Vietnam Airlines’ 2025 Annual General Meeting was held on the morning of June 25

|

For 2025, the national carrier aims for consolidated revenue of nearly VND 117,000 billion, up 3.5% year-on-year. Meanwhile, pre-tax profit is expected to decrease to VND 5,600 billion. The company attributes the projected profit decline compared to the previous year mainly to the absence of other income from debt write-offs.

This plan is based on estimates of transporting 25.4 million passengers and 346,000 tons of cargo, an increase of 11.6% and 11.5%, respectively, compared to 2024.

In 2025, Vietnam Airlines aims to expand its international network with six new routes. The new routes include Hanoi – Milan (Italy), Ho Chi Minh City – Beijing (China), Nha Trang – Busan (South Korea), Ho Chi Minh City – Bali (Indonesia), Phu Quoc – Taiwan, and Phu Quoc – Seoul (South Korea).

At the same time, the airline will resume previously suspended international routes such as Hanoi – Moscow, Hanoi – Taiwan, Ho Chi Minh City – Hong Kong, Danang – Osaka, Danang – Bangkok, and Hanoi – Kuala Lumpur.

In the domestic market, Vietnam Airlines aims to maintain its market share above 42%. The number of seat kilometers in the domestic market is expected to increase by 9.6% year-on-year, mainly due to optimizing flight frequencies and protecting market share for core products in the domestic network.

Estimated profit of VND 1,600 billion in Q2

At the meeting, Vietnam Airlines’ leaders shared that in Q2 2025, the airline continued to outperform most key targets. The company estimates air transport revenue at about VND 22,100 billion, surpassing the plan by 5.9%.

The pre-tax profit of Vietnam Airlines’ parent company in Q2 2025 is estimated at VND 1,000 billion, while the consolidated pre-tax profit reaches approximately VND 1,600 billion.

For the first six months of 2025, the parent company estimates a pre-tax profit of over VND 4,000 billion, while the consolidated pre-tax profit surpasses VND 5,000 billion. The management attributes this positive result mainly to the recovery of the international aviation market, with international routes contributing 65% of the revenue.

Receiving new aircraft from 2030

One of Vietnam Airlines’ critical strategic decisions is the project to invest in 50 modern narrow-body aircraft worth over VND 92,000 billion, expected to be implemented from 2030 to 2035. The project aims to improve fuel efficiency, reduce emissions, and enhance competitiveness.

According to Chairman of the Board of Directors, Dang Ngoc Hoa, the airline has signed a preliminary contract with aircraft suppliers. The plan is to receive 14 aircraft from 2030, followed by the remaining ones in subsequent years.

Regarding wide-body aircraft, Vietnam Airlines currently operates mainly Airbus A350 and Boeing 787. The company is actively seeking opportunities to lease and purchase additional aircraft before 2030 to support its international expansion. By 2035, the wide-body fleet size is expected to reach approximately 50 aircraft, including 20 replacements and 30 for expansion.

In the upcoming period, Vietnam Airlines will continue to invest significantly in cargo transportation. The company is planning to build logistics centers at key airports such as Noi Bai and Long Thanh.

Regarding capital sources, the airline has issued additional shares to increase its charter capital to a maximum of VND 22,000 billion, divided into two phases. Phase 1, with a scale of VND 9,000 billion, is expected to be completed in 2025. Phase 2 will be implemented from 2026. The additional capital will help improve the company’s financial capacity and reduce state ownership.

– 16:21 25/06/2025

“Ricons Postpones IPO Again, Eyes Expansion in Infrastructure Construction”

The leadership team at the Construction Investment Joint Stock Company, Ricons, expresses optimism about growth prospects and opportunities arising from significant infrastructure projects. However, they remain cautious about the real estate industry’s liquidity situation. The contractor has also deferred its IPO plans until market conditions improve.

“CEO Le Van Quang: Minh Phu Could Profit at Least 100 Billion VND per Month Starting From June”

Despite a modest first-quarter profit of over VND 17 billion, Le Van Quang, CEO of Minh Phu Seafood Corporation (UPCoM: MPC), remains confident in achieving an ambitious target of VND 997 billion in after-tax profits for the year.

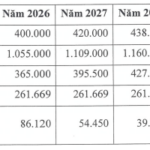

“Noibai Cargo Services Aims High: Targets 2.14 Trillion VND in Profit Before Tax Over Next 5 Years”

In 2025, Noi Bai Cargo Services Joint Stock Company (HOSE: NCT) aims to handle a cargo volume of 382,000 tons, generating approximately VND 1 trillion in revenue, a remarkable surge of over 9% from the previous year. The company has set its sights on a net profit target of VND 271 billion, reflecting a 2% increase.

Profits Surge for MSN in Q2, Mining Sector Turns a Profit

The second quarter of 2025 saw a notable transformation in the non-core mining segment of the Masan Group (HOSE: MSN). Amidst global trade volatility, this segment, which was once a financial burden, has turned a new leaf. With a surge in output prices, the mining division has successfully averted losses, charting a positive course for the company’s financial trajectory.

“Viettel’s Subsidiary Offers Lucrative 15% Cash Dividend to Shareholders”

Viettel Consulting and Services Joint Stock Company (UPCoM: VTK), a subsidiary of the Military – Telecom Industry Corporation (Viettel), announces a cash dividend for 2024 with a ratio of 15% (equivalent to VND 1,500/share). The ex-dividend date is July 3rd, and the expected payment date is July 15th.