The US dollar is on track to complete its worst first half-year performance since 1986. One might argue that the selling of the dollar is happening across all entities, everywhere, and in all assets denominated in this currency.

In some respects, that assessment is correct, according to a piece by Reuters columnist Jamie McGeever. Investors globally are reducing their holdings of dollar-denominated assets, pushing the Dollar Index – a measure of the greenback’s value against a basket of six other major currencies – to its lowest level in three and a half years recently. The index has fallen by 9.6% since the beginning of the year.

However, McGeever notes that in some regions, the selling pressure has been more intense.

Not surprisingly, non-US investors have been the biggest sellers of the dollar, with selling pressure related to US stocks concentrated in Europe, and bond-selling mainly coming from Asia.

According to Bank of America’s foreign exchange strategy team, Europe’s “real money” investors – including institutional investors such as pension funds and insurance companies – have been the main drivers of the dollar sell-off in the second quarter. This group has cut its holdings of dollar-denominated assets to their lowest level since 2022 in just a few weeks.

But the story may not be that simple. While European investors’ increased risk aversion to dollar assets has attracted much attention recently, research suggests that most of the average daily decline in the dollar over the past few months occurred during Asian market trading hours, indicating that Asian investors holding US bonds may also be increasing their risk aversion to dollar positions.

So, where is the greater selling pressure on the dollar coming from: geographic diversification in equity portfolios or bond selling? And where is the dollar selling mainly coming from: Europe or Asia?

At first glance, one might blame the stock market for the dollar selling, as foreign investors hold a larger amount of US stocks than US bonds in nominal terms. But in percentage terms, the footprint of foreign investors in the US bond market is larger than in the stock market.

According to the Bank for International Settlements (BIS), foreign investors own more than $31 trillion of US securities, including $17.6 trillion in stocks and $13.6 trillion in bonds. This accounts for about 18% of the total US stock market, compared with 21% of the US agency and corporate bond market, and a third of the US Treasury bond market.

Analysts at UBS estimate that investors from the euro area account for 25% of the total US stocks held by foreign investors, after net purchases of US stocks in recent years. They argue that this makes the dollar particularly vulnerable if US stocks continue to underperform compared to European and Asian markets.

Delving deeper into the numbers, UBS analysts find that the total net unhedged USD asset holdings of foreign investors are $23.5 trillion. Of this, investors from G10 countries hold $13.4 trillion, including $9.3 trillion in stocks and $4.1 trillion in bonds.

These are very large numbers, and it would not take a large shift to trigger significant cross-border capital flows.

UBS estimates that a 5% reduction in G10 investors’ dollar asset positions would be equivalent to around $670 billion in asset sales. As most G10 countries are in Europe, most of this selling would come from there.

So far, European investors have mainly dumped US stocks, but it’s worth noting that they have also significantly increased their exposure to US bonds in the past decade, especially during 2014-2022 when the European Central Bank’s key interest rates were negative.

According to UBS estimates, investors from the euro area have bought $3.4 trillion in foreign bonds since 2014. So, even a modest rebalancing away from US bonds could have a significant impact on prices.

However, Asian investors seem to have more power in the US bond market, as they own about a third of the US Treasury and agency bonds held by foreigners. That number could be much higher because a large amount of US bonds are held by institutions based in the euro area, the Caribbean, and the UK, which are actually custodians for Asian investors, especially China.

Up to now, there hasn’t been a massive sell-off in US assets, and it’s unlikely that there will be one. But one notable point is that US assets are increasingly being held by private sector investors – a group that has replaced central banks as the main buyers in the US asset market in recent years.

The private sector is typically more price-sensitive than the official sector. This means that these positions may be more prone to selling than in the past, especially if the idea that American exceptionalism is waning takes hold in investors’ minds.

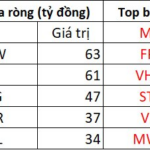

The Foreign Buying Frenzy: Institutional Investors Pour Over $30 Million into Vietnam’s Top 4 Blue-chip Stocks

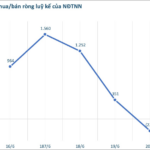

The Ho Chi Minh City stock market faced a challenging day with the highest sell-off across the board, amounting to a substantial 115 billion VND.

Foreign Sell-Off Surges Over $37 Million on Futures Expiry, Dumping Blue-Chip Stocks

The sell-off continued into the afternoon, with FPT stocks witnessing a massive foreign sell-off, amounting to a staggering 389 billion VND.