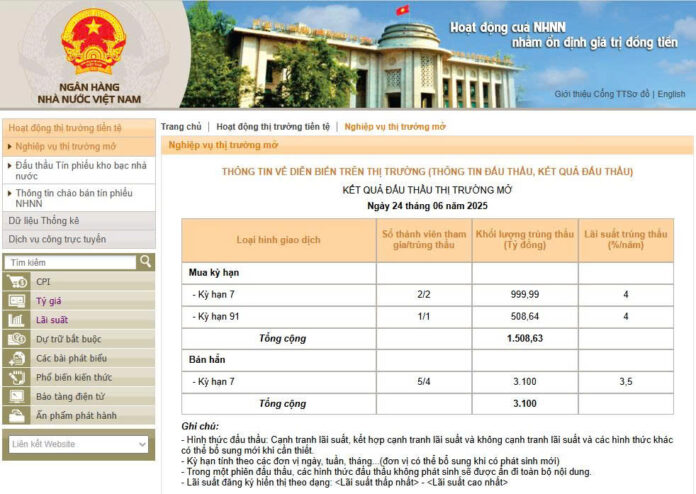

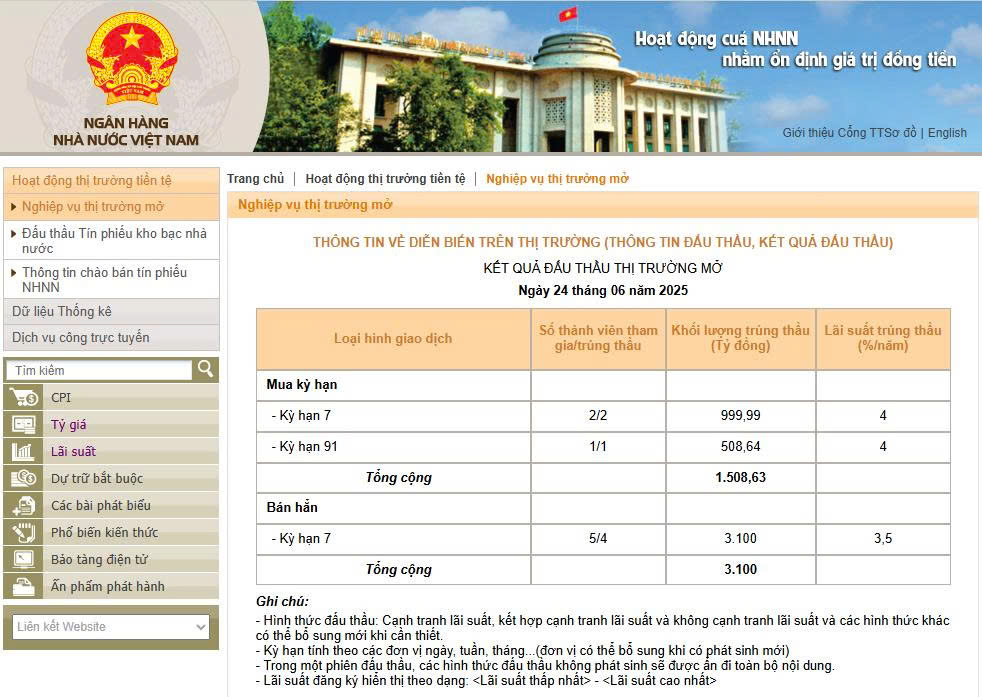

The forex market witnessed a notable development on June 24th as the State Bank of Vietnam (SBV) resumed the issuance of treasury bills after a nearly four-month hiatus. The issuance amounted to VND 3,100 billion, with a 7-day term and an interest rate of 3.5%/year.

Mr. Nguyen Trong Dinh Tam, Deputy Director of Analysis at Asean Securities Joint Stock Company (Aseansc), opined that this move is apt given the persistent upward trajectory of the USD/VND exchange rate lately.

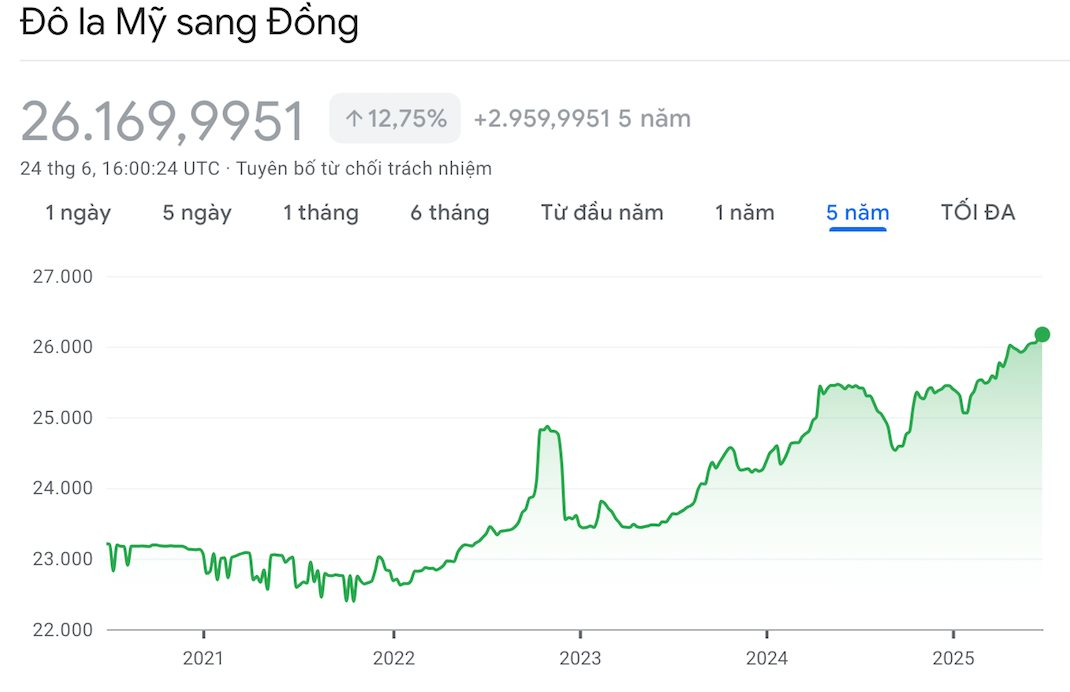

The central exchange rate announced by the SBV on June 24th stood at 25,058 VND/USD, surging by 30 VND compared to the previous session. Since the beginning of the year, the USD/VND exchange rate has climbed by nearly 3%, despite a roughly 9% drop in the DXY index, which gauges the US dollar’s performance in the international market.

Mr. Tam highlighted that while the appreciation of the exchange rate in 2024 was primarily driven by a robust US dollar, the current upward trend is largely attributed to surging import demands to facilitate exports during the 90-day deferred tax period.

The expert suggested that the SBV is in a phase of gauging the impact on the USD/VND exchange rate by employing treasury bills as a tool, considering: (1) the modest scale of the June 24th issuance, (2) its short-term nature, (3) a relatively lower interest rate compared to previous issuances (albeit higher than the March issuances), and (4) the SBV’s continuation of term-structure buying (injecting money) in the latest session, amounting to over VND 1,500 billion.

According to Mr. Tam, the predominant stance of monetary policy remains accommodative, as evidenced by sustained efforts to maintain low administered interest rates and promote credit growth, with a key objective of supporting economic growth to meet the 2025 plan.

Assessing the impact on the stock market, Aseansc’s expert opined that the current probing move has had minimal effect on market liquidity. However, if the exchange rate persists without showing signs of cooling down in the short term, and the SBV starts to demonstrate more flexibility in increasing the frequency and scale of treasury bill issuances, it could gradually influence the psychology of investors in the stock market.

“Nevertheless, we foresee a gradual adjustment in the USD/VND exchange rate in the latter part of the year due to the waning of the 90-day tariff deferral effect. In our base case scenario, we anticipate that Vietnam’s exports of key commodities will retain their competitive edge even after the implementation of new tax rates.

Additionally, the expected two rate cuts by the Fed in the second half of the year, coupled with an anticipated increase in the supply of US dollars due to prospects like an upgraded stock market, remittances, and spending by foreign tourists, are also expected to contribute to easing exchange rate pressures,” the expert elaborated.

Exchange Rate to Show Signs of Cooling Down

Concordantly, Vietcombank Securities (VCBS) echoed a similar sentiment in a recent report, predicting that the USD/VND exchange rate will exhibit clearer signs of cooling down in the upcoming period as Vietnam continues to demonstrate its solid foundation for stability. They asserted that Vietnam remains an attractive destination for investment and business operations.

According to VCBS’s assessment, speculative sentiment for the US dollar among both individual and institutional investors remains elevated. This reflects the market’s cautious approach amid the absence of official information regarding the outcome of tariff negotiations between Vietnam and the United States. Furthermore, the 90-day deferral of applying the countervailing tax, granted by President Trump, is nearing its end in early July, prompting investors to gravitate towards defensive assets like the US dollar.

Consequently, VCBS remains optimistic about a more favorable trajectory in the foreign exchange market, given the temporary easing of trade tensions compared to the previous period.

VN-Index: Poised for a New Uptrend, Eyes Set on the 1,400 Mark

“The steady cash flow among large-cap stocks has kept the VN-Index buoyant at its highest levels since the beginning of 2025,” said Mr. Tâm.

The World Mobile Leadership Sells its Stake: Unveiling the Reasons Behind the Move.

Mr. Pham Van Trong, a Board member and the CEO of Bach Hoa Xanh – a subsidiary of Mobile World Investment Corporation (MWG), has recently sold 94,700 MWG shares, reducing his ownership to 0.21% of the charter capital. This move by Mr. Trong, a key stakeholder in the company, has sparked interest and raised questions among investors and industry observers alike.

“The Surge of Pham Nhat Vuong’s Wealth: Unraveling the Reasons Behind His Rising Fortune”

The Asian stock markets rallied following the news of a ceasefire agreement between Israel and Iran. VN-Index reached new heights today (June 24th), led by the Vingroup conglomerate. The net worth of Vietnam’s billionaire, Pham Nhat Vuong, soared by an additional $726 million.

Heavy Fines for Indochinese Import-Export (DDG) for Misleading and Incomplete Information

The Vietnam Securities Commission (VSC) has imposed a fine of VND 370 million on Indochine Import-Export JSC (DDG) for misleading and incomplete disclosures. The company was found to have withheld critical information, a direct violation of transparency regulations. This punitive action underscores the VSC’s commitment to upholding market integrity and protecting investors by ensuring that listed companies maintain the highest standards of disclosure and transparency.