Domestic and foreign investors showed more aggressive buying behavior this afternoon, boosting liquidity and turning many stocks towards the green. Compared to the morning session, the breadth of the index evened out. If it weren’t for the pressure from the large caps, the VN-Index would have recovered successfully.

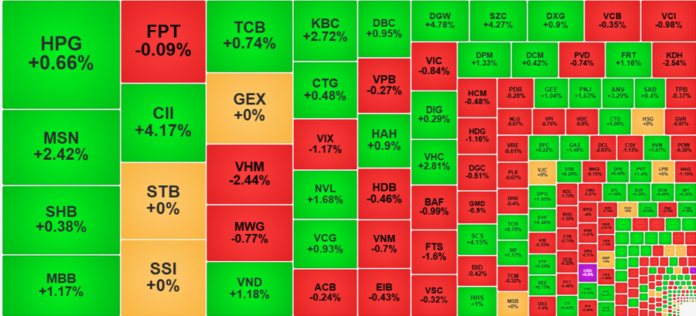

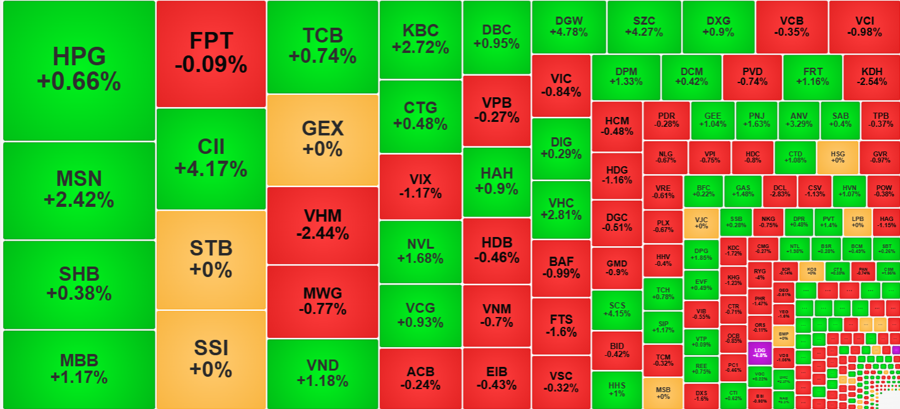

The index closed slightly lower by 1.08 points (-0.08%) compared to the reference, and VHM evaporated 2.44%, taking away more than 1.8 points. Not to mention the decline of VIC by 0.84%, VCB by 0.35%, and BID by 0.42%.

Among these red stocks, VIC and VHM weakened very quickly. By the end of the morning session, VHM had only decreased by 1.03%, but it fell further by 1.43% in the afternoon. VIC also weakened by approximately 0.84% in the afternoon compared to its morning closing price. VHM experienced the most noticeable selling pressure, especially in the latter half of the afternoon session and the ATC period. This afternoon’s liquidity for VHM alone reached VND256.8 billion, making it one of the most liquid stocks in the VN30 basket.

On a positive note, while the largest caps showed signs of weakness, the rest of the blue-chip basket improved. Statistics show that 17 stocks in the VN30 basket rose in the afternoon compared to the morning session, while 11 stocks fell. Leading the gainers was MSN, which attracted the best capital inflows and had the highest liquidity in the basket, with VND350.2 billion in the afternoon session. MSN rose an additional 1.41% from the morning session and closed up a total of 2.42%, becoming the stock that pulled the most points. Unfortunately, with MSN’s market capitalization ranking only 15th on the HoSE floor, the points gained were about 0.6 points, still less than VIC’s decline.

Other stocks in the blue-chip basket that impressively reversed with high liquidity include CTG, up 1.21%, surpassing the reference by 0.48%; MBB reversing by 1.37% to gain 1.17%; SHB reversing by 1.16% to gain 0.38%; BCM reversing by 1.14% to gain 0.49%; and STB recovering from a morning loss of 1.08% to close at the reference price. The VN30-Index closed slightly lower by 0.12% with 10 gainers and 16 losers.

The rest of the market also performed significantly better than in the morning. The breadth of the HoSE floor at the end of the day recorded 141 gainers and 155 losers, a much more balanced picture compared to the morning session (77 gainers and 188 losers). The group of stocks rising over 1% also expanded to 56 (compared to 34 in the morning) and accounted for 26.6% of the total trading value on the HoSE floor.

The best-performing stocks included many names with impressive buying pressure. MSN, of course, stood out the most. This stock had the second-largest liquidity in the market after HPG, but HPG only rose weakly by 0.66%. Trading in the hundreds of billions of VND also occurred with MBB, up 1.17%; CII, up 4.17%; VND, up 1.18%; KBC, up 2.72%; NVL, up 1.68%; DGW, up 4.78%; SZC, up 4.27%; VHC, up 2.81%; DPM, up 1.33%; and FRT, up 1.16%.

Strong liquidity helped many stocks in this group to reverse with a large margin. For example, MSN rose up to 2.56% from its intraday low; CII increased by 5.26%, VND by 3.94%, DGW by 5.63%, and VHC by 3.54%… If investors participated in bottom-fishing, the intraday profit margin in these stocks would have been quite significant. Stocks with lower liquidity but higher gains included LGL, LDG, HUB, SCS, and ANV, all above 3%.

The return to a balanced breadth indicated that many stocks had successfully rebounded. The rest mostly escaped the lows and recovered, but they hadn’t reached the turning point yet. Besides VHM, the group of significant losers included VIX, FTS, KDH, and HDG, with large trading volumes of around VND100 billion. Among the 155 losing stocks, 55 fell by more than 1%, but they only accounted for 9.1% of the HoSE floor trading value. This suggests that not many stocks experienced clear sell-offs.

The matched liquidity of the two floors in the afternoon session increased by 24.4% compared to the morning, with HoSE up 25.8%. The more active trading and price recovery reflected the initiative from the buying side. This was a positive signal contrary to the dull and sell-off sentiment in the morning. Foreign investors also bought twice as much in the afternoon as in the morning, reaching over VND1,243 billion, resulting in a net position of +VND287.5 billion. In the morning session, this group had net sold VND558.4 billion. GEX was the biggest surprise, with a net buy of VND252.7 billion.

“Premier Pham Minh Chinh Visits Shanghai Stock Exchange, Seeks Insights on Developing a Financial Hub”

On the morning of June 26th, during his working visit to China, Prime Minister Pham Minh Chinh visited the Shanghai Stock Exchange (SSE) in Shanghai.

Market Pulse for June 26: A Sea of Red

The Vietnamese stock market indices witnessed a downward trend during the morning session, amid mounting pressures. The VN-Index dipped by 0.23%, shedding 3.14 points to close at 1,363.61. Similarly, the HNX-Index and UPCoM-Index followed suit, with the former declining by 0.06%, a loss of 0.14 points to 227.52, while the latter contracted by 0.25 points or 0.25% to finish at 99.69.

The Tapping Into a Profound Cash Flow Crisis: “Liquidity Dries Up as Foreign Investors Sell-Off”

The cautious sentiment continues to loom over the market, with investors opting to reduce their trading activities. This resulted in a 17% decline in trading volume on the two exchanges this morning compared to yesterday, leaving stocks drowning in a sea of red. The large-cap group of the VN-Index could only muster two stocks in the green, lacking the momentum to buoy the index.