Paternity Leave Enhanced: A Step Towards Equality

Male employees are now entitled to 60 days of paid leave to care for their wives and newborns.

Prior to July 1st, 2025, according to section d, clause 2, article 34 of the 2014 Social Insurance Law, the duration of paternity leave was limited to the first 30 days following the birth.

However, as of July 1st, 2025, this period has been extended to 60 days, starting from the date of the wife’s delivery. During this period, male employees who participate in compulsory social insurance are entitled to the following leave entitlements:

– 5 working days off when their wife gives birth naturally.

– 7 working days off when the wife undergoes a cesarean section or delivers prematurely before 32 weeks.

– 10 working days off for twins. For triplets or more, the father is entitled to an additional 3 days off for each additional child, starting from the third child.

– 14 working days off if the wife has a cesarean section with twins. In the case of triplets or more requiring surgery, the father is granted an extra 3 days off for each additional child.

Male employees can now take leave to care for their wives and newborns during the crucial first 60 days. (Illustration – Source: VNA)

In cases where the employee takes multiple periods of leave, the final leave must commence within the first 60 days, and the total duration of leave must not exceed the stipulated timeframe.

As of July 1st, 2025, the law permits male employees to take leave to care for their wives and newborns during the initial 60 days, as opposed to the previous limit of 30 days. However, the total leave duration must not surpass the timeframe specified in Article 53 of the 2024 Social Insurance Law.

Additionally, fathers can request additional time off beyond this period, but it will not be considered as paid paternity leave. They may utilize their annual leave allowance or take unpaid leave for this purpose.

Voluntary Social Insurance Participants: Equal Benefits for All

The 2024 Social Insurance Law, passed by the National Assembly on July 29th, 2024, introduced a significant change by extending maternity benefits to all participants in the voluntary social insurance program.

Article 94 of the Law No. 41/2024/QH15 stipulates that male employees with pregnant wives are also eligible for maternity benefits. Consequently, even if the wife is not employed or enrolled in social insurance, as long as the husband participates in the voluntary social insurance program, the family will receive maternity benefits. The benefit amount stands at 2 million VND per child, as outlined in Article 95 of the 2024 Social Insurance Law.

According to Article 94 of the 2024 Law, the eligibility criteria for receiving maternity benefits are as follows:

Firstly, individuals with at least 6 months of voluntary social insurance contributions or a combination of compulsory and voluntary social insurance contributions within the 12 months preceding childbirth are entitled to benefits if they meet one of the following conditions:

– The female employee gives birth.

– The male employee’s wife gives birth.

If both spouses are insured: Only one spouse is entitled to receive maternity benefits.

If both spouses qualify for maternity benefits under both voluntary and compulsory social insurance schemes: They will only receive benefits under the compulsory social insurance scheme.

Secondly, if the insured female employee passes away after giving birth, the child’s father or caregiver is entitled to receive maternity benefits.

Thirdly, if the wife meets the conditions for maternity benefits under the compulsory social insurance scheme, and the husband qualifies for benefits under the voluntary scheme, the wife will receive benefits under the compulsory scheme, while the husband will receive benefits under the voluntary scheme.

Lastly, if the husband meets the conditions for maternity benefits under the compulsory scheme, and the wife qualifies under the voluntary scheme, the husband will receive benefits under the compulsory scheme, and the wife will receive benefits under the voluntary scheme.

Inclusion and Support for Miscarriages

According to Article 52 of the 2024 Social Insurance Law, female employees who experience the termination of their pregnancy, including miscarriage, abortion, stillbirth, intrauterine fetal death during labor, or ectopic pregnancy, as indicated by a medical professional from an authorized healthcare facility, are entitled to leave and maternity benefits.

The maximum leave duration is determined based on the gestational age as follows:

– Up to 10 days: Pregnancy under 5 weeks.

– Up to 20 days: Pregnancy between 5 and 12 weeks.

– Up to 40 days: Pregnancy between 13 and 21 weeks.

– 120 days: Pregnancy of 22 weeks or more.

Before July 1st, only cases of miscarriage, abortion, or ectopic pregnancy with medical indications were eligible for maternity benefits. However, under the new law, all cases requiring medical intervention to terminate the pregnancy are covered, regardless of the underlying cause.

Unconditional Support for Bereaved Mothers

As per Clause 2, Article 52 of the 2024 Social Insurance Law, female employees with a pregnancy of at least 22 weeks who meet the conditions specified in Clauses 2, 3, or 5 of Article 50 of this Law, and experience a miscarriage, abortion, stillbirth, or intrauterine fetal death during labor, are entitled to the same leave and benefits as those who give birth.

This means that the mother is still entitled to the full 6-month leave, and the father is eligible for paternity leave, regardless of the tragic outcome. Both parents will receive the standard maternity and paternity benefits.

Before July 1st, 2025, according to Clause 3, Article 34 of the 2014 Social Insurance Law, if the child passed away within the first two months after birth, the mother was granted 4 months of leave from the date of birth. If the child passed away after the age of 2 months, the mother was entitled to 2 months of leave from the date of the child’s death, but the total leave duration could not exceed 6 months.

Furthermore, according to Clause 4, Article 53 of the new Law, in cases of multiple births, if one or more fetuses are stillborn or die during labor, the leave duration and one-time allowance upon childbirth are calculated based on the total number of fetuses, including both living and deceased children.

Enhanced Benefits for a Brighter Future

Starting July 1st, 2025, the one-time allowance for childbirth has been doubled to 2 times the reference rate at the time of birth. With the current reference rate equivalent to the base salary of VND 2.34 million/month, this amounts to approximately VND 4.68 million per child.

Additionally, Article 60 of the Law introduces a provision for post-natal convalescence, with benefits for one day of rest and recovery set at 30% of the reference rate.

The Booming Pensioner Population

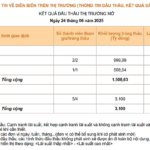

Over 46,500 people receive monthly pension and social insurance benefits, a staggering 54% increase compared to the previous period. This notable rise contrasts with a significant drop in the number of individuals opting for a one-time social insurance withdrawal.

“The Exemption from Mandatory Social Insurance from July 1st”

The Social Insurance Law of 2024 will come into force on July 1st, 2025, and with it, a notable change: an outline of the instances where compulsory social insurance contributions are not required.