The Vietnamese stock market continued to trade erratically near the peak reached earlier this year. At the close of the June 26 session, the VN-Index dipped slightly by 1.08 points, or 0.08%, to 1,365.67. Trading liquidity plummeted compared to the previous session, with the matching value on HoSE reaching a meager VND 14,944 billion.

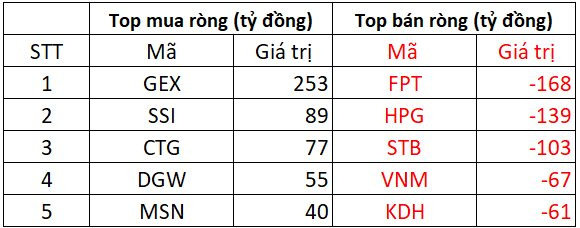

In terms of foreign investors’ activities, they net sold VND 324 billion in this session. Specifically:

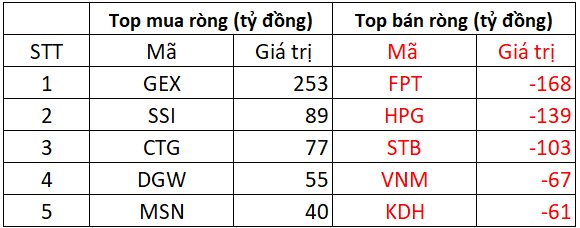

Foreign investors net sold nearly VND 271 billion on HoSE

In the selling side, FPT witnessed the strongest net selling by foreign investors, with a value of approximately VND 168 billion. HPG and STB followed suit, with net selling values of over VND 100 billion each. VNM and KDH were net sold in the range of VND 61-67 billion.

Conversely, GEX witnessed the strongest net buying across the market, attracting VND 253 billion from foreign investors. Other blue-chip stocks that were strongly net bought included SSI, CTG, DGW, and MSN, with values ranging from VND 40 billion to VND 89 billion per stock.

On the HNX, foreign investors net sold over VND 47 billion

In terms of net buying, NTP led with a value of VND 8 billion. NVB, TNG, and DTD witnessed modest net buying of VND 2 billion each, followed by DL1, which was net bought for half a billion VND in this session.

On the opposite side, PVS witnessed the strongest net selling of approximately VND 29 billion. CEO followed with net selling of VND 14 billion, while MBS, IDC, and VGS experienced net selling in the range of VND several billion.

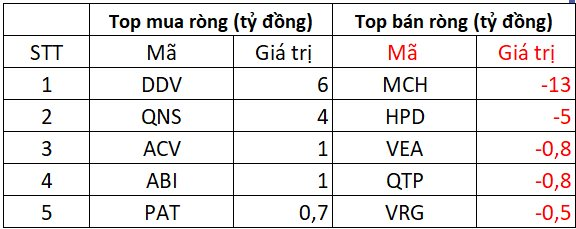

On the UPCoM, foreign investors net sold approximately VND 6 billion

Turning to net buying, DDV and QNS were net bought for VND 6 billion and VND 4 billion, respectively. ACV, ABI, and PAT witnessed negligible net buying, ranging from a few hundred million to VND 1 billion.

Conversely, MCH experienced net selling of VND 13 billion, and HPD saw net selling of VND 5 billion. Additionally, VEA, QTP, and VRG underwent modest net selling of a few hundred million VND.

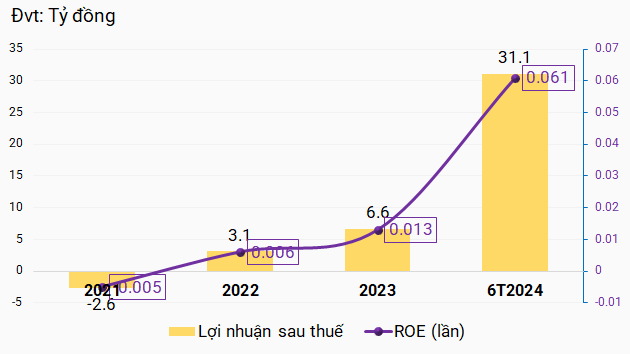

The World Mobile Leadership Sells its Stake: Unveiling the Reasons Behind the Move.

Mr. Pham Van Trong, a Board member and the CEO of Bach Hoa Xanh – a subsidiary of Mobile World Investment Corporation (MWG), has recently sold 94,700 MWG shares, reducing his ownership to 0.21% of the charter capital. This move by Mr. Trong, a key stakeholder in the company, has sparked interest and raised questions among investors and industry observers alike.