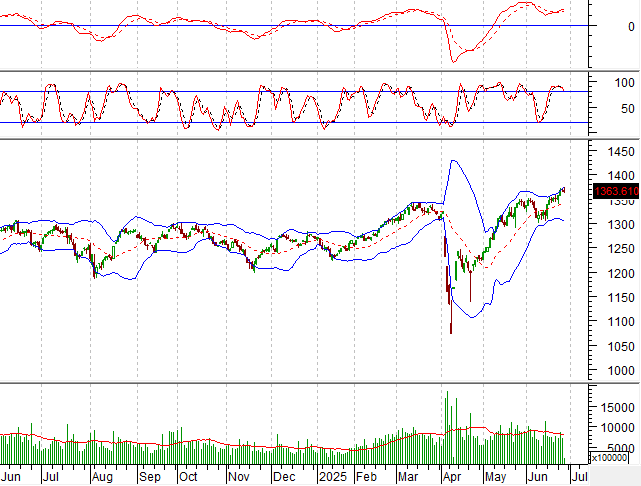

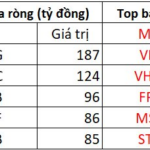

Technical Signals for VN-Index

During the trading session on the morning of June 26, 2025, the VN-Index opened lower and formed a candle pattern resembling an Inverted Hammer, indicating investors’ pessimistic sentiment.

Additionally, the index oscillated and remained on the Middle line of the Bollinger Bands indicator while the MACD indicator continued to give a buy signal. This suggests that the market’s optimistic signal still persists.

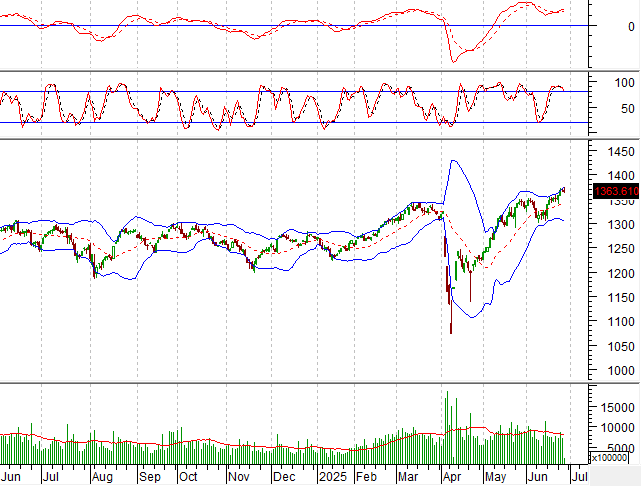

Technical Signals for HNX-Index

In the trading session on the morning of June 26, 2025, the HNX-Index opened lower and formed a Doji candle pattern with a small body, indicating a tug-of-war situation.

Moreover, the index is retesting the 100-day SMA and 20-day SMA while the Stochastic Oscillators indicator continues to weaken after giving a sell signal. If the situation remains unchanged, the risk of correction will persist.

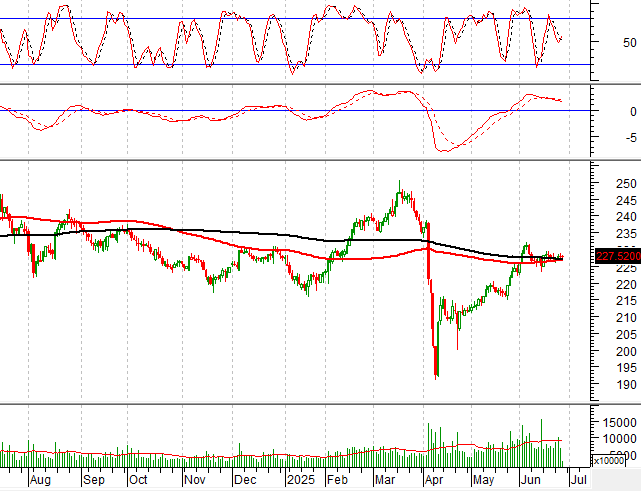

EIB – Vietnam Export Import Commercial Joint Stock Bank

During the morning session of June 26, 2025, EIB stock price declined along with a significant drop in trading volume, reflecting investors’ cautious sentiment.

Additionally, the price is retesting the Middle line of the Bollinger Bands indicator while the ADX indicator remains in the gray area (20

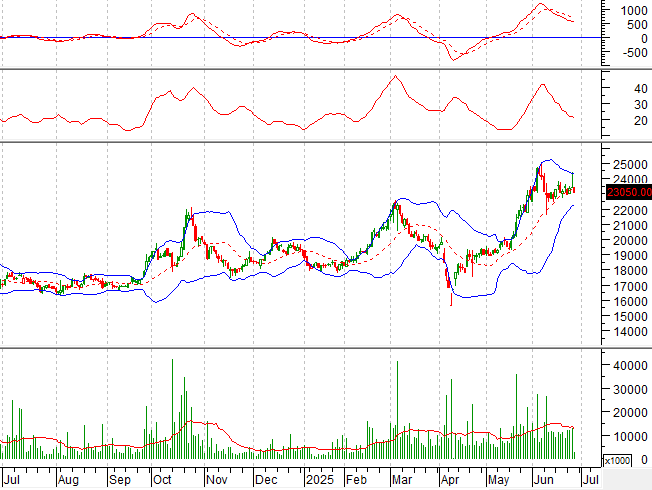

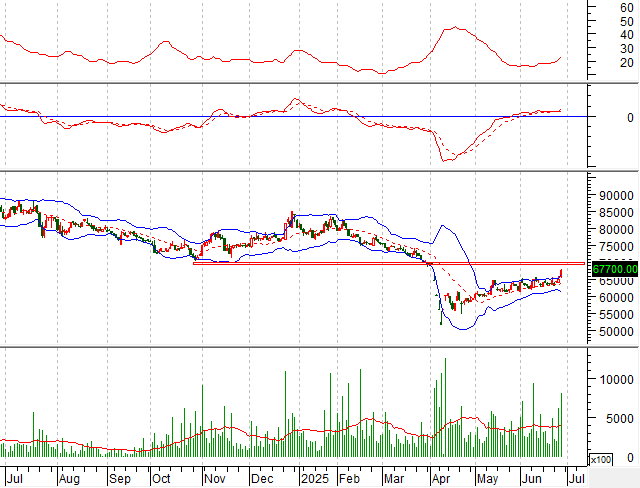

SCS – Saigon Goods Service Joint Stock Company

In the trading session on the morning of June 26, 2025, the SCS stock price surged and formed a candle pattern similar to a White Marubozu, accompanied by a trading volume exceeding the 20-session average, indicating vibrant trading activities.

Additionally, both the MACD and Stochastic Oscillators indicators gave buy signals while the price closely followed the upper band of the Bollinger Bands indicator, suggesting a rather optimistic outlook for the short term.

If the situation remains unchanged, the old bottom broken in October 2024 (equivalent to the 69,000-70,000 region) will be the target price for this recovery.

Technical Analysis Department, Vietstock Consulting

– 12:31 26/06/2025

Market Pulse for June 26: Referral Efforts Fall Flat

The market witnessed a strong tug-of-war in the afternoon session as it attempted to rebound from the continuous decline in the morning. Significant support was observed at the 1,360-point threshold, indicating a potential turning point for the market sentiment.

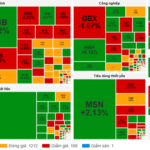

Market Pulse for June 26: A Sea of Red

The Vietnamese stock market indices witnessed a downward trend during the morning session, amid mounting pressures. The VN-Index dipped by 0.23%, shedding 3.14 points to close at 1,363.61. Similarly, the HNX-Index and UPCoM-Index followed suit, with the former declining by 0.06%, a loss of 0.14 points to 227.52, while the latter contracted by 0.25 points or 0.25% to finish at 99.69.

The Tapping Into a Profound Cash Flow Crisis: “Liquidity Dries Up as Foreign Investors Sell-Off”

The cautious sentiment continues to loom over the market, with investors opting to reduce their trading activities. This resulted in a 17% decline in trading volume on the two exchanges this morning compared to yesterday, leaving stocks drowning in a sea of red. The large-cap group of the VN-Index could only muster two stocks in the green, lacking the momentum to buoy the index.

Market Pulse for June 26th: Adjusting, VN-Index Dips Below Reference

The market opened with a slight uptick, but soon took a swift downturn, dipping below the reference mark. As of 10:20 am, the VN-Index shed 1.67 points to 1,365.08, the HNX-Index fell 0.48 points to 227.18, and the UPCoM-Index dropped 0.12 points to 99.82.