In late May, the Provincial People’s Council of Nghe An province voted to adopt a new land price framework for the area. As a result, prices in several locations were adjusted upward by two to ten times, and even by fifteen times in some cases.

Vinh City, Nghe An Province

The adoption of the new land price framework by Nghe An province is intended to align land prices with market values, curb land speculation and price gouging, and minimize tax losses.

However, according to VTC News’ investigation, some drawbacks have emerged alongside the positive effects. Specifically, when families divide and give away their garden land to their children for house construction, the cost of converting garden land to residential land is exorbitantly high because the government’s land price framework is already close to market prices. As a consequence, the conversion tax is as expensive as purchasing a new plot of land, which has left many citizens dissatisfied.

On May 16, Ms. Nguyen Thi Hong (wife of Mr. Dong) and her daughter, Ms. Tran Van Anh (residents of Hung Loc ward, Vinh city), brought their paperwork to the Vinh City One-Stop Service Center to initiate the process of converting 300 square meters of garden land to residential land.

According to Ms. Van Anh, after submitting her documents, she received an acknowledgment receipt and was asked to return on June 6 to collect the tax notification. However, when they returned on the appointed day, officials informed them that the paperwork was still being processed and rescheduled the appointment for June 16. When her mother inquired again at the Vinh City Tax Team on June 17, she was told that the file was not available and was asked to come back in seven days.

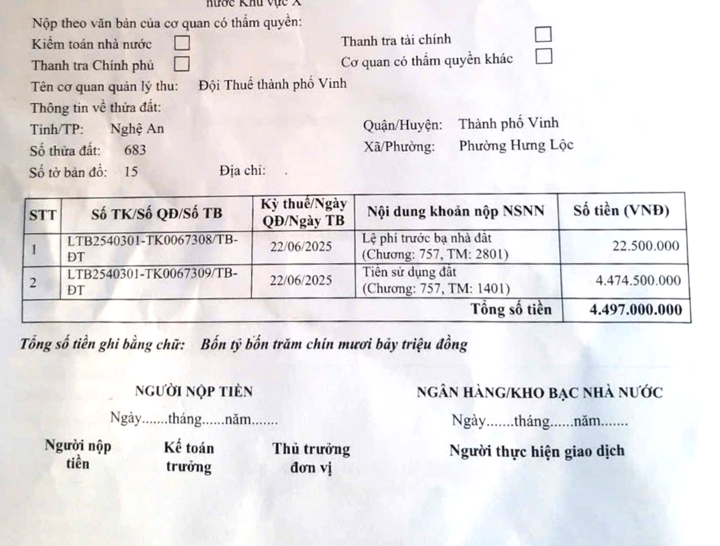

On June 23, upon receiving the tax notification, Ms. Van Anh was shocked to discover that the tax amount due was nearly VND 4.5 billion, equivalent to a post-conversion land price of VND 15 million per square meter.

“The market land price in this area is around VND 10 million per square meter. If we were to sell all 300 square meters of land after converting its purpose and splitting the red book, we would only get VND 3 billion, while our family has to pay nearly VND 4.5 billion in taxes,” Ms. Van Anh lamented.

Ms. Van Anh from Vinh City was shocked by the high tax for converting garden land to residential land, amounting to nearly VND 4.5 billion.

According to Mr. Vo Hong Hai, Deputy Chief of the Office of the People’s Committee of Vinh City and Head of the Vinh City Public Administration Service Center, there was a case of three siblings in Hung Hoa ward (Vinh city) who owned land granted before 1980, had built houses on it, and now wanted to change the land purpose to receive separate land certificates from their parents. Initially, the family expected to pay around VND 1.4 billion based on the old price framework, but with the new framework, the amount due for the conversion reached nearly VND 11 billion.

Many citizens agree with Nghe An province’s decision to align land prices with market values. However, some hope that the authorities will consider amending the tax regulations for families dividing and giving away garden land to their children (those who do not own any red book) for housing construction.

“Navigating Online Sales Tax: A Guide to Compliance for E-commerce Businesses”

For non-residents, personal income tax rates for online sales are set at 1%, with services taxed at 5%, transportation at 2%, and certain product-related services taxed at a rate of 1%.

The Alluring Allure of Danang’s Land: Unveiling the Potential of Vietnam’s Precious Property

The proposed adjustments to land prices in Da Nang, Vietnam, are quite remarkable. Specifically, the Bach Dang Street section, stretching from the Han River Bridge to the Dragon Bridge, boasts an impressive price tag of over 340.9 million Vietnamese dong per square meter. This prime real estate is set to become one of the most expensive areas in the city, reflecting its prestige and potential for development.