.91%. Despite delays in guiding documents, the policy orientation has somewhat bolstered investors’ confidence in restarting stalled projects.

|

The domestic market also needs to be vigilant about potential shocks that could change the lending rate and credit conditions. This presents a balancing act between stimulating growth and ensuring system safety—a challenge to be closely monitored in the coming period. |

In reality, lending rates for home purchases have significantly decreased compared to last year, now ranging between 8-10% annually. Some banks even offer short-term promotional packages with rates as low as 5-6% in the first two years, making it easier for first-time homebuyers to access capital and stimulating market demand. Additionally, significant progress has been made in social housing policies, encouraging more enterprises to enter this segment. Providing affordable housing not only meets genuine demands but also boosts credit due to better capital absorption from the market.

Moreover, 2025 marks the year of accelerated public investment, with numerous key infrastructure projects underway and expected to be completed. This provides a significant boost to the real estate market in satellite areas, as many investors seize the opportunity to initiate new projects, anticipating the wave of shifting residential and investment demands.

An Additional Boost from State-Owned Enterprises

Following the positive credit signals, another significant change has been approved by the National Assembly regarding the Law on Management and Use of State Capital Invested in Production and Business (amended). The new law expands the scope for state-owned enterprises (SOEs) to participate in real estate investment and business, provided it aligns with their primary industries or is included in their development strategies approved by authorized agencies. This marks a significant shift from previous strict restrictions on SOEs’ real estate investment activities.

|

The relaxation of legal constraints, increased autonomy for state capital owners, and evaluation of investment efficiency based on overall business results empower SOEs to proactively and efficiently utilize land and public assets. Their participation also expands the supply force in the market, enhancing competition and improving the diversity of products.

In the long run, if large SOEs leverage their advantages in land resources and financial capabilities to develop social housing, satellite cities, or industrial real estate, the market will benefit from both scale and quality improvements.

Positive Outlook but with Proper Guidance

The outlook for the real estate market in the second half of 2025 is relatively positive, supported by several fundamental factors. Low-interest rates, improved legal frameworks, and rebounding housing demands after a prolonged suppression are key drivers of the market’s recovery.

However, this recovery also brings some warnings. Housing prices in many areas remain significantly higher than the average income of urban residents, especially for first-time homebuyers. If not properly controlled, the gap between prices and affordability can lead to a potential supply-demand imbalance in the medium term. Therefore, the market structure needs adjustment to focus on genuine demands, offering reasonable prices and products that match buyers’ payment capabilities.

Moreover, amidst the volatile global economic landscape, with prolonged inflation in major economies, rapid shifts in monetary policies, and geopolitical tensions, the domestic market must remain cautious about potential shocks that could change lending rates and credit conditions. This presents a delicate balancing act between growth stimulation and systemic safety—a challenge that warrants close monitoring in the upcoming period.

Lao Trinh

– 19:00 21/06/2025

A New Era of Social Housing: From Pilot to Breakthrough

The legislature has just passed Resolution 201/2025, ushering in a new era of specialized policies for social housing development over the next five years. This landmark decision is expected to address the housing needs of low-income earners and invigorate investment in affordable housing, a segment that has long been stagnant due to legal hurdles.

“Refining the Legal Framework for Sole Proprietorships: Encouraging Household Businesses to Embrace the Benefits of Incorporation.”

“The President of the National Assembly has requested that the Minister of Finance, the Government, and related ministries and branches propose amendments to the Law on Supporting Small and Medium-sized Enterprises. They are also tasked with reviewing and completing the legal framework for business registration, encouraging household businesses to transform into enterprises, and providing specific guidance on abolishing the lump-sum tax payment for household businesses.”

“A Plea to Exclude Social Housing from Audit Scrutiny to Relieve Pressure on Businesses”

“HoREA, a reputable organization, has proposed an interesting suggestion. They recommend that the State Audit should refrain from auditing social housing projects (NƠXH) undertaken by enterprises that voluntarily acquired land use rights or possess non-public land. This proposal aims to alleviate potential pressure on these enterprises, which could ultimately benefit all involved parties.”

The Ultimate Opportunity: Exclusive Release of 115 Apartments in Hanoi Starting at a Mere 12.2 Million VND per Square Meter

The 115 social housing units at Ecohome 3 and CT2A Tower, part of the prestigious Thach Ban residential area, are now available for sale after a successful five-year rental period. With prices starting from just 12.2 million VND per square meter, this is an incredible opportunity to own a piece of this sought-after development.