Caution prevailed among investors today, with reduced trading activity causing a 17% drop in liquidity on the two exchanges compared to yesterday morning, as stocks plunged into the red. The large-cap group, which makes up the majority of the VN-Index, could only manage to keep two stocks in positive territory, unable to buoy the index.

The VN-Index managed to stay in positive territory for only the first 45 minutes of the morning session, with the highest point reached at the market open. The index then trended downwards for almost the entire remaining session, closing 3.11 points lower, or a loss of 0.23%. The market breadth was extremely poor, with 88 advancing stocks compared to 188 declining ones.

Today’s highlight was the liquidity, or lack thereof. After the record-breaking session on June 24th, which saw strong trading activity, the following two sessions failed to attract buying momentum. Instead, liquidity has been on a clear downward trend. The total matched value on the HoSE this morning was just over VND 6,619 billion, an 18% decrease from yesterday morning and the lowest in 11 sessions. It appears that the market participants reacted negatively to the index’s peak-breaking performance.

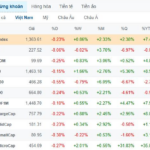

One of the reasons for investor caution is the fact that the VN-Index’s peak breakthrough was largely due to a handful of large-cap stocks, with VIC and VHM playing the most significant roles. These two stocks are currently struggling at the old peak levels. VIC rose as much as 1.25% but has since fallen back to the reference price. VHM, on the other hand, traded lower throughout the morning session and is currently down 1.03% from the reference price.

The remaining large-cap stocks were unable to step up and fill the void left by VIC and VHM. VCB managed to hold steady, while BID, CTG, and FPT all posted significant losses. BID reversed course by approximately 0.83% from its intraday high and ended the session down 0.56% from the reference price. CTG fell by 1.08%, resulting in a 0.72% loss, while FPT reversed its 1.35% gain to close 0.34% lower.

Among the ten largest stocks by market capitalization on the HoSE, only TCB and GAS managed to stay in positive territory, with TCB up 0.44% and GAS up 1.19%. TCB is also facing significant pressure, as its price rose to its intraday high just a few minutes after the market opened, surging 1.92% from the reference price. GAS benefited from a rebound in oil prices, but this was an isolated case, as most other energy stocks continued to decline sharply. Out of the VN30 basket, there are currently seven gainers. In addition to GAS, HPG rose 1.1%, and MSN climbed 1%. These two stocks have undergone significant corrections and are not among the largest stocks by market capitalization. On the flip side, the VN30 basket contains 18 losers, with VHM being the only large-cap stock among them. STB fell by 1.07%, and GVR declined by 1.14%, but their impact on the index was limited. The rest of the basket mostly underwent narrow fluctuations, with a general downward trend prevailing during the morning session. The VN30-Index also closed the morning session lower, down 0.15%.

With such a narrow market breadth, stocks outside the blue-chip group also struggled. Out of the 77 gainers, only 15 stocks managed to rise more than 1% with liquidity exceeding VND 10 billion. The weak buying power meant that stocks were largely at the mercy of sellers. HPG, MSN, and KBC were the only three stocks that witnessed superior buying pressure, each recording liquidity of over VND 100 billion. Stocks like SZC, SCS, FRT, VHC, HVN, LDG, SIP, REE, struggled with matched volume in the range of several dozen billion VND.

On a positive note, selling pressure was not overly intense. While the number of declining stocks far outnumbered the advancing ones, the magnitude of losses was relatively small. Approximately 50 stocks in the VN-Index posted losses of more than 1%, with only 18 of them recording liquidity above VND 10 billion. This indicates that the market’s weakness stems primarily from lackluster buying rather than aggressive selling. This trend was also evident during yesterday’s session.

Foreign investors are showing notable signs of increased selling activity. While their buying value was roughly on par with yesterday’s morning session, their selling value surged by 36% on the HoSE. The net selling value reached VND 558.4 billion, and the total net selling value across the three exchanges exceeded VND 600 billion. In reality, the scale of foreign selling is not exceptionally large, but due to the weak buying sentiment, their net position has turned negative. This suggests that the appetite for investment across the entire market is weak, not just among domestic investors.

Notable stocks that experienced net selling by foreign investors include FPT (VND 127.9 billion), HPG (VND 80.9 billion), GEX (VND 41.7 billion), VNM (VND 34.7 billion), and MWG (VND 31.5 billion). On the net buying side, KBC stood out with VND 29.3 billion, followed by DGW with VND 28.6 billion and SSI with VND 25.6 billion.

The slowdown in liquidity and the negative market breadth, coupled with narrow losses, reflect the prevailing cautious sentiment among investors. Sellers are not “running for the exits,” but buyers are hesitant to step in. The market is currently in a holding pattern, awaiting the final decision on the countervailing tax rate, which will likely trigger a “reshuffling” of portfolios.