China is stimulating its economy through financial packages and monetary easing, but the effects will only be visible after a 9-12 month lag, according to Mr. Thuan. Meanwhile, many countries are still delaying infrastructure investments due to a wait-and-see approach. As a result, the bulk cargo market has been stagnant throughout 2024 and this trend is expected to continue into 2025.

Amidst this uncertainty, PDV has shifted its focus to time charter (TC) contracts instead of chasing short-term spot rates. As TC contracts typically last only 4-6 months, the company has withdrawn some of its vessels from the pool to negotiate independently.

“We are no longer gambling on short-term fluctuations. Our priority is to maintain stable efficiency,” emphasized Mr. Thuan.

In 2024, PDV recorded a remarkable pre-tax profit of VND 120 billion, surpassing its target thanks to its timely chartering strategy. However, 2025 is expected to be more challenging as many transport companies have started reporting losses. Nonetheless, PDV remains optimistic and aims for a pre-tax profit of VND 110 billion, with expected revenue of VND 1,700 billion, the highest ever.

According to the director, the majority of PDV’s revenue currently comes from its chemical tanker fleet, thanks to a larger number of vessels and stable freight rates. Revenue from this segment is almost double that of the bulk carrier segment. In the first half of 2025, the company estimates revenue of VND 800 billion, but profit is expected to be around VND 20 billion due to industry cycle specifics and tax implications.

Mr. Ho Si Thuan, Director of PDV, presenting to shareholders in the morning of June 26 – Photo: Tu Kinh.

|

In terms of investment, PDV plans to sell the PVT Neptune (built in 2008) and replace it with a new chemical tanker that is more suitable for the US route. If sold at the right time, the company could realize a profit of 4-7 million USD, although this has not been included in the profit plan. Meanwhile, the two bulk carriers, PVT Coral and PVT Topaz, received at the end of last year are currently making losses, but the company considers this a necessary investment phase during a weak market.

“We bought the vessels when prices were not overly high, so we will benefit when the market recovers,” Mr. Thuan explained.

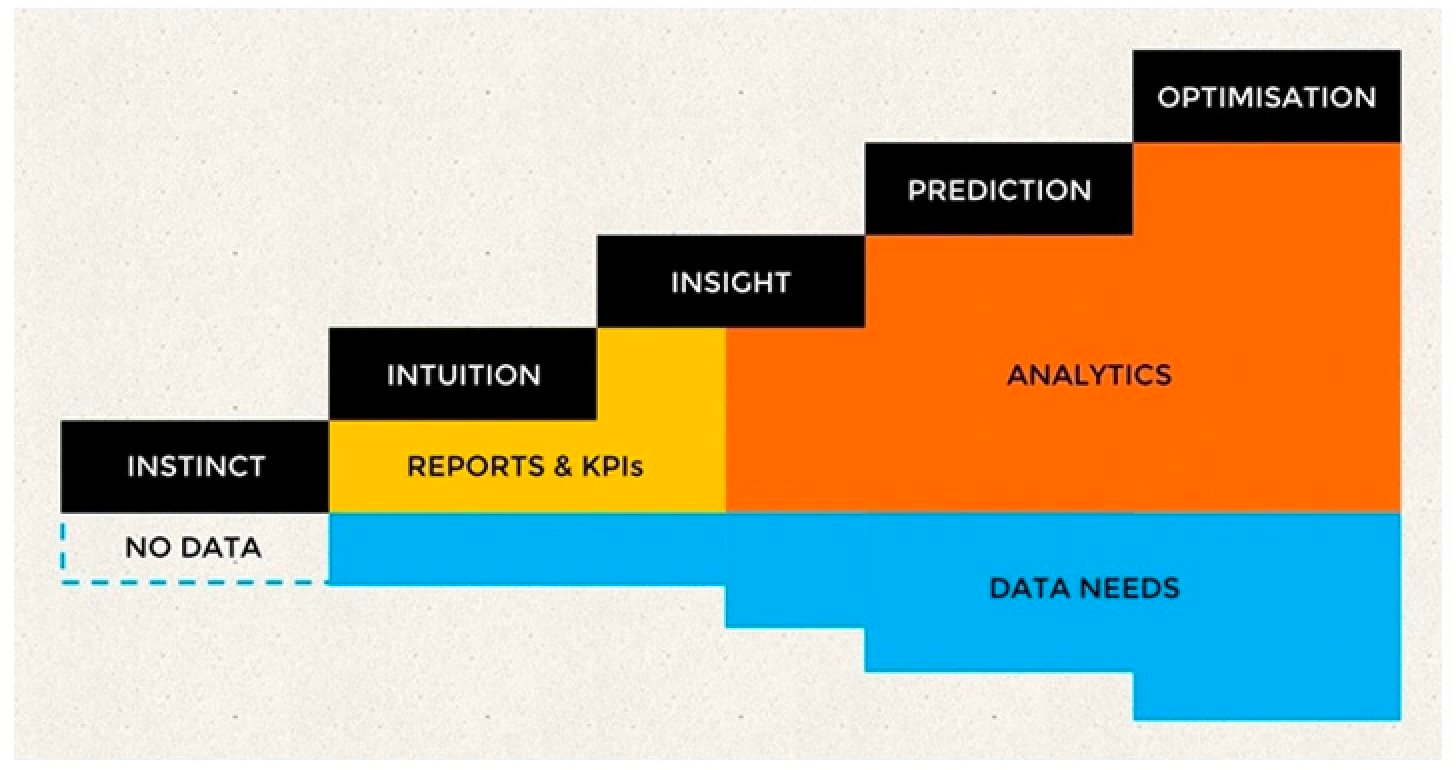

Looking towards the long-term, PDV is formulating a development strategy until 2040-2050 as requested by the Vietnam National Oil and Gas Group (PVN). One of the irreversible trends is the energy transition.

As a result, PDV is focusing its investments on chemical tankers and small bulk carriers (handysize, supramax – below 75,000 DWT). This segment is flexible and aligns with consumption trends and diverse transportation networks. By 2030, demand for gasoline is expected to decline faster than crude oil, while chemicals – a key input for industries – will maintain a stable growth rate.

The consumption structure of coal is also changing. Currently, about 1,100 million tons are used for power generation, mainly transported by large vessels such as capesize. However, this figure is expected to drop to 850 million tons in the next 5-7 years. In contrast, demand from industries such as iron and steel, cement, and grains – which use smaller vessels – is expected to remain stable.

Concurrently, PDV is shifting its fleet from the Middle East to the Pacific route, following the trend of the US becoming a global chemical and oil export hub. The sale of the 13,000 DWT vessel and its replacement with a vessel of 20,000 DWT or more aims to ensure eligibility for long-haul routes and stringent requirements, such as those of the US market.

Regarding the US fee for vessels over 80,000 DWT originating from China, PDV is not affected. “We are listening with a happier mindset because our current fleet does not include any vessels built in China, and all are below the 80,000 DWT threshold,” the company representative said. In fact, if the regulation tightens, PDV may even benefit as competitors are restricted.

For the period of 2026-2030, PDV aims to increase its charter capital to VND 1,700 billion, nearly triple the current amount, and boost owner’s equity to VND 2,400 billion. The fleet is expected to double to 18 vessels, with a younger average age and a restructured composition to meet higher operating standards. The company will also renew its fleet by selling older vessels and investing in new ones.

At the AGM, PDV elected Ms. Phan Thi Thu Ha as an independent member of the Board of Directors, replacing Mr. Hoang Minh Tuan, who resigned. Ms. Bui Lan Anh was also reappointed as Head of the Supervisory Board for the 2025-2030 term. Shareholders also approved a dividend plan totaling VND 165 billion, equivalent to 25% of charter capital, comprising 20% in shares and 5% in cash.

Towards the end of the meeting, Mr. Ho Si Thuan announced that he would be stepping down as Director to take on the role of Chairman of the Board of Directors, handing over the operational leadership to Mr. Le Truc Lam. “Mr. Lam is younger and has a clearer managerial ambition. After many years as Director, I tend to be more cautious, so a managerial position would be more suitable,” he explained.

Ms. Phan Thi Thu Ha (second from left) and Ms. Bui Lan Anh receiving congratulations from the PDV Board of Management – Photo: Tu Kinh

|