Techcom Securities Joint Stock Company (TCBS) has just announced a resolution approving the plan to increase its charter capital through the initial public offering (IPO) of shares, the issuance of shares to the public, the intended use of proceeds from the offering, and the listing of securities.

Specifically, TCBS plans to offer a maximum of over 231 million shares, equivalent to 11.11% of capital. The offering price has not been disclosed. TCBS’s charter capital is expected to increase to VND 23,113 billion after the offering, retaining its position as the leader in charter capital in the securities industry. The expected timeline for the offering is from Q3 2025 to Q1 2026.

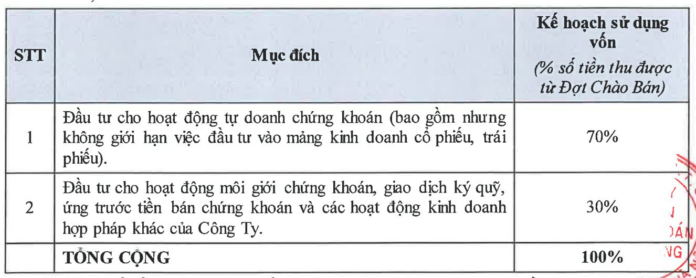

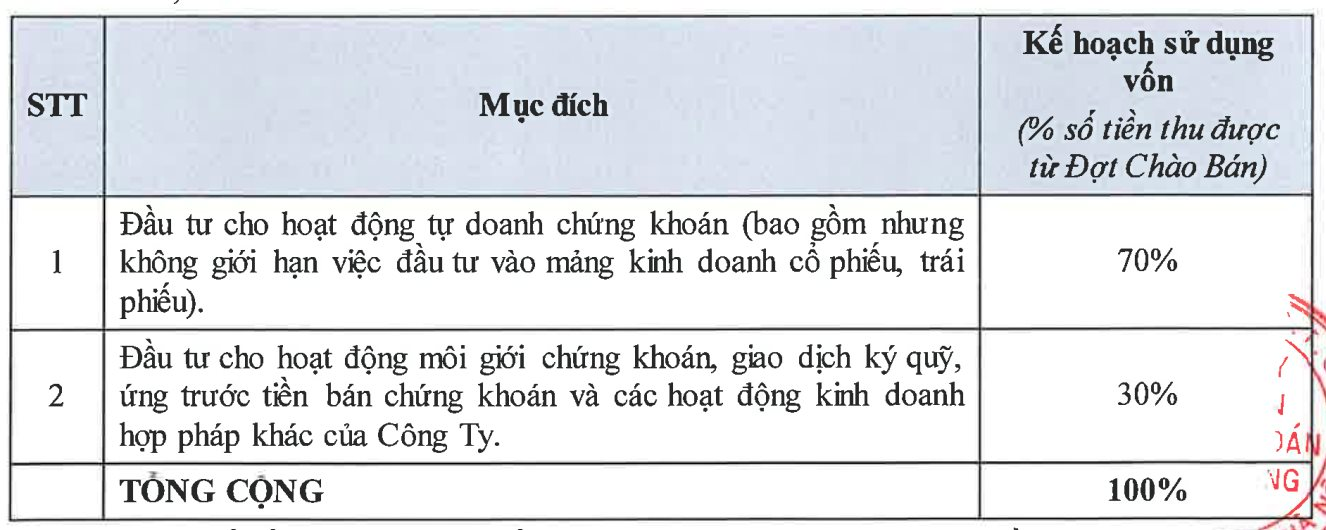

In terms of the intended use of proceeds, TCBS plans to allocate 70% of the funds raised to proprietary trading in securities (including but not limited to investing in stocks and bonds) to maintain high yields, especially during the attractive valuation phase of the Vietnamese stock market.

The remaining 30% of the funds are intended to be invested in securities brokerage activities, margin trading, pre-selling securities, and other legal business activities to meet the needs of customers in securities trading and margin lending. TCBS also plans to continue growing its market share and customer base in the future.

At the 2025 Annual General Meeting of Shareholders, Mr. Ho Hung Anh, Chairman of the Board of Directors of Techcombank, stated that TCBS plans to conduct an IPO this year and has worked with 1-2 large investors, receiving very positive feedback. The Chairman shared that the IPO is slated for the end of 2025, but it depends heavily on the financial market, market trends, and issues related to the upgrade of the Vietnamese stock market.

In June, TCBS completed a private placement of nearly 119 million shares to 25 professional investors who purchased the entire offered volume. Mr. Nguyen Xuan Minh, Chairman of the Board of Directors, participated in the offering by purchasing over 106 million shares, increasing his ownership in TCBS to over 168 million shares (8.09%). With an offering price of VND 11,585 per share, TCBS raised nearly VND 1,400 billion. These privately placed shares will be subject to a one-year lock-up period.

Currently, TCBS not only leads in charter capital but also boasts the largest owner’s equity in the industry. As of Q1 2025, the company also held the highest margin and UTTB debt, approximating VND 30,500 billion. Regarding business performance, TCBS targets a 22% revenue growth to VND 9,323 billion for 2025. The profit plan projects a 20% increase to VND 5,765 billion. After the first quarter, TCBS recorded nearly VND 1,310 billion in pre-tax profit, achieving approximately 23% of the full-year plan.

The HUT Group Prepares to Offer Nearly 180 Million Shares, Aiming for a Massive Capital Increase

The Hanoi Stock Exchange-listed Tasco Joint Stock Company (HUT) has announced June 30, 2023, as the record date for its upcoming rights offering. Shareholders of record on this date will be eligible to participate in the offering, which will see the company offering over 178.5 million shares to existing shareholders. The ex-rights date, or the first date the stock will trade without the right to participate in the offering, is set for June 27, 2023.

“Noibai Cargo Services Aims High: Targets 2.14 Trillion VND in Profit Before Tax Over Next 5 Years”

In 2025, Noi Bai Cargo Services Joint Stock Company (HOSE: NCT) aims to handle a cargo volume of 382,000 tons, generating approximately VND 1 trillion in revenue, a remarkable surge of over 9% from the previous year. The company has set its sights on a net profit target of VND 271 billion, reflecting a 2% increase.

“Real Estate Giant Scraps Billion-Dollar Plan, Abandons Pursuit of Mr. Dũng ‘Lò Vôi”s Đại Nam Project”

The ever-changing economic landscape and unfavorable market conditions have posed challenges for the planned issuance.