Gold prices continue their downward spiral as geopolitical tensions ease following a ceasefire agreement between Iran and Israel.

With the de-escalation of tensions, the demand for gold, traditionally considered a safe-haven asset, has significantly diminished. Additionally, a strong rebound in global stocks and a sharp decline in oil prices have further pressured the precious metal market.

Investors are now closely monitoring the upcoming speech by the Chairman of the Federal Reserve before Congress. Market sentiments are divided over interest rate policies, with expectations that the Fed will maintain a cautious approach rather than aggressive easing. This could further negatively impact gold prices in the short term.

Gold Price Movement Today

+ Domestic Gold Prices

Gold prices continue to plummet. (Photo: Minh Duc)

As of 6 a.m. on June 25, gold bars at Doji and SJC were listed at VND 117.7-119.7 million/tael (buying-selling), unchanged from the opening of the previous day.

Meanwhile, Doji listed gold rings at VND 114-116 million/tael (buying-selling), down VND 500,000/tael from the opening of the previous day.

+ International Gold Prices

Gold prices listed on Kitco were at $3,321/ounce, down $32/ounce from the previous day’s close. Gold futures last traded at $3,324/ounce.

Gold Price Forecast

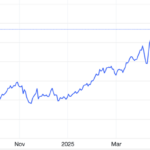

Many investors expect that if the ceasefire holds and based on technical analysis, gold prices could drop further in the coming days, possibly reaching the $3,250/ounce level or even $3,100/ounce. Gold has been on a six-month upward trend, with gains of nearly 30%.

Investors are closely monitoring the actions of Israel and Iran. Previously, Netanyahu told President Trump that while he could not cancel all attacks, he would significantly reduce the number of targets. Israel later confirmed that it had attacked a target in Iran and that fighter jets were returning. Investors are waiting to see if Iran will continue to retaliate or cease its response.

The Golden Touch: Unlocking the Radiance of SJC Gold

Looking ahead to next week’s trends, gold price predictions are elusive, according to several expert analysts.