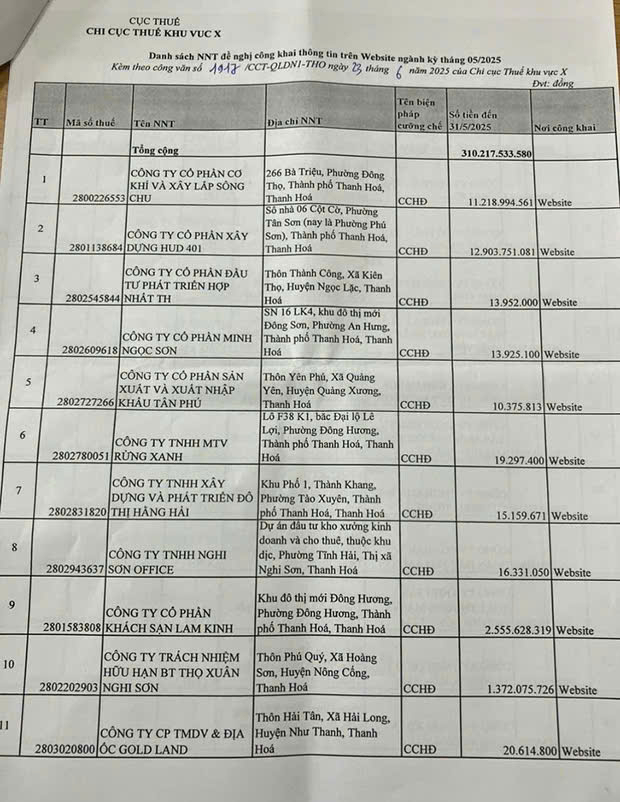

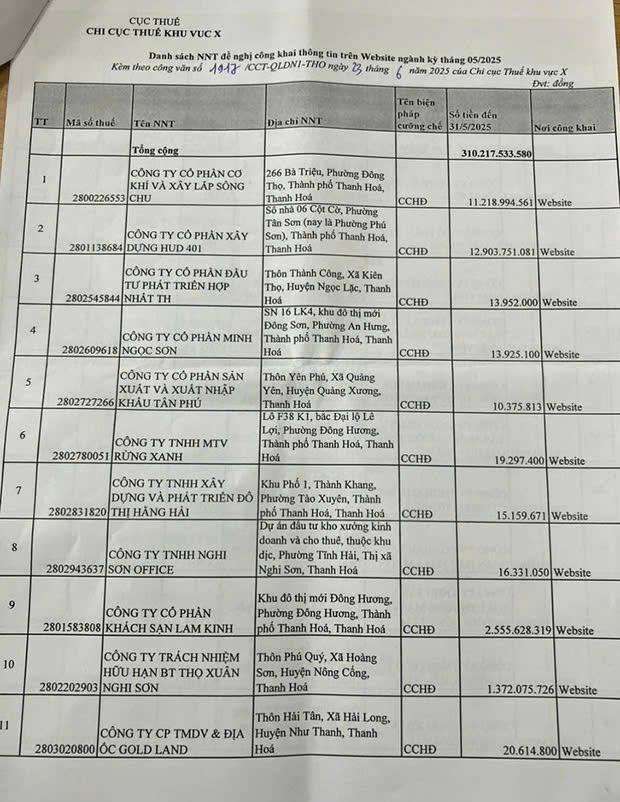

Detailed information about these businesses and their debt is made public to increase transparency and encourage the fulfillment of financial obligations by the respective entities.

Specifically, Cong Thanh Joint Stock Cement Company, located in Tan Truong, Nghi Son Town, is the largest tax debtor with VND 59 billion in debt.

This is followed by Construction Joint Stock Company No. 5, headquartered in Bac Son Ward, Bim Son Town, with VND 39 billion in debt. Ba La – Bim Son Production and Trading Joint Stock Company, also in Bac Son Ward, Bim Son Town, owes VND 34 billion.

Thanh Hoa Industrial Ship Joint Stock Company, located at 259 Ba Trieu, Dong Tho Ward, Thanh Hoa City, owes VND 19 billion. Bac Trung Nam Joint Stock Company, address at 321 Ba Trieu, Dong Tho Ward, Thanh Hoa City, is in debt of VND 16 billion.

Song Da 4 Joint Stock Company’s branch in Hoi Xuan, Quan Hoa District, owes VND 16 billion. LICOG15 Joint Stock Company, at 44 Tran Phu, Ba Dinh Ward, Bim Son Town, has VND 14 billion in debt. Song Chu Mechanics and Construction Joint Stock Company, 266 Ba Trieu, Dong Tho Ward, Thanh Hoa City, owes VND 11 billion.

Transport Infrastructure Investment and Construction Joint Stock Company 838, 306 Ba Trieu, Dong Tho Ward, Thanh Hoa City, has a debt of VND 10 billion. Thien Xuan – Lam Son Joint Stock Company, 18-20 Hang Dong, Dien Bien Ward, Thanh Hoa City, owes VND 9 billion.

The remaining five enterprises in the top 15 tax debtors are Thanh Son Stone Exploitation and Processing Joint Stock Company with VND 6 billion in debt; Thanh Dat Consulting and Construction Joint Stock Company with VND 6 billion; Hong Ha Construction Joint Stock Company with VND 5 billion; Boat No. 28 Construction Joint Stock Company with VND 5 billion; and Hung Gia Thanh Hoa Trading and Real Estate Joint Stock Company with VND 5 billion in debt.

The total debt of these 15 enterprises is nearly VND 260 billion, accounting for a large portion of Thanh Hoa province’s total tax debt.

The published list only includes enterprises with registered business addresses in Thanh Hoa. Many other enterprises operate or have projects in the province but are headquartered elsewhere, thus not included. For instance, FLC Group, with multiple projects in Thanh Hoa but headquartered in Hanoi, currently has a tax debt of VND 185 billion in the province.

Area X Tax Department has issued Document No. 1917/CCT-QLDN1-THO on the public announcement of large tax debtors under code 3801.

According to Article 100 of the Law on Tax Administration No. 38/2019/QH14, tax authorities are entitled to disclose debt information, debt duration, and apply violation handling measures. This indirect enforcement measure aims to pressure enterprises into fulfilling their financial obligations.

When an enterprise is overdue in tax payment for more than 90 days or shows signs of delinquency, the tax authority can freeze their bank account, revoke their business license, suspend their invoice use, and apply other measures.

Publicizing the list of tax debtors helps enhance tax management effectiveness and enables organizations and individuals to monitor and fulfill their financial obligations as regulated.

The enterprises on this list are under close supervision by the tax authority to facilitate debt collection and ensure budget revenue for Thanh Hoa province.

The Tax Evasion Director: A Debt of Almost $2000 Could Result in a Departure Delay

Amidst the surge in overdue tax debts, customs authorities are rigorously employing exit bans on legal representatives of delinquent businesses. These businesses, despite exhibiting signs of evasion, have accumulated tax debts amounting to merely a few million dong. This decisive action underscores the authorities’ unwavering commitment to curbing tax delinquency and safeguarding public finances.

The Deadline for Financial Obligations on Residential Land in Ho Chi Minh City

Within 60 working days from the date of the specific land price assessment, the competent land management agency shall prepare the dossier. If the legal dossier is found to be solid upon scrutiny, the land management agency shall select an organization to carry out the land price assessment.

Electronic Invoicing: 5 High-Risk Tax Scenarios to Look Out For

The new regulations by the Ministry of Finance outline five additional criteria for identifying high-risk taxpayers in relation to electronic invoicing. These criteria are designed to target those who do not operate at their registered address, have a history of fraud, or are involved in the buying and selling of invoices based on tax authority data.