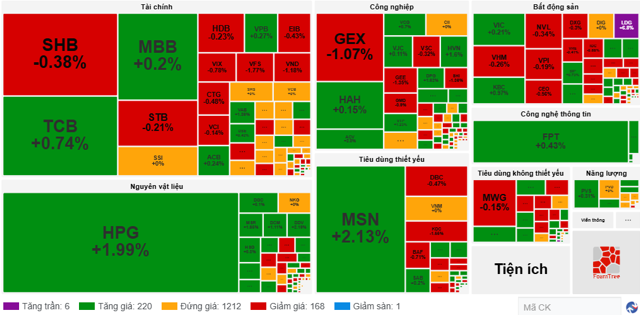

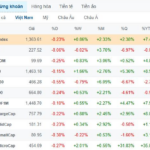

A look at the market map reveals that the decline of the banking group was one of the main pressures, with MBB down 0.2%, STB down 0.64%, SHB down 0.77%, HDB down 0.46%, and CTG down 0.72%. Additionally, VCB dipped by 0.18%. Alongside the banking group, the securities group also witnessed declines, with SSI down 0.41%, VND down 1.77%, VIX down 0.78%, and VCI down 0.56%. The real estate sector followed suit, with VHM decreasing by 0.9%, CEO by 0.56%, DIG by 0.29%, and DXG by 0.6%. However, a surprising outlier was the upward surge of LDG, which hit the ceiling with a volume of over 8 million shares.

Contrasting the downward trend in the Vietnamese market, most Asian markets rebounded from their initial losses. The Shanghai Composite, Singapore Straits Times, and Nikkei 225 all turned positive.

On June 26, 2025, Vietnam’s stock market opened with a slight gain, as reflected by the VN-Index rising 1.84 points to 1,368.59. Similarly, the HNX-Index and UPCoM-Index followed suit, increasing by 0.04 points to 227.7 and 0.18 points to 100.12, respectively.

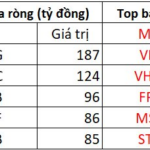

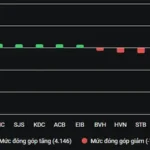

Market liquidity was recorded at nearly 60 million shares, corresponding to a value of over VND 1,489 billion. The market witnessed a mild increase, with 226 codes trading up, not significantly outnumbering the 169 codes trading down, while 1,212 codes remained unchanged. This upward movement was largely attributed to the strong performance of pillar stocks such as HPG, which climbed by 1.99%, MSN by 2.13%, TCB by 0.74%, and FPT by 0.43%. Examining the market map, a positive sentiment was evident in the materials sector, led by HPG, alongside MSR, which rose by 1.86%, DCM by 1.11%, and DDV by 2.18%.

|

Pillar stocks shine with green on the market map

Source: VietstockFinance

|

The market remained unfazed by the news of Vietnam’s absence from MSCI’s 2025 market ranking announcement. This outcome was anticipated, given that most of MSCI’s assessments remained unchanged, particularly the quantitative criteria.

Turning to global stock markets, Asian markets opened with declines across the board, including the All Ordinaries, Hang Seng, Shanghai Composite, and Singapore Straits Times, while the Nikkei 225 bucked the trend and posted gains.

In the US stock market overnight, the S&P 500 hovered around 6,092.16 points, as investors watched closely to see if it could reclaim its all-time high. Meanwhile, the Nasdaq Composite climbed 0.31% to 19,973.55, and the Dow Jones rose 0.25% to 42,982.43.

– 10:45 26/06/2025

The American Stock Market: A Sideways Shuffle as Crude Oil Prices Bounce Back

Nvidia stock was the pillar of strength for the indices in this session, surging 4.3% to a record high of $154.31 per share.

VN-Index: Poised for a New Uptrend, Eyes Set on the 1,400 Mark

“The steady cash flow among large-cap stocks has kept the VN-Index buoyant at its highest levels since the beginning of 2025,” said Mr. Tâm.