VN-Index Hits 3-Year High, Boosting Investor Confidence

Vietnam’s stock market wrapped up a vibrant trading week with a strong upward momentum, pushing the VN-Index closer to the 1,350-point mark, the highest level in over three years.

Compared to the previous week, the HoSE representative index surged by approximately 2.6%, driven by the breakthrough performance of several leading stock groups, including oil and gas, banking, securities, and steel. The market’s robust recovery occurred amidst improved investor sentiment as the government prioritized growth-stimulating policies and interbank interest rates continued to plummet, facilitating the flow of capital into financial investment channels.

Market liquidity remained high, indicating a resurgence in buying activity following a period of adjustment. Individual investors have become more active on forums and social media networks, actively discussing potential stocks and short-term investment trends.

Some investors even expressed regret for not seizing the buying opportunity during the market correction in the previous two weeks, especially in sectors considered promising for the latter half of 2025.

The current upward trajectory bolsters expectations for an upcoming season of positive financial reports, as many listed companies foresee improved profits due to reduced capital costs and recovering demand.

However, some securities companies hold a less optimistic outlook. SHS Securities believes that the short-term trend of the VN-Index will maintain its upward trajectory above the support level of 1,330 points, corresponding to the 20-session average price, with resistance around 1,350 points. But short-term selling pressure will increase as the market approaches the old peak prices and is in the final stages of trade negotiations, temporarily postponing tariff imposition.

Nguyen Duc Khang, Head of Analysis at Pinetree Securities, provided further insights, stating that while the VN-Index witnessed a substantial weekly gain of over 30 points, the performance lacked conviction. The dominant trend remained the rotation of support among sectors and stocks, lacking clear consensus. Market liquidity continuously rotated among stock groups, but each upward movement only focused on a few specific stocks rather than providing uniform momentum for the entire sector.

VN-Index ends the week with a strong surge, nearing the 1,350-point mark

“Investor caution and short-term trading strategies prevail in the absence of supportive news. As the index struggles to break through the old peak and liquidity shows evident signs of prudence, the VN-Index is likely to undergo a corrective phase next week. Investors are awaiting the outcome of tariff negotiations between Vietnam and the US, expected in early July, as a pivotal factor in determining the subsequent trend,” said Khang.

Which Sector Stocks to Buy?

From a different perspective, Dinh Quang Hinh, Head of Macroeconomics and Market Strategy at VNDIRECT Securities, opined that if the VN-Index sustains its position above the 1,350-point level next week, the short-term upward trend will be reinforced, paving the way for aspirations to conquer higher levels at 1,380 – 1,400 points. However, amidst prevailing risk factors, investors should maintain a balanced portfolio, refraining from excessive concentration.

VN-Index reaches the highest level in over three years

“Risk management remains key, even as the market conveys more positive signals. Stocks with strong liquidity and stable business prospects, less affected by geopolitical tensions, such as retail, technology, and real estate, could be prioritized for holding during this phase,” said Hinh.

SHS Securities also recommended that stock purchases should be based on updates and assessments of companies’ fundamentals, valuations, second-quarter financial results for 2025, and growth prospects for the remaining six months. They advised prioritizing holdings, awaiting evaluations, and updates on fundamentals, with investment targets focused on stocks with robust fundamentals, leading industries in strategic sectors, and exceptional growth within the economy.

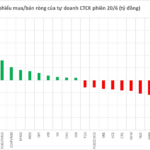

The Foreign Sell-Off Continues: Another Day of Heavy Selling by Foreign Investors, with a Focus on Offloading Securities Stocks

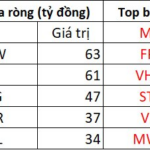

The market witnessed a contrasting trend today, with VIC, HPG, and GEX leading the gains. These stocks witnessed strong net buying, with respective values of VND 68 billion, 65 billion, and 60 billion.

Seizing the Moment: Investors Scoop Up Nearly VND 700 Billion as VN-Index Dips

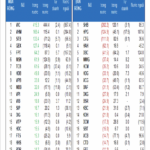

Individual investors posted net purchases of VND 672.7 billion, including VND 416.0 billion in net matched orders. In terms of matched orders alone, they net bought in 8 out of 18 sectors, mainly in the Real Estate sector.