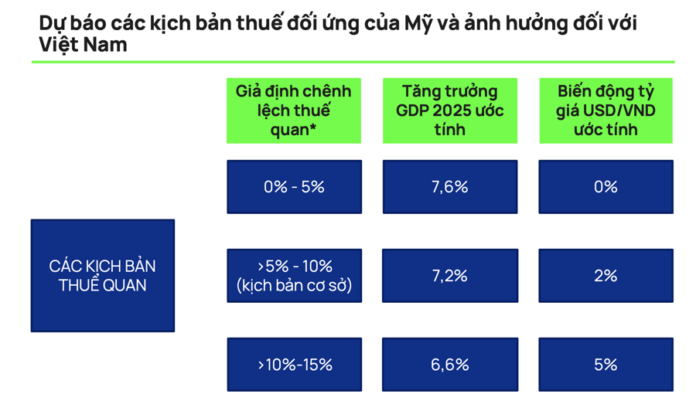

Vietcap Securities has updated its macroeconomic outlook and stock market forecast for the second half of 2025, maintaining its GDP growth forecast for 2025 at 7.2%.

ANTICIPATING A 5-10% TARIFF DISPARITY BETWEEN VIETNAM AND COMPETING COUNTRIES

Key factors that could impact Vietnam’s economic growth in the latter half of 2025 include:

Firstly, countervailing duty risks. US countervailing duties could put pressure on the global economy. Bloomberg’s consensus forecast for 2025 global GDP growth has been revised downward by 0.4 percentage points, from 3.1% in December 2024 to 2.7% in May 2025.

The 90-day postponement of countervailing duties may support production and encourage front-loading activities in Q2. However, the outcome of tariff negotiations will be a critical factor that could affect Vietnam’s exports and manufacturing sector.

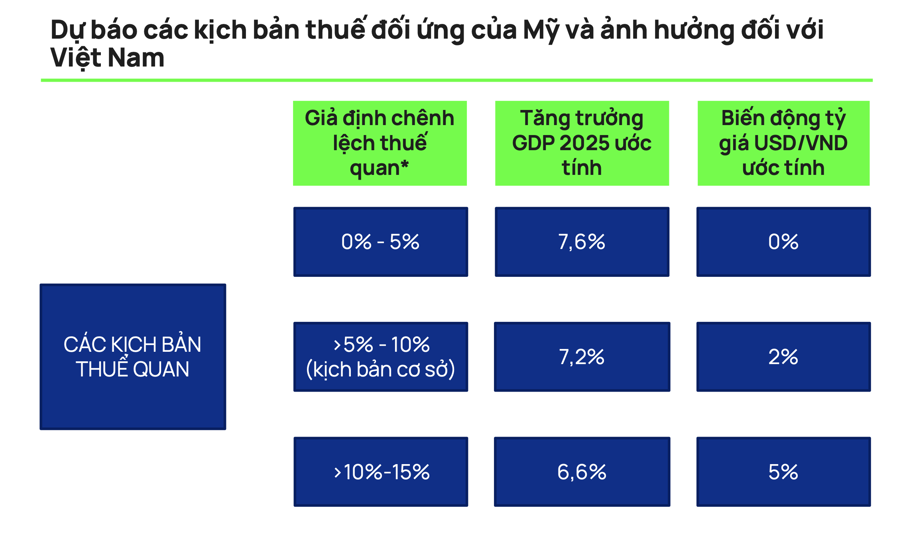

In the base-case scenario, Vietcap anticipates that Vietnam can negotiate with the US to reduce the tariff disparity and narrow the gap between Vietnam and competing manufacturing countries in key export sectors to the US (to 5-10%) compared to the April 2nd announcement (13% – excluding China) and maintain it significantly lower than the tariff applied to China.

Secondly, enhanced fiscal support: In Q1/2025, the National Assembly increased the plan for development investment spending from the state budget by 28% compared to the estimated disbursement in 2024 (+10% compared to the 2025 target previously approved by the National Assembly in November 2024).

The government will boost public investment to stimulate economic growth. We estimate that increased fiscal spending could offset the negative impact of countervailing duties in the second half of 2025.

Thirdly, the State Bank will maintain a loose monetary policy in 2025 to support the economy, and Vietcap forecasts that the ceiling deposit interest rate (for terms below 6 months) will remain unchanged at 4.75% during 2025 – 2027 (compared to the previous forecast of a 25 basis point hike by the end of 2025).

The securities firm maintains its GDP growth forecast for 2026 at 7.5% and raises its GDP growth forecast for 2027 from 7.5% to 8.0%. Public investment is expected to be a key driver of Vietnam’s economic growth in the medium term (2026 – 2030). With public debt at 36-37% (well below the 60% ceiling), the government has ample fiscal space to continue implementing economic stimulus measures.

POTENTIAL SECTOR WINNERS

The VN-Index gained 5.2% in the first five months of 2025 in local currency terms. However, the market experienced a sharp 6.2% correction in April, mainly due to the announcement of countervailing duties by the US on Vietnam – one of the highest rates globally. The market rebounded strongly in May, thanks to the government’s timely actions to mitigate the impact of tariffs and positive progress in tariff negotiations between Vietnam and the US.

Currently, while there is still uncertainty about the outcome of tariff negotiations, the latest updates suggest that Vietnam and the US held the third round of technical talks in early June 2025.

Based on these developments, Vietcap revises downward its target for the VN-Index in 2025 and 2026, with the new targets set at 1,420 and 1,570 points, respectively. This adjustment is generally in line with the reduction in the overall profit forecast for 2025/2026.

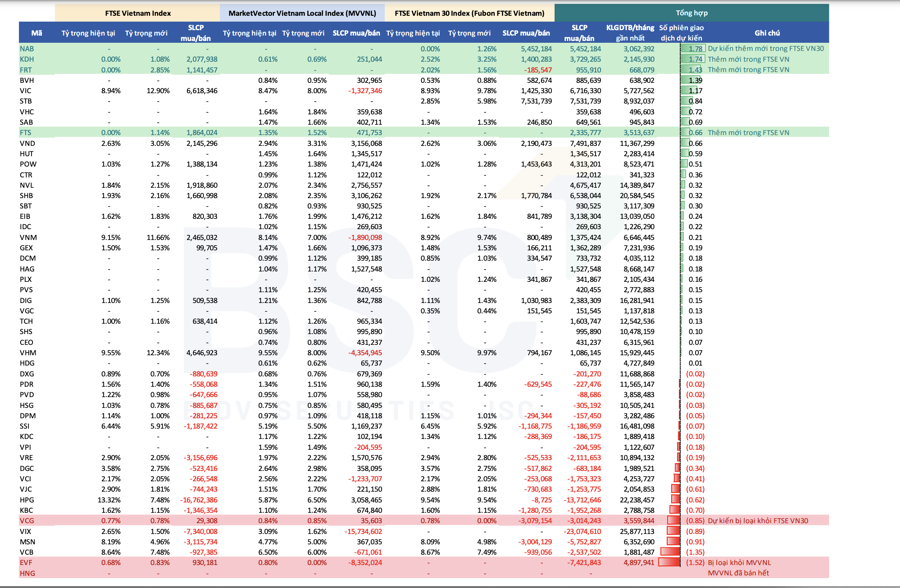

Among large-cap sectors, Vietcap continues to recommend increasing exposure to stocks in the Banking and Consumer sectors. The outcome of tariff negotiations will be a game-changer for the market, and the 90-day countervailing duty suspension is coming to an end.

The selected stocks will demonstrate sustainable growth across different tariff scenarios. Picks in the Banking sector include MBB, TCB, STB, and FRT for the Consumer sector. Additionally, FPT in the Technology sector is also favored as IT services are not directly impacted by tariffs.

Vietnam’s enhanced fiscal spending and loose monetary policy are expected to boost the Infrastructure and Real Estate sectors. Vietcap is bullish on steel producer HPG and reputable real estate developers such as KDH and NLG.

In the event that Vietnam secures a favorable tariff agreement, Vietcap will expand its recommended portfolio to include leading enterprises that have been disproportionately impacted by recent uncertainties. Notable stocks include CTG, VCB, VPB (Banking); MWG, PNJ, MSN (Consumer); and IDC, KBC (Industrial Parks).

Furthermore, Vietcap’s analysts also propose other top picks such as DGC, TLG (Industrial Manufacturing); ACV, AST (Transportation); PVS, PLX (Oil & Gas); HDG, QTP (Electricity & Water); and BMP (Materials).

Monetary Policy Amidst Military Conflict Risks

The global economy, already fragile due to unpredictable US tariff policies, now faces a perfect storm with the military conflict in the Middle East. This double whammy significantly heightens the risks of a recession and inflation.

Is the VN-Index at Risk as Political Tensions Rise and Trade Negotiations Near an End?

With strong performance improvements over the past week and month, and indications of divergence in the Vn-Index, a short-term correction could bring the VN-Index back to the support region of 1300 – 1308 points. In a scenario of unfavorable tariff adjustments or heightened Middle East tensions, the market’s support region could lie between 1270 and 1280 points.